GBP/NZD forecast for November 26, 2020

Let’s look at the bigger picture on a weekly level. We will see that the GBP/NZD pair is on a rising trend line since October 2016 and is currently testing a moving average (MA) of 200 around the 1.90000 level, while on the upper side, we have a resistance of MA 50 and MA 100. that the GBP/NZD pair is reaching the level of 50.0% for the third time. At this time frame, the bottom line of the trend is important to us.

On the daily chart, the image is more bearish and is currently supported between 1.90000-1.91000. When we adjust the Fibonacci level, we see that it is visiting the level of 78.6% for the third time and that the now is more likely to break below because, after each rejection from the Fibonacci level, the up pullback is getting smaller, first to Fibonacci level 50.0% and a second time to Fibonacci level 61.8%.

On the first pullback to a Fibonacci level, we see that our resistance and moving average is MA 200. On the second pullback to Fibonacci level 61.8%, our resistance is also the moving average of MA 50 and MA 100. Here the zone of support for Fibonacci 78.6% is critical.

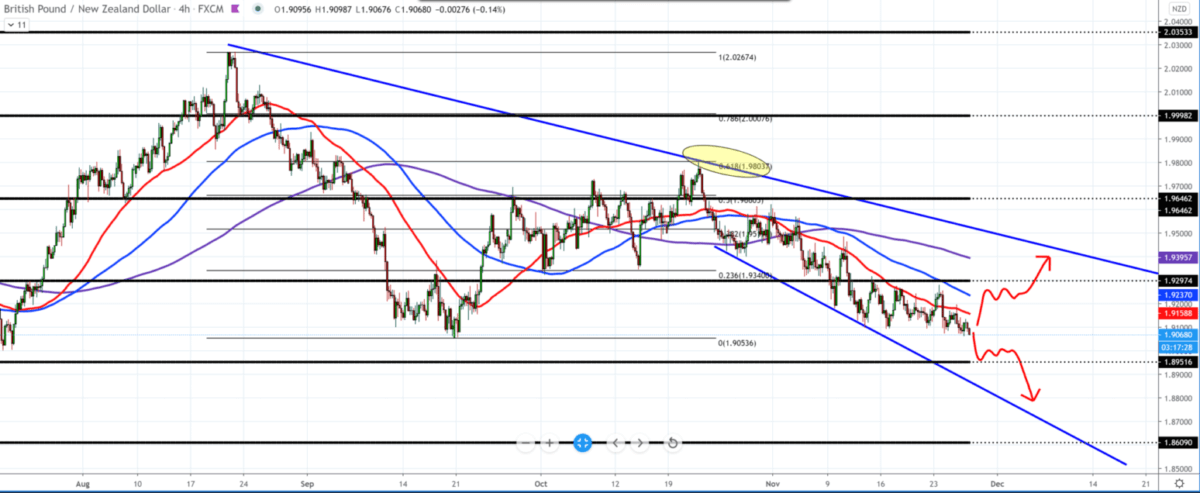

In a smaller four-hour chart, we see that the GBP/NZD pair has failed to break above the moving cross-sections of MA 50 and MA 100 since early November, which coincides with the UK lockdown due to the increased number of newly infected with the coronavirus.

When we adjust the Fibonacci level from the previous High and Low, we see that the pullback was up to the Fibonacci level of 61.8% since fallen, where it now coincides with the previous Low. We need to follow whether the chart will make a lower low and whether the zone 1.90000-1.91000 will withstand as good support, or we will see a break below and look at new levels for this currency pair. Below 1.89500, the limits open for 1.88000, and all the way down to 1.86000.

From the news, we can single out: The Reserve Bank of New Zealand (RBNZ) is urging the government to consider changes in tax policy to stop the rise in house prices, Governor Adrian Orr said in an interview with Radio New Zealand this morning. Adrian Orr also said Wednesday that the central bank remained “fully focused” on its key inflation and employment mandates and returned the spotlight to the government’s focus on the housing market.

-

Support

-

Platform

-

Spread

-

Trading Instrument