EUR/NZD forecast for November 10, 2020

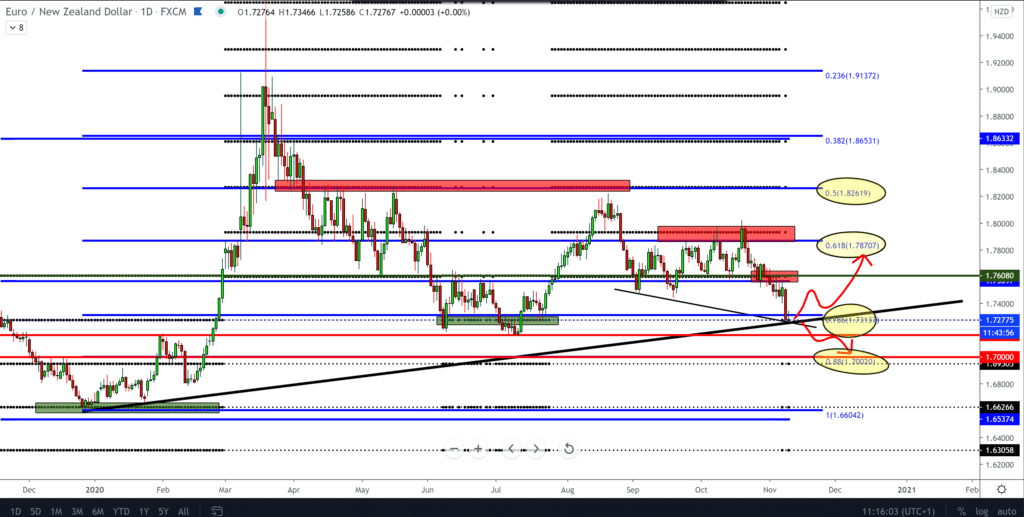

If we look at the annual chart of the EUR/NZD pair, we will see a big jump in the first three and a half months of almost 20% from 1.66000 to 1.99100. After that, we see a pullback of 78.2% to today’s price of 1.73220, which is only 4.5% more than the price from the beginning of the year.

When we underline the trend line with low from the beginning of the line, we will see that the EUR/NZD pair is currently on it, which should mean that there is a probability that it will bounce and move up. The economic calendar contains the German ZEV Economic Sentiment for November, which should show a worsening of trust from today’s news.

Europe’s largest economy is going through a second blockade, but the economic impact should be less than the first blockade in March and April. Amid a tangled background of viruses across Europe, and the ECB should be further eased next month.

Although it could also verbally intervene if necessary, it may not be easy to profit in euros unless the New Zealand dollar begins to weaken materially.

Tonight we have essential news for the New Zealand dollar, and that is that the New Zealand Reserve Bank will present its position on whether the interest rate will remain at the same level or will be a change.

The current interest rate is 0.25%. If it stays at the same level, it is also important to listen to the officials of the Reserve Bank of New Zealand about the next steps, possible stimuli, aid packages to the economy to eliminate the consequences of coronavirus.

The number of newly infected coronavirus cases in New Zealand is under control and at a low level. However, in the last two months, the newly infected corona is slowly growing, and the curve is pointing upwards.

-

Support

-

Platform

-

Spread

-

Trading Instrument