EUR/USD forecast for December 17, 2020

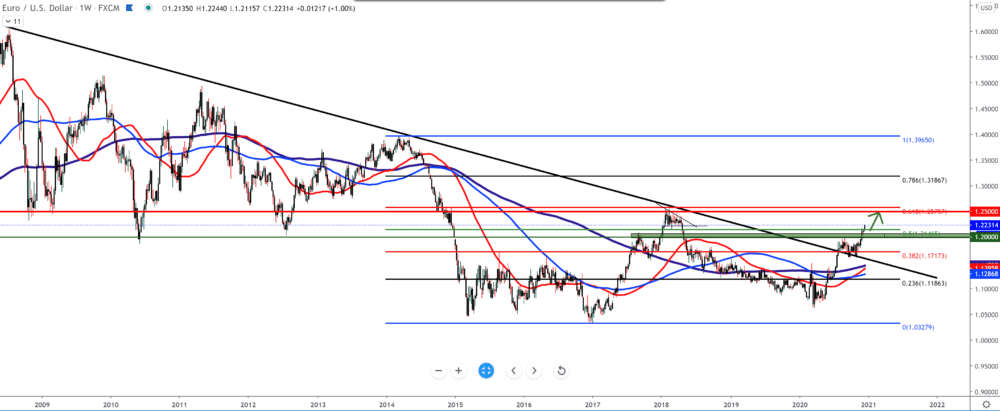

On the weekly chart, we see that the Euro made a break above the Fibonacci level of 50.0%. Since the bullish momentum is strong, we can expect the pair to climb to the level of 61.8%. The dollar continues to weaken; last night’s Fed report on interest rates remained at 0.25%; in one of the rare chances in the November statement, the Fed also said it plans to continue buying bonds at a rate of at least $ 120 billion a month until “significant further progress” is made towards its political goals. The Fed’s latest projections show that the central bank still expects interest rates to remain at almost zero during at least 2023.

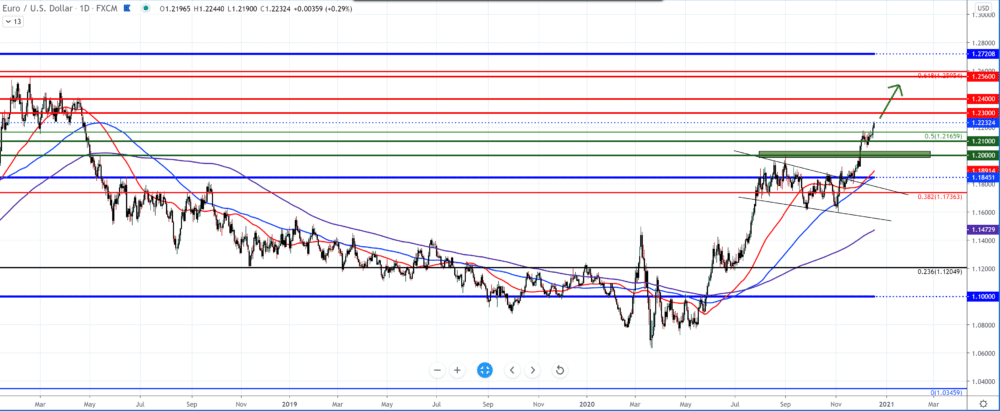

On the daily chart, we also see a break above the Fibonacci level of 50.0% at 1.21600. We can expect the EUR/USD pair to reach 1.23000 soon. From the bottom, we have support at 1.21000, and moving averages are far below. The bearish scenario is very likely until the previous high of April 2018, and we can expect consolidations on a smaller time frame.

In the four-hour time frame, we see a growing channel supporting all three moving averages within the channel. The break was made above 1.21800 after a brief consolidation and crossed above 1.22000. The bullish scenario’s continuation is still very likely; a break below 1.20500 can give us a bearish signal, but in the short term to the lower edge of the growing channel.

From the economic news today, we have The Consumer Price Index (CPI), the forecasts are that the report will be at the same level. From the news for the US dollar, we can single out: Building Permit measures, Initial Jobless Claims, The Philadelphia Federal Reserve Manufacturing Index rates.

NZD/JPY forecast for December 17, 2020

A report released by the Department of Commerce on Wednesday shows that business stocks in the United States increased by more than expected in October. We can expect the dollar to fall in the coming period as well.

-

Support

-

Platform

-

Spread

-

Trading Instrument