Gold and Silver: Bearish pressure is still evident

- For the fourth day already, the price of gold is moving sideways in the $1730-1750 range.

- The price of silver fell further this morning to $18.62, where it has support for now.

- A prolonged sell-off in equity markets – amid persistent fears of a possible global recession – has emerged as a key factor providing some support to the precious metal.

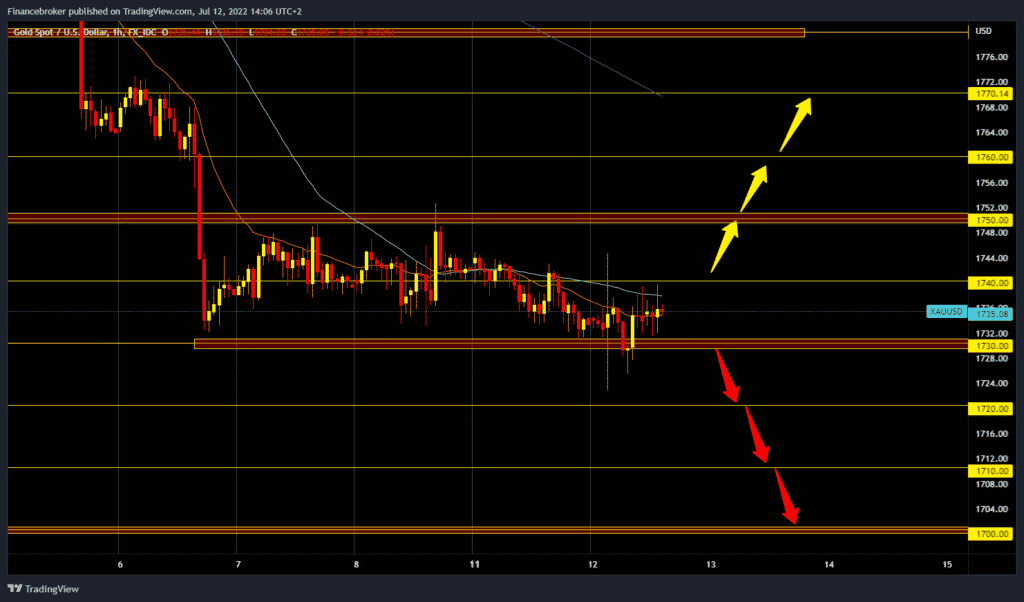

Gold chart analysis

For the fourth day already, the price of gold is moving sideways in the $1730-1750 range. This morning the price went down at one point to $1723 but quickly returned to the $1739 level. Today’s movement is relatively calm, and most days, it takes place between $1720-1730. Bearish pressure is still evident; if the dollar’s strengthening continues, a gold price fall is expected. We need a drop below $1720 and a continuation of negative consolidation for a bearish option. Potential lower targets are $1710 and $1700 levels. And the bullish option, we need growth above the $1740 level. Further continuation of positive consolidation could raise the price to $1750. A price break above would increase bullish optimism that we could see a continued recovery in the price of gold.

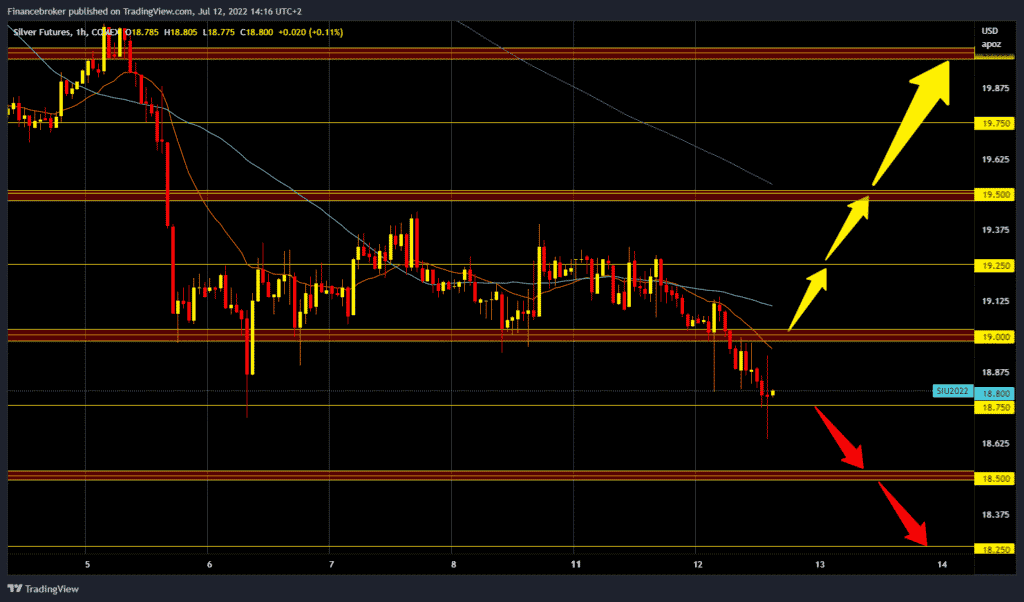

Silver chart analysis

The price of silver fell further this morning to $18.62, where it has support for now. Compared to the beginning of trading last night, the price dropped by 1.81%. A strong dollar also affects the price of silver, so continuing the decline is possible. For a bearish option, we need a continuation of the negative consolidation. Also, we need continuation of the pullback to the $18.50 level. For a bullish option, we need another positive consolidation and a return above the $19.00 price. After that, we could expect the price to continue to recover further as it finds support in the MA20 moving average. Potential higher targets are $19.25 and $19.50.

Market overview

A prolonged sell-off in equity markets – amid persistent fears of a possible global recession – has emerged as a key factor providing some support to the precious metal. Relentless buying of the US dollar, fueled by expectations of a hawkish Fed, acted as drag and kept a lid on any significant rise in the price of gold.

The USD index jumped to a new two-decade high. It continued to gain support from growing acceptance that the Fed will maintain its aggressive tightening policy to curb rising inflation. The bets were further vindicated by the minutes of the FOMC meeting released last week, which indicated that another rate hike of 0,50% or 0,75% is likely at the upcoming FOMC meeting in July.

Meanwhile, a worsening global economic outlook and further declines in US Treasury yields, led by a flight to safety, could continue to support gold prices.