USD/CHF Forecast for March 4

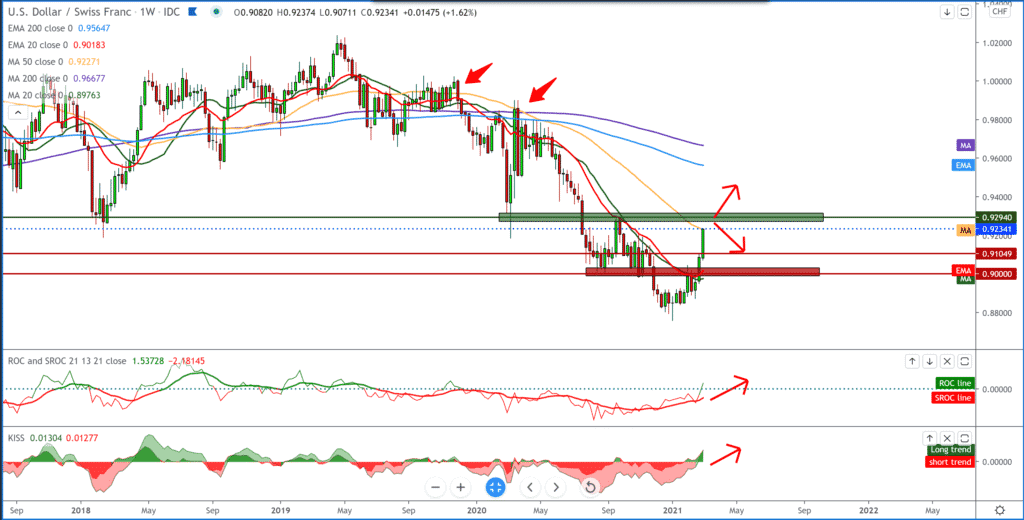

Looking at the chart on the weekly time frame, we see that the dollar continues to reduce losses against the Swiss franc, testing that the moving average MA50 to 0.92250 breaks above that zone, and MA50 technically leads us to a moving averages MA200 and EMA200. If we see the dollar slow down, then we expect a pullback to better support at 0.90000.

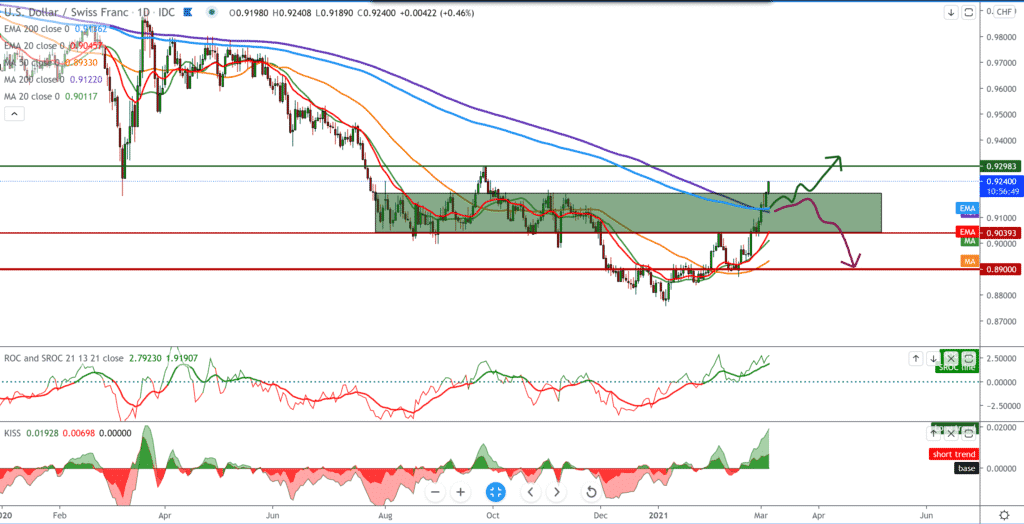

On the daily time frame, we have already made a break above MA200 and EMA200 and a break up outside the previous consolidation zone where we now look at the previous high at 0.92980 from September 2020. For the bearish scenario, we need a return below moving averages MA200 and EMA200 and below 0.91000.

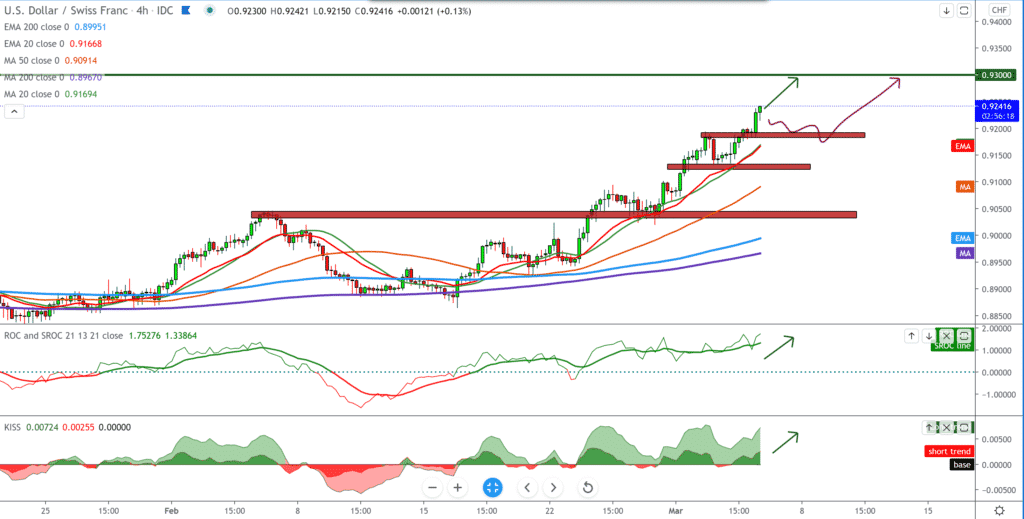

The chart is very bullish on the four-hour time frame, and for now, there are no indications of a change in trend. The pullback is possible but only in the midst of a growing trend followed by moving averages below. In the coming period, we can expect further growth of this currency pair.

From the important news for these two currencies, we can single out the following: After reporting on the US service sector’s activity at an almost two-year high in the previous month, the Institute for Supply Management released a report on Wednesday showing the slowdown in February. The ISM said its PMI for services fell to 55.3 in February from 58.7 in January, although readings above 50 still point to growth in the sector. Economists expected the index to come unchanged. The withdrawal of services for PMI services followed after the index reached its highest level since it reached 58.8 in February 2019. The decrease for the main index is partly the result of a slowdown in the growth rate of new orders, as the index of new orders fell to 51.9 in February from 61.8 in January.

-

Support

-

Platform

-

Spread

-

Trading Instrument