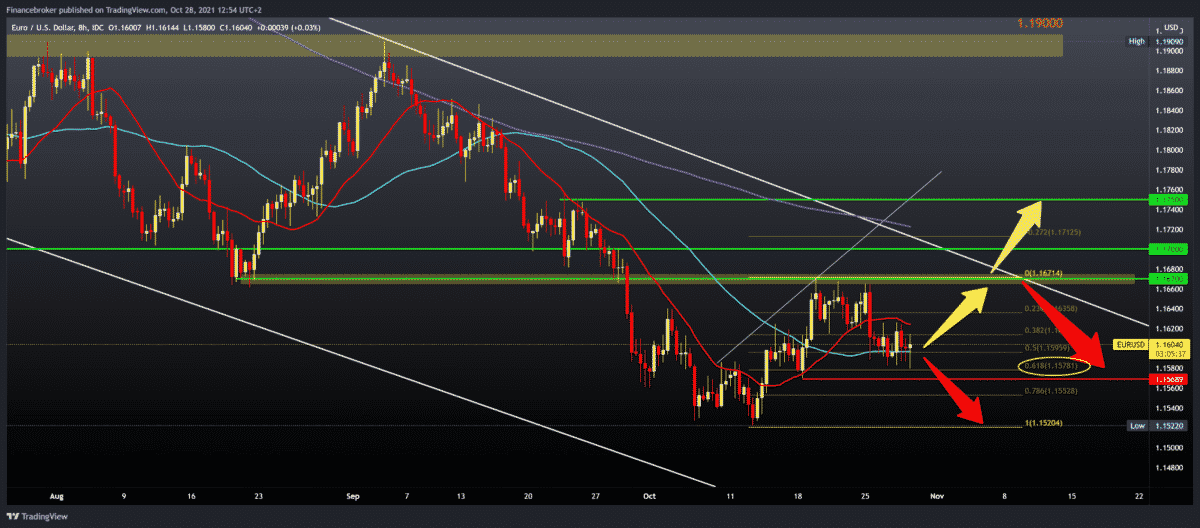

EURUSD, GBPUSD Today in Consolidation

Pair EURUSD has been consolidating around 1.16000 for a few days now, and we can expect a more concrete movement on the chart soon. By setting the Fibonacci level between 1.15220 and 1.16700, the pair made a pullback from the previous high to 61.8% Fibonacci level at 1.15780.

Bullish scenario:

- We need positive consolidation at the current Fibonacci level and MA50 moving average.

- For further continuation, we need a break above the MA20 moving average in the 38.2% Fibonacci level zone at 1.18140.

- The first above our resistance is the 1.16700 zone, then the 1.17000 zone of the upper trend line.

Bearish scenario:

- We need a negative consolidation below the MA50 moving average and 61.8% Fibonacci levels at 1.15780.

- A further drop in EURUSD brings us to 1.15690 last week’s low, while stronger support awaits us at 1.15220 October’s lower low.

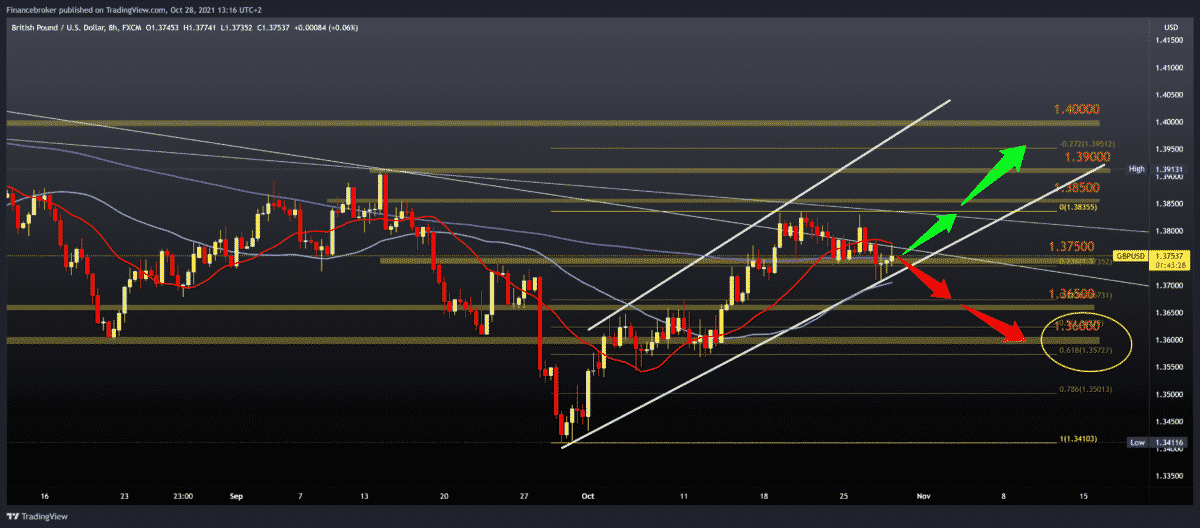

GBPUSD chart analysis

Pair GBUPSD further confirmed support at 1.37300 during the Asian session. In the European session, the pair continued on the bullish side, climbing to the current 1.37630. We are in a growing channel during October, and in the coming period, we can expect further movement towards higher levels on the chart.

Bullish scenario:

- GBPUSD has support in the MA50 moving average and bottom line channel.

- We need a break above the MA20 moving average and above 1.38000.

- Stronger resistance awaits us at 1.38350 in the October resistance zone.

- The break above us can take us to new levels this month on the chart.

Bearish scenario:

- We need negative consolidation and a pull below the MA50 moving average and the bottom channel line.

- We are looking for lower support at 1.36000 at 38.2% Fibonacci level.

- The next major support awaits us in the zone 50.0-61.8% Fibonacci level 1.35700-1.36500.

Market overview

Data released by the Federal Labor Agency on Thursday, unemployment in Germany fell sharply in October.

The number of unemployed people fell by 39,000 in October after falling by 31,000 in September. The economists’ forecast is -20,000. The unemployment rate dropped to 5.4 percent in October, in line with expectations, from 5.5 percent in September.

The company’s demand for new staff is growing, and part-time work continues to decline, said the Federal Employment Agency executive director, Detlef Scheele. The consequences of the corona crisis on the labor market are still visible. But they are less and less, Scheele added.

Bank of Japan

The Bank of Japan maintained its monetary stimulus and reduced its growth outlook for the current fiscal year as supply-side constraints reduced production and exports amid weak consumption.

The board, led by Haruhiko Kuroda, voted 8-1 on Thursday to keep the interest rate at -0.1 percent on current accounts held by financial institutions in the central bank.

The bank will continue to buy the necessary amount of Japanese government bonds without setting an upper limit so that the ten-year JGB yields will remain at around zero percent.

According to the latest Outlook on Economic Activity and Prices, the risks to economic activity have reduced so far but are generally balanced for the future.

The growth outlook for fiscal 2021 was reduced to 3.4 percent from 3.8 percent. In contrast, the projection for the next fiscal is optimistic to 2.9 percent from 2.7 percent.

The UK

British Chancellor Rishi Sunak has increased public spending by a whopping 150 billion GBP to support a big economic improvement after the crisis caused by the coronavirus pandemic.

That will be the biggest increase in this century, with real consumption growth of 3.8 percent per year until 2024-25, Sunak said in his autumn speech on the budget in the parliament.

The chancellor said that the latest budget started working on the preparation for the new economy after Covid.

Core inflation, which reached 3.1 percent in September. It is expected to rise further to an average of 4 percent next year, Sunak said, citing official forecasts.

The chancellor blamed disruptions in the global supply chain and rising energy prices for higher inflation.

-

Support

-

Platform

-

Spread

-

Trading Instrument