EUR/AUD forecast for December 30, 2020

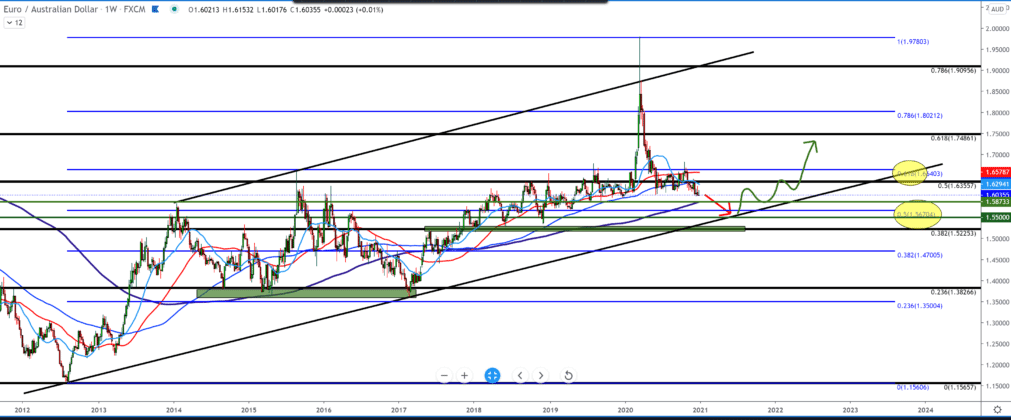

Looking at the EUR/AUD pair chart on a weekly time frame, we see that the euro is losing against the Australian dollar. The bearish scenario is still likely up to the moving average of the MA200, where we can expect some resistance. If we see a break below the target, we have a 1.55000 bottom line of a large growing channel. The bearish scenario is effective but close to resistance, so one should be careful.

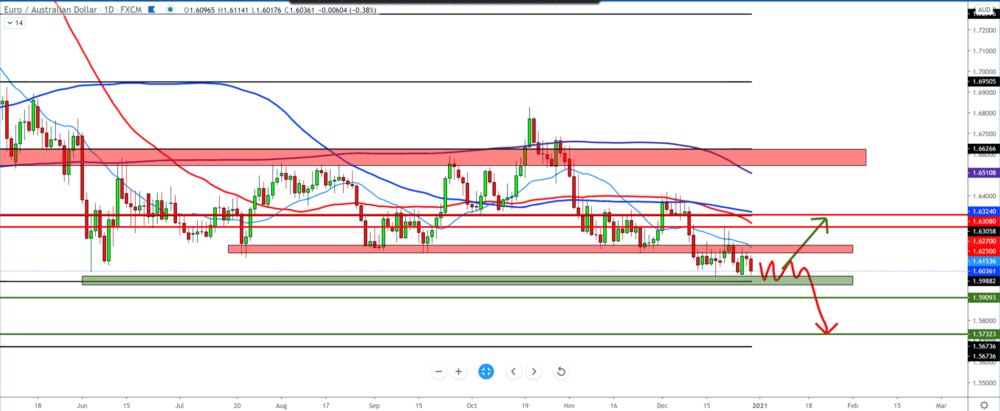

On the daily chart, we see that the EUR/AUD pair is under pressure from all moving averages, even below MA20, and is now testing the psychological level of 1.60000. A break below 1.6000 can be a sign for us to continue the bearish scenario to 1.57500, while on the contrary, if we see consolidation, we can see it as the beginning of a bullish scenario to 1.62500.

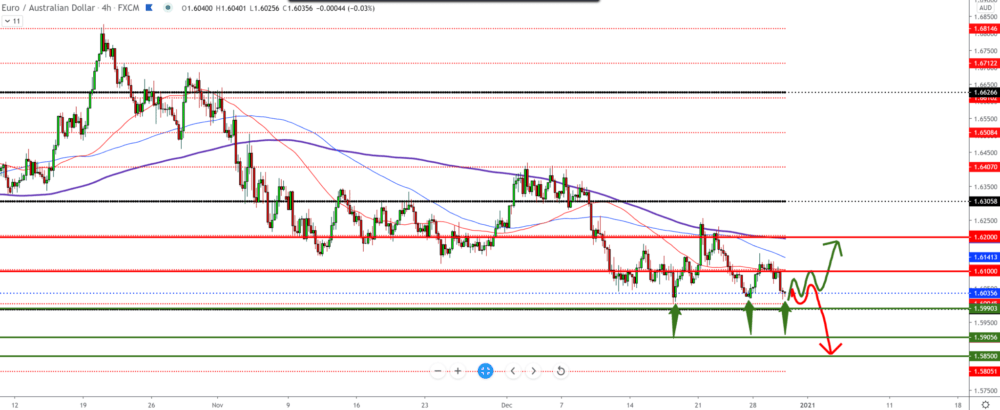

In the four-hour time frame, we see that the EUR/AUD pair has retreated up three times with 1.60000, which is, for now, the support that resists and supports the euro. A break below that can push the pair to 1.58500. Otherwise, if support continues to resist, we can expect a stronger bounce out of the zone and a jump to 1.62000.

This week is weak with economic news due to the end of the year; our focus may be reported on corona cases, vaccinations, statements on implementing the Brexit agreement, statements of politicians, presidents, etc.

Germany reports 1129 deaths in the latest update today. According to local media, a contagious variant of the UK virus strain has circulated among the German population since November. Increasing bets on a strong global economic recovery in 2021 continue to support the prevailing mood in the market. This, in turn, continued to weigh on the safe US dollar and was seen as one of the key factors favoring perceived riskier currencies, including the Australian dollar.

-

Support

-

Platform

-

Spread

-

Trading Instrument