Oil and Natural Gas: Potential for Bullish Continuation

- The oil price fell to the $87.80 level yesterday.

- The price of natural gas dropped to the $6.30 level yesterday,

- The decision of the OPEC and other producers, led by Saudi Arabia and Russia, was seen as a stab in the back of US President Joe Biden.

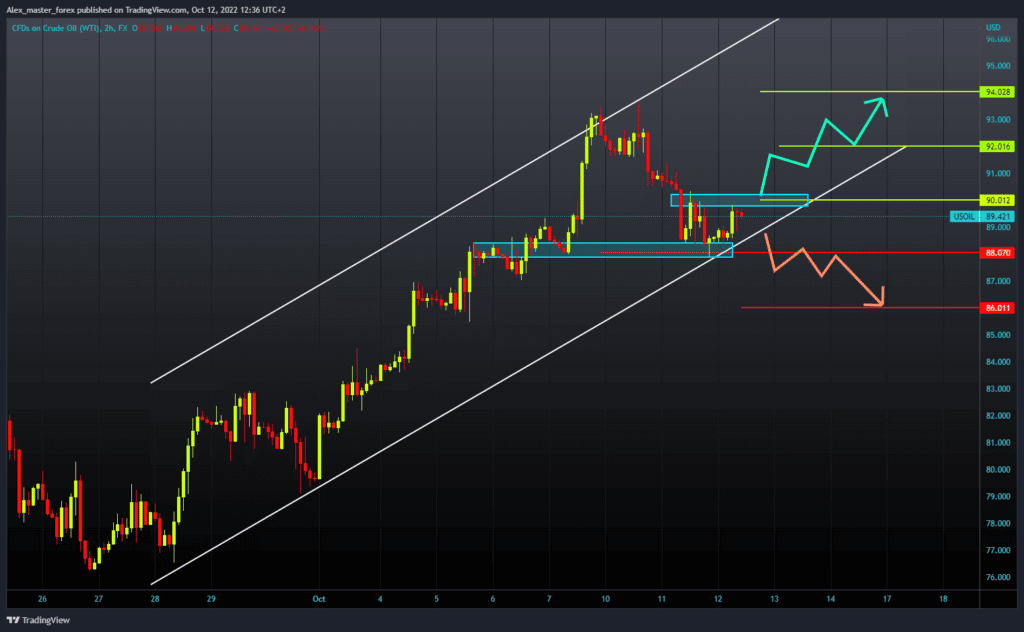

Oil chart analysis

The oil price fell to the $87.80 level yesterday, but during the Asian trading session, it managed to return above the $88.00 level, and now we are at the $89.50 level. Since the beginning of trading last night, the oil price has recovered by 1.0%. We need to climb above the $90.00 level to start a bullish recovery. Then the oil price would have to stay in that place, and a new bullish impulse could follow to continue the price recovery. Potential higher targets are the $92.00 and $94.00 levels. We need a return to the previous low at the $88.00 level for a bearish option. A longer hold there could increase the bearish pressure, which would lead to a further drop in the price of oil. Potential lower targets are the $87.00 and $86.00 levels.

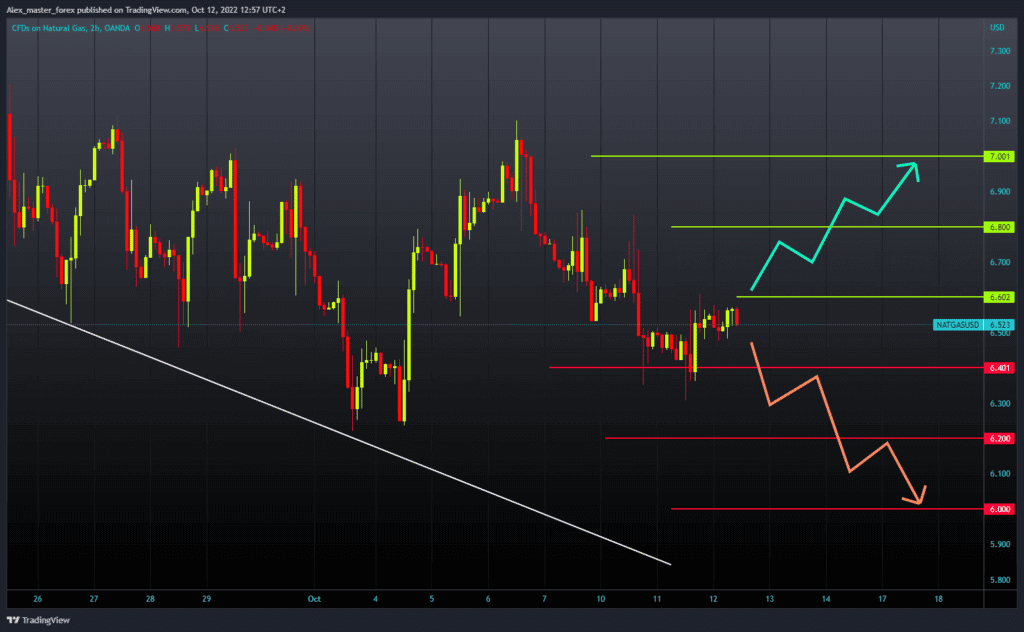

Natural gas chart analysis

The price of natural gas dropped to the $6.30 level yesterday after which a bullish impulse followed, and the price moved to the $6.60 level. During the Asian trading session, the price moved in a narrow range of $6.50-$6.60. For a bullish option, we need a break above $6.60, and with a new positive consolidation, we could see a recovery in gas prices. Potential higher targets are the $6.80 and $7.00 levels. We need a negative consolidation and a price drop to the $6.40 level for a bearish option. Increased pressure in that place would lead to a further drop in the price of gas – Potential lower targets are the $6.20 and $6.00 levels.

Market Overview

The decision of the Organization of Petroleum Exporting Countries (OPEC) and other producers, led by Saudi Arabia and Russia, was seen as a stab in the back of US President Joe Biden.

The announcement of a reduction in oil production complicates the West’s efforts to deprive Russia of funds for waging war in Ukraine, which also marks a new and perhaps dangerous break between producing countries and importing countries, especially between the US and Saudi Arabia. Angered by Saudi Arabia’s decision to team up with Russia to cut oil production, Biden indicated he was open to retaliatory measures proposed in the US Congress, including a freeze on arms sales and new antitrust measures. A White House official said that Biden is reassessing relations with Saudi Arabia after the OPEC Plus decision that strengthened President Vladimir Putin’s government but could also raise US gasoline prices ahead of the November election.