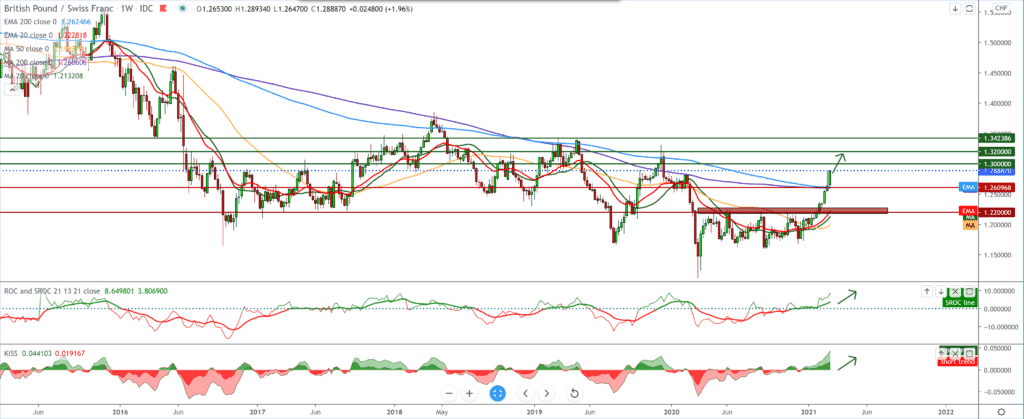

GBP/CHF Forecast for March 4

Looking at the chart on the weekly time frame, we see that this last week is also very bullish for the pound against the Swiss franc, and as such, we can look in the future. Our next bullish target is the previous high at 1.33000 from December 2019. Global vaccination of the population against coronavirus throws aside currencies such as the Swiss franc and the Japanese yen, directing investors to other currencies by global risk reduction.

The daily chart is also in a strong bullish trend, and we see a retest to the 1.25000 previous psychological level with the support of moving averages from below. We are now getting closer to the level of 1.30000 from the end of 2019 and the beginning of 2020, before the global coronavirus pandemic. The bearish scenario is not in sight. For now, we can look for it on a smaller time frame within this growing trend.

We also see a very bullish trend on the four-hour time frame, with less consolidation ending up back in place on the chart before consolidation close to 1.29000. The psychological limit for investors is 1.30000, but that should not be a problem and should be overcome by reducing global trading risk. For the bearish scenario, there are no signs on the chart. For now, first, break below the moving averages of MA20 and EMA20, but there are no such signs on the chart.

For this pair, we can single out the following economic news: The British construction sector returned to positive territory in February. The results of the IHS Markit survey and the Chartered Institute of Procurement & Supply showed on Thursday.

The index of construction procurement managers rose more than expected to 53.3 from 49.2 in January. A score above 50.0 indicates expansion. The expected level was 51.0.

Household work continued to be the strongest area of growth in February, although the recovery speed slowed slightly.

The slowdown in house construction has more than been offset by the sharpest rise in commercial business since last September and a slower decline in construction activity.

The research showed that the volume of new orders increased for the ninth month in a row in February. The higher workload has encouraged additional staff recruitment. The rate of job creation was the fastest since March 2019. the British Chancellor of the Exchequer surprised the markets by announcing a “super deduction” for companies that would encourage investment. While the new British budget consists of a sharp increase in income tax in 2023 – from 19% to 25% – optimistic economic forecasts, the expansion of the work scheme and other benefits seem to put the economy on a positive footing. The pound also continues to benefit from the rapid introduction of vaccines in the UK, around a third of the population – the world leader among large countries.

-

Support

-

Platform

-

Spread

-

Trading Instrument