Oil and Natural Gas: Impact of global recession

- During Asian trading, the price of crude oil consolidated after falling again yesterday afternoon.

- The price of natural gas has been stable for two days and is in the range of $5.40-$5.60.

- The American Petroleum Institute (API) reported a crude oil increase of 3.825 million barrels this week, while analysts had forecast a draw of 1.1 million barrels.

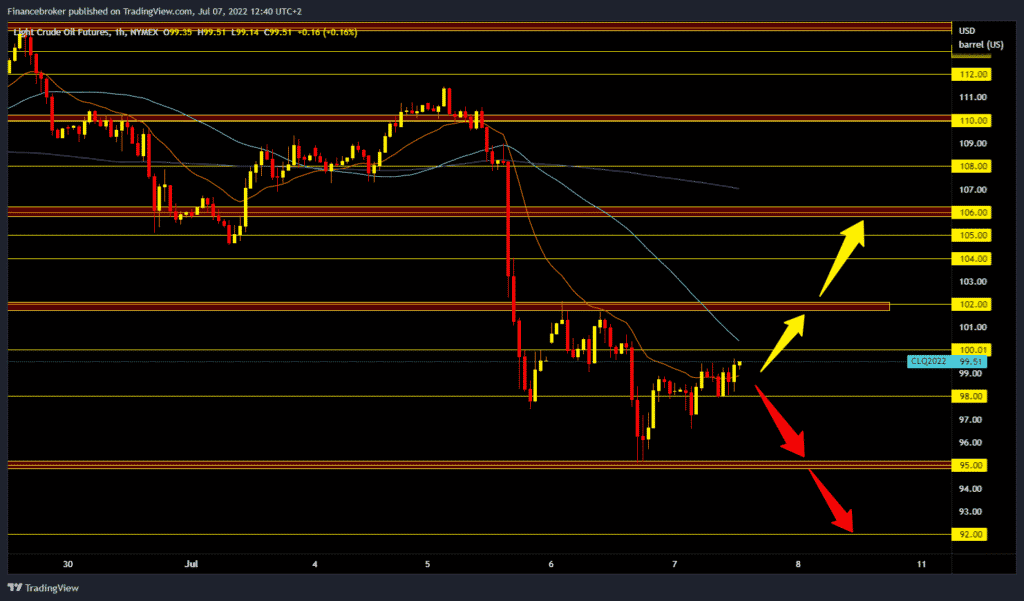

Oil chart analysis

During Asian trading, the price of crude oil consolidated after falling again yesterday afternoon. An increase in the number of bets that the price could be lower pushed the price of oil below $100 per barrel. And mostly because of the increasing prospects for a global recession and thus a probable impact on the demand for energy products. The American Petroleum Institute announced last night that U.S. crude oil inventories rose by 3.825 million barrels. Also, the increase in the number of infections in China, with the Chinese government still not introducing new measures against the pandemic, represents a possible obstacle to the continued recovery of oil demand in China. U.S. inventories are at their lowest level since 2004 as refineries run near max capacity. Refineries on the U.S. Gulf Coast are at about 98% utilization, the highest in the last three and a half years.

The strong strengthening of the U.S. dollar makes the real oil price more difficult and expensive for all those for whom the dollar is not their national currency. Crude oil is trading at $99.20 a barrel, up 0.70% since the start of trading overnight. We need a positive consolidation above the $100.00 level for a bullish option. After that, we could continue towards yesterday’s resistance at $102.00. For a bearish option, we need a negative consolidation and a pullback below $98.00. Potential lower targets are $97.00 and $95.00 prices. At 4:30 p.m., an official government report on the state of crude oil and petroleum products stocks in the U.S. will be published.

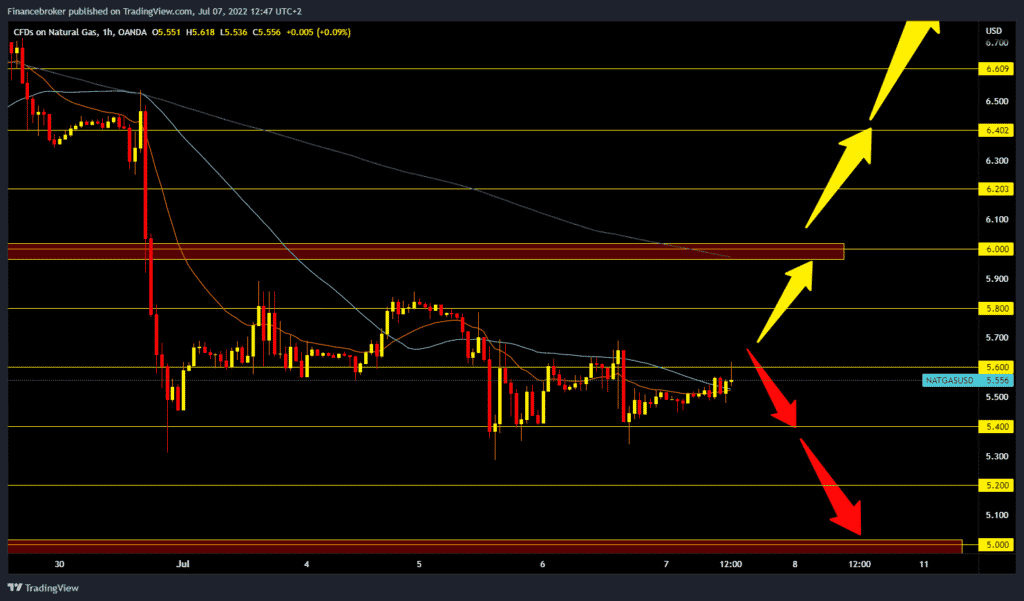

Natural gas chart analysis

The price of natural gas has been stable for two days and is in the range of $5.40-$5.60. We currently have support in the MA20 and MA50 moving averages, and now we need a break above $5.60 to try to continue the price recovery. Potential higher targets are $5.80 and $6.00 levels. We need a negative consolidation and a retest of the $5.40 level support for a bearish option. A price break below would increase the bearish pressure, and we could expect the price to continue falling. Potential lower targets are $5.20 and $5.00 levels.

Market overview

API Reports

The American Petroleum Institute (API) reported a crude oil increase of 3.825 million barrels this week, while analysts had forecast a draw of 1.1 million barrels.

The build comes as the Energy Department released 5.9 million barrels from the strategic oil reserve in the week ending July 1, to 492 million barrels — the lowest level since 1985.

According to API data, US crude oil inventories have fallen by about 68 million barrels since the start of 2021 and nearly 5 million barrels since the beginning of 2020.