Oil and Natural Gas: The price is calm

- During the Asian trading session, the price of crude oil fell again from $103.00 to $98.40.

- For the fourth day, the price of natural gas is in a bullish trend.

- Russia’s account surplus to record high.

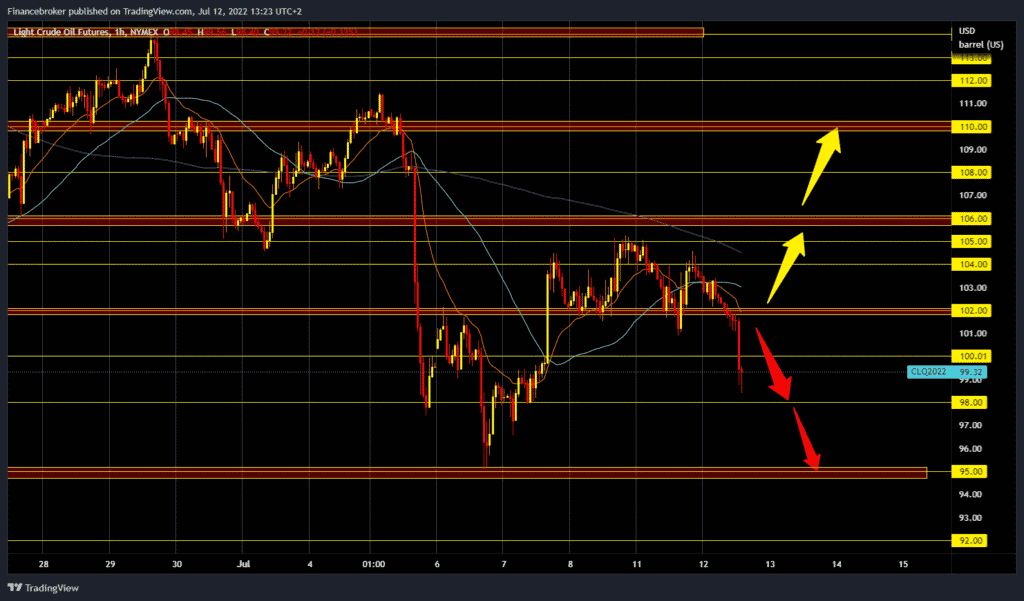

Oil chart analysis

During the Asian trading session, the price of crude oil fell again from $103.00 to $98.40. Multiple Chinese cities are adopting new measures to curb the spread of the COVID-19 pandemic, from business shutdowns to partial shutdowns, to curb new infections as the highly contagious omicron sub-variant emerges in the country. Tomorrow, the US president will travel to the Middle East to meet with Arab leaders. Also, the strong strengthening of the US dollar makes the real oil price more difficult and expensive for all those for whom the dollar is not their national currency.

Crude oil is trading at $98.85 a barrel, down 5.04% since trading began last night. We now need a continuation of this negative consolidation and a drop below the $98.00 support zone for a bearish option. If we fail to climb above the $100.00 level, the price could fall once more to $95.00, last week’s low. For a bullish option, we need a new positive consolidation and a return above the $100.00 level. After that, getting back above the $102.00 level is very important. If we manage to stay at that level, the following targets are $104.00, $105.00 and $106.00 levels.

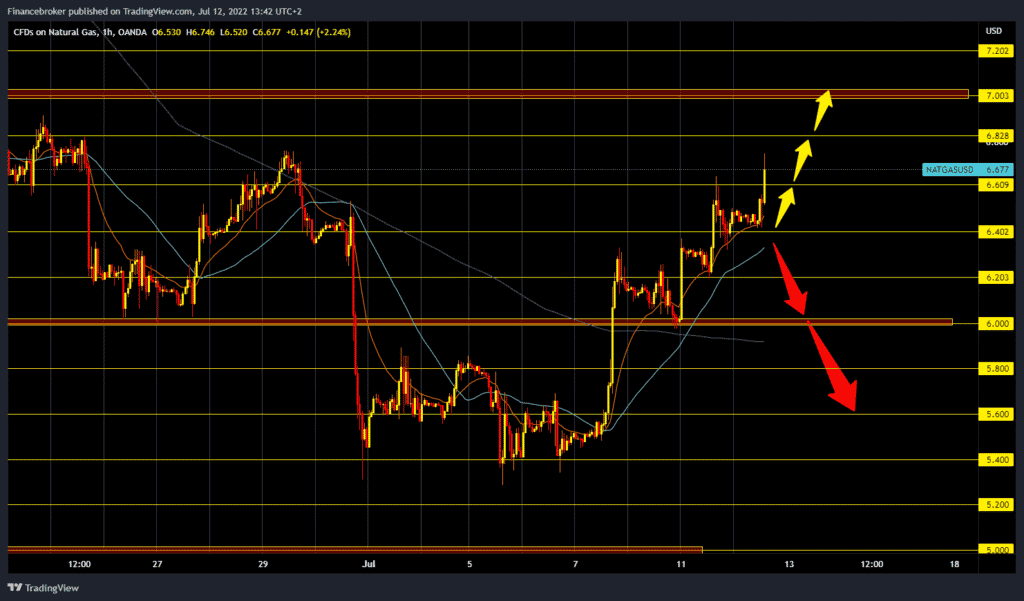

Natural gas chart analysis

For the fourth day, the price of natural gas is in a bullish trend: during the Asian trading session, the price was calm, and as the European session began, we saw a strong bullish impulse that pushed the price to the $6.60 resistance zone. Natural gas is now trading at $6.70, up 3.21% since trading began last night. To continue the bullish option, we need the continuation of this bullish impulse, and our target is the $7.00 resistance zone. We need a new negative consolidation and a pullback below the $6.40 level for a bearish option. After that, the gas price could continue to pull back to the $6.00 level. If that level does not support us, then the price continues towards last week’s lows around the $5.40 level.

Market overview

Russia’s account surplus to record high

According to data released by the central bank cited by Bloomberg, Russia’s current account surplus hit a new record for the second quarter.

The surplus, now more than $70 billion, comes on the back of growing exports of oil and gas and other commodities that have outpaced sanctions imposed on the country by Western powers.

The surplus was also fueled by high prices and a drop in imports – to $72.3 billion in Q1 from $88.7 billion in Q2 – thanks to sanctions, which have a greater effect on imports than exports.

Sanctions on Russian energy exports have made little progress in limiting the flow of funds to Russia that it could use to continue its aggression in Ukraine. India, for example, has been buying record amounts of Russian crude oil – nearly 1 million barrels per day since June – which is about one-fifth of India’s total crude oil imports, according to Reuters.