Earnings per Share: Basic vs Diluted

When calculating the earnings per share (EPS) of a company, there are two differing formulas. We can talk about an EPS that is basic and one that is diluted. Both can be useful depending on the exact context of the business an investor may be studying. Therefore, in this article, we will be explaining the EPS formula in both forms. We will then expand on how to use them.

To begin, what we need to explore is the purpose of the EPS. Investors calculate the EPS of a company to attain a reasonable understanding of the profitability of a particular business’ stock. It is specifically useful for public companies. A private company would have no need to publish such figures. It allows investors to understand which stocks would yield them with the greatest returns. A higher EPS would indicate that a stock’s price may rise in the future. A higher EPS value is, therefore, desirable. Anyone holding stocks would usually not directly be able to profit from higher stock profitability. Still, they may be able to negotiate for higher dividends from a company by contacting the board.

You can also use the EPS figure for calculating other, more advanced figures, like the price-to-earnings ratio. This means dividing the price of a stock by its EPS. This figure signifies how much the market values the stock against each dollar it earns. It tells investors if analysts believe a stock is undervalued or overvalued.

Now that we know what investors need an EPS figure for, we can move on to explaining the basic formula for both the basic and diluted EPS.

Calculating the EPS Formula

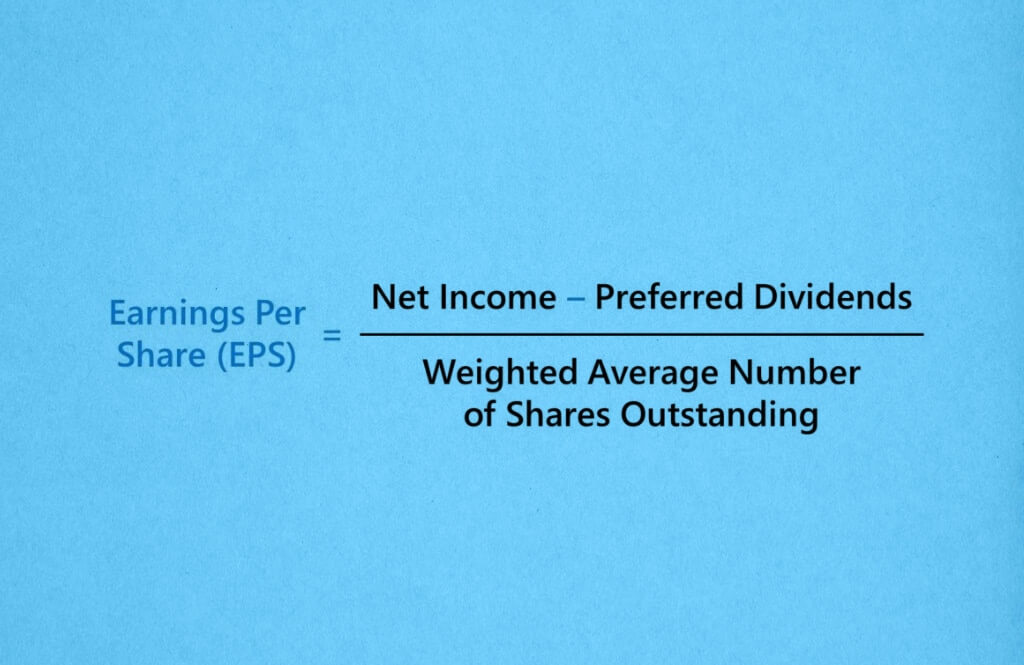

The net income of a company does not tell the whole story of how profitable it would be to invest in a company. The number of shares available can significantly change how much potential profit a company would offer per share. Keeping this in mind, calculating the EPS formula is actually quite simple. You first calculate the net income of a company, subtract the dividends of preferred stocks and then divide that figure by the weighted average number of outstanding shares (shares that investors hold). Or, to be more straightforward: EPS = (Net Income – dividends of preferred stock) / weighted average number of outstanding shares. So this then gives you the profits of a company per share.

A diluted EPS formula is a little different. You start similarly by taking the net income of a company and subtracting the dividends of preferred stocks. The next part is where the difference appears. At this point, you will need to add the weighted average number of outstanding shares to dilutive shares (securities that could be converted into shares, such as options and warrants, among others). If we were to write out the formula, it would be like this: diluted EPS = (Net Income – dividends of preferred stock) / (weighted average number of outstanding shares + number of dilutive shares). So, the use of this formula also takes into account the conversion of all convertible securities.

When to Use the Basic vs Diluted EPS Formula

So, there is a reason for the existence of two different earnings per share formulas. The basic EPS formula gives you an upfront evaluation of a company and may be more useful for evaluating a company with a simple capital structure. Hence, it would be better to view the basic EPS of smaller and newer companies that could offer investment opportunities.

The result of the basic formula would give a higher EPS value than the diluted formula (although it may be the same in rare cases). Therefore, when using the basic vs the diluted earnings per share formula, the basic tends to promise investors with higher profitability. Hence, on the surface, the basic formula gives results that are more attractive but could potentially be deceiving. Companies can also intentionally mess with the basic EPS figures to make their company appear more attractive. They could, for example, buy back their shares, artificially inflating the price of the EPS value.

A diluted EPS offers a more comprehensive picture of a company. Using it is especially useful for larger companies with complicated capital structures. A company could issue a large number of additional shares, possibly to raise additional funds, diluting investors’ current holdings. This would mean the conversion of convertible preferred stocks, bonds, etc. This would severely change how investors view a certain company. Therefore, it would be best for them to calculate this possibility before a company issues these shares. So, this formula accounts for all potential shares that could exist at the moment.

The Disadvantage of Using EPS

Both are actually relatively basic figures, although very important, and any investor would have to study other numbers to gain a deeper understanding of how a company may function. We mentioned the price-to-earnings ratio earlier, which is a good example of a formula that offers more useful data to potential investors. One example of what the EPS figure does not take into account is the value of the assets of a company. So, one company could be far more efficient than another in creating value with fewer underlying assets. This first company would likely be a more attractive investment for stock traders, as the company model is likely more effective.

Another factor that the EPS may not take into account is what analysts call ‘extraordinary items’. These can be any number of things. They generally are relevant in unusual events that could have brought great profits to a company at a certain point. This event may not be repeatable, so investors might get the wrong impression based on the EPS figure that they calculate after this event. For example, a company may sell a very valuable asset, like a factory, to move to a location in which the land value will be lower. This factory would be an extraordinary item that temporarily distorts the EPS. Some companies may even purposefully distort the EPS figure by selling an extraordinary item.

Conclusions of The Basic vs Diluted EPS Formula

So we can make some conclusions on the formulas for earnings per share, the basic vs diluted versions. The diluted EPS would give a greater insight into the potential risk an investor would have when buying a stock when compared to the basic EPS. On the whole, then, in most cases, the diluted EPS is preferable. Analysts, therefore, tend to prefer using the diluted formula, which companies tend to help provide the result of. Companies will still offer a basic EPS, as it is easier to comprehend for investors with less experience. Comparing and contrasting both would give you the best comprehension of a company’s potential.