EURUSD, GBPUSD Delete Part of Last Week’s Losses

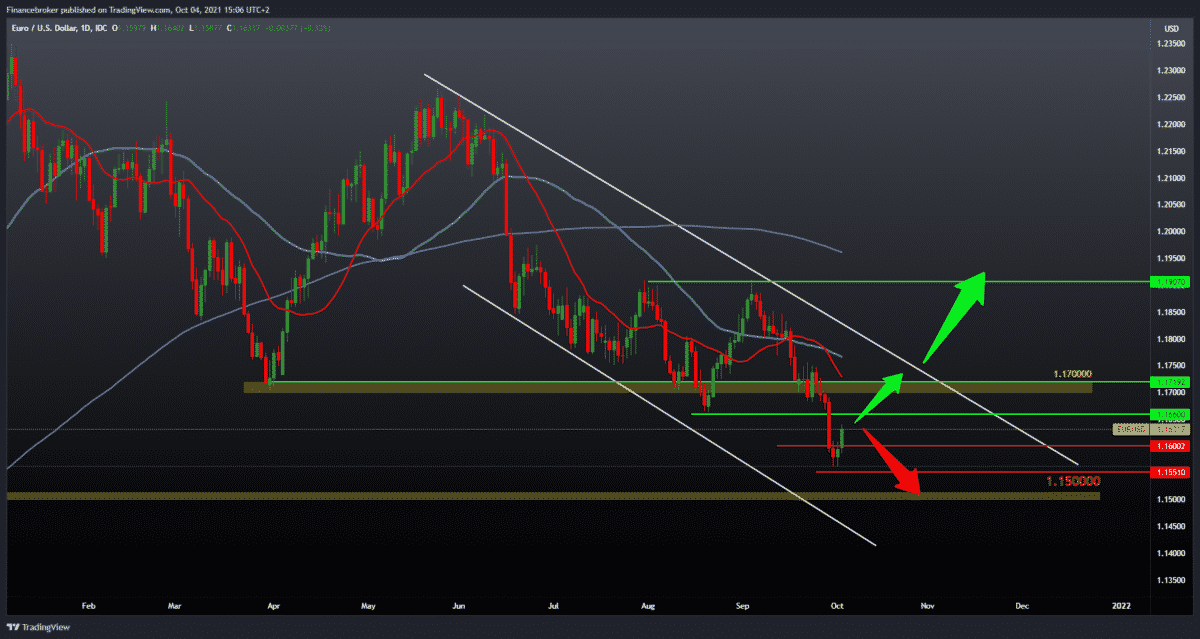

Looking at the EURUSD chart on the daily time frame, we see that the pair found support at 1.15550 on Friday, and today we continue in the bullish trend, and the current weak dollar may allow us to climb to higher levels on the chart. Our first tests are at 1.16600. After that, if we continue, our next resistance is in the 20-day moving average in the zone around 1.17000. More broadly, we are still in a downward channel, and just a break above the top line, we can expect a stronger bullish signal and confirmation on the chart to continue the bullish trend. We expect resistance in moving average for the bearish trends, followed by a harmful consolidation that again steers us towards last week’s low at 1.15550.

GBPUSD chart analysis

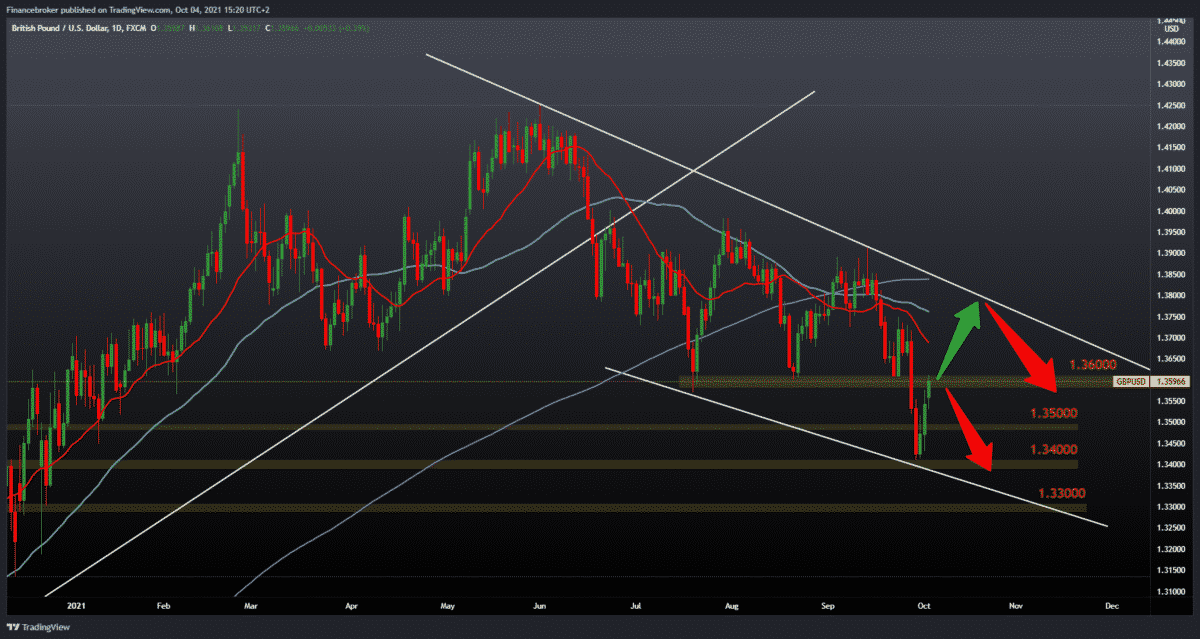

Looking at the GBPUSD chart on the daily time frame, we see that the pair found support at 1.34000. After that, we have a recovery to the current 1.36000. We are now in an important place because the zone at 1.36000 has been our support since February. High pressure is technically created by moving averages from the top. To continue the bullish trend, we need a break above them. Above, the next resistance awaits us in the form of a trend line, which is also an obstacle for a stronger bullish trend. For the bearish scenario, we need resistance in the current zone at 1.36000 or above resistance in moving averages. Negative consolidation will then direct us again to the previous low and increase the pressure to make a break and lower even lower on the chart.

Market overview

Investor confidence in the eurozone fell for the third month in a row in October, research data from the Sentik Institute for Behavior Research showed on Monday.

The investor sentiment index fell more than expected in October to 16.9 from 19.6 in September. The expected level was 18.6. The last result was the lowest since April 2021.

The current estimate worsened in October. The index of the current situation fell to 26.3 from 30.8 in the previous month.

Similarly, the expectation index rose to 8.0 from 9.0 in the previous month.

The process of economic recovery continues to decline, Sentik said. The constant loss of momentum does not signal the revival of autumn, which usually occurs at this time of year.

The research center announced that the question of whether this is a reversal of the trend or just a slowdown in growth remains open.

Sentik said that it is still crucial that expectations do not fall below the zero line. Then a more substantial decline in economic production would be expected – then a reversal of the trend would be prepared.

A Wrap Up

In Germany, the investor confidence index slipped to 20.0 in October from 20.9 in September.

Inflation in the eurozone raised to its highest level in 13 years due to a jump in energy prices in September, Eurostat data showed on Friday.

Inflation increased to 3.4 percent in September from 3.0 percent in August. That rate was above the economists’ forecast of 3.3 percent, and this is the highest rate since September 2008.

Core inflation, without excludes energy, food, alcohol, and tobacco, rose, as expected, to 1.9 percent; the previous month was 1.6 percent.

The overall rise in consumer prices was driven by a 17.4 percent increase in energy prices.

Inflation will continue to rise and will reach 4% in November, said Jack Allen-Reynolds, an economist at Capital Economics.

Inflation is likely to drop sharply next year, and recent strong results increase the chances that the European Central Bank will announce the end of the PEPP in March at the December meeting, the economist said.

-

Support

-

Platform

-

Spread

-

Trading Instrument