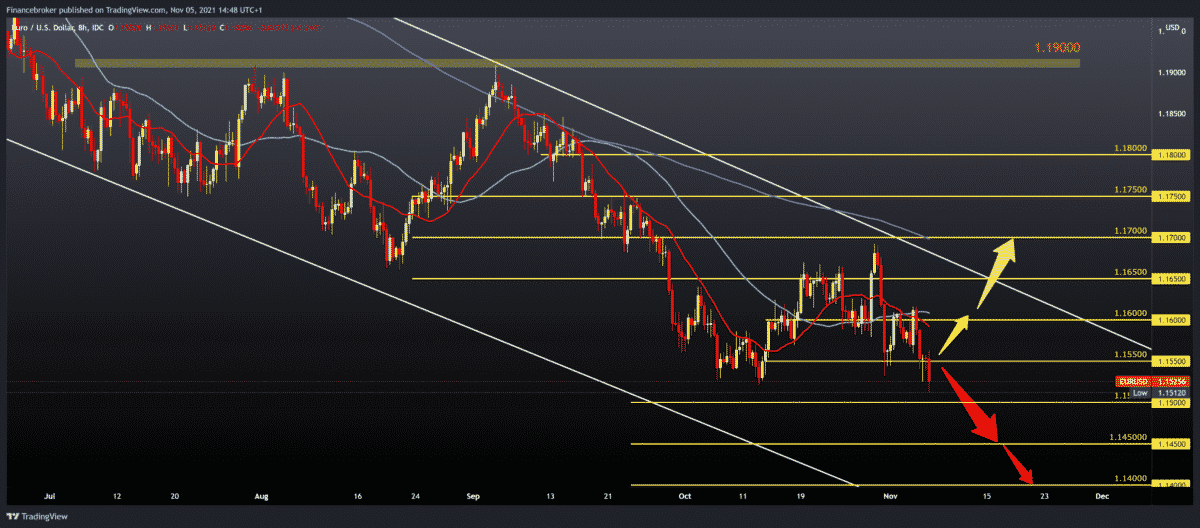

EURUSD, GBPUSD still in the negative zone

Pair managed to make a new minimum this year today by dropping to 1.15120. We have a break from the previous lower low from October, and now we need to pay attention to whether the daily candlestick will close below and confirm the new lower low. Today’s positive news about the reduction of unemployment in the US and the positive Nonfarm Payrolls are likely to strengthen the dollar index further. This sequence of events will lead to a further withdrawal of EURUSD to lower levels by the end of the year.

Bullish scenario:

- First, we need a positive consolidation above 1.15500 and then above 1.16000. In that zone, additional resistance is created by both MA20 and MA50 moving averages.

- A break above it will reduce the bearish impact, and we can expect further growth to the next resistance at 1.16500.

- There awaits us there the October resistance zone that brought us back to the lower support zones couple of times.

- If we manage to break above the next resistance, we have the upper falling trend line and MA200 moving average in the area 1.17000-1.17200.

Bearish scenario:

- EURUSD continues its negative consolidation and increases the pressure on the psychological support zone to 1.15000.

- Breakthrough below the descent us to the new lows in this year 1.14500, then to 1.14000.

- EURUSD is still moving in a big falling channel, and as long as we are in it, we can consider ourselves in a bearish trend.

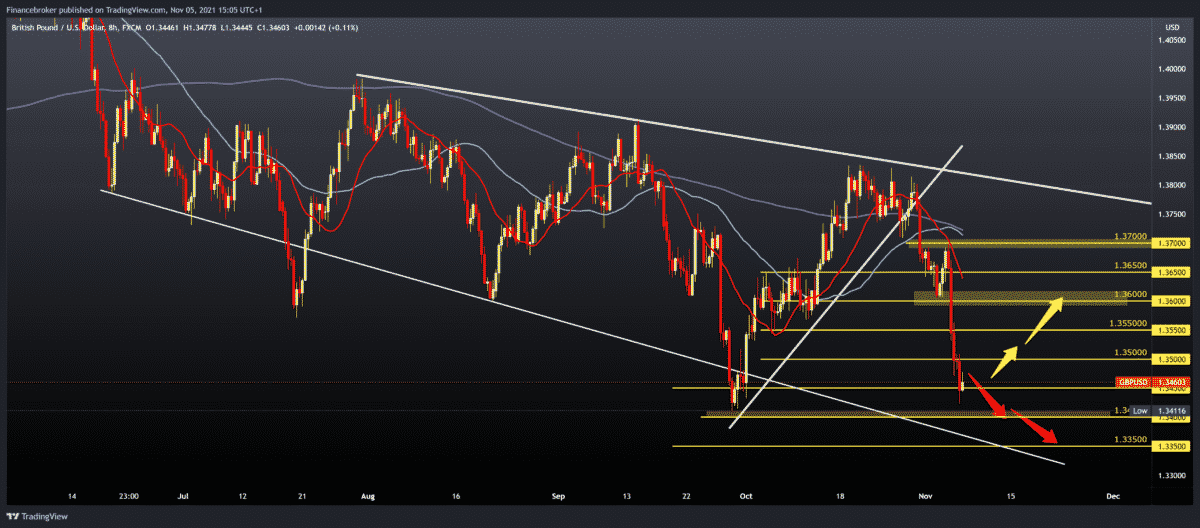

GBPUSD chart analysis

Pair GBPUSD is in a similar situation, under great bearish pressure. Within three days, the pair dropped about 360 pips from 1.38000 to 1.34400. There is no end in sight to this bearish pressure, and the pair is getting closer to this year’s low of 1.34116. The broad picture is very bearish, and based on that, we could expect a continuation of the descent to lower support zones by the end of this year.

Bullish scenario:

- We need better support at the current level of 1.34500, and we need positive consolidation on the chart as the first sign of repair.

- GBPUSD must make a new break above the psychological level at 1.35000.

- The next higher resistance awaits us in the zone of 1.36000, where there was a higher consolidation in October.

- The first MA20 moving average awaits us at 1.36500, and the next MA50 and MA200 are in the zone around 1.37000.

Bearish scenario:

- The sequel to the bearish scenario is more certain, as we are close to the previous low.

- There is a possibility of a break and a descent to new lower levels this year.

- A break below the 1.34166 September lower low opens the door to 1.34000, then 1.33500 and 1.33000 to the lower potential new supports.

Market overview

House prices in the U.K. rose the fastest in the last four months in October, raising the average real estate price to the highest level in history, according to the data of the research published on Friday by the branch of Lloyd’s Bank Halifax.

House prices rose 0.9 percent on a monthly basis in October, slower than 1.7 percent in September.

In the three months to October, house prices rose 8.1 percent from the same period last year, the most since June. Prices rose 7.4 percent in the three months to September.

“Given that the Bank of England expecting to respond to rising inflation risks by raising interest rates as early as next month, we expect demand for home purchases to cool in the coming months as borrowing costs increase. Said Gali, director of Halifax.

After reporting a slowdown in job growth over the past two months, the Department of Labor released a report Friday showing that U.S. employment rose more than expected in October.

The report states that employment on the payroll outside agriculture rose by 531,000 jobs in October after rising by 312,000 revised upwards in September.

Economists expected employment to jump by 425,000 jobs compared to the addition of 194,000 jobs originally reported for the previous month.

“The employment report in October indicated a renewed acceleration in job creation, supported by improved health conditions and a gradual renewal of labor supply,” said Gregory Daco, chief U.S. economist at Oxford Economics.

-

Support

-

Platform

-

Spread

-

Trading Instrument