CHF/JPY forecast for January 29, 2021

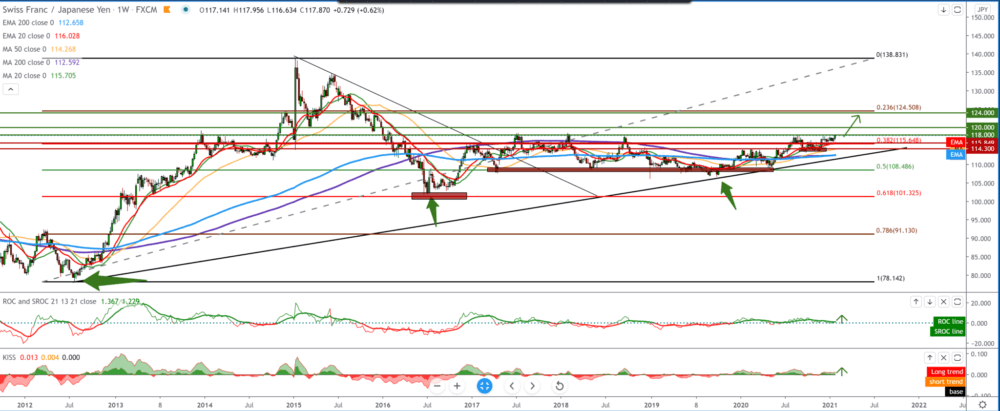

Looking at the chart on the weekly time frame, we see that the CHF/JPY pair has come again right up to 118.00 long-term resistance since 2017. the Swiss franc has a very good opportunity to break through that zone soon and move up first towards 119.00 and later towards the psychological level at 120.00. Technically speaking, when we set the Fibonacci retracement level, we see how the pair bounces on each Fibonacci level. We can see that the big support was at the 50.0% level and after the last rejection up, the pair climbed to 38.2% level at 115.60. Currently, the pair at 117,850 managed to separate from the Fibonacci level of 38.2% and move towards 120.00. In the long run, this pair is in the bulls trend in the coming period.

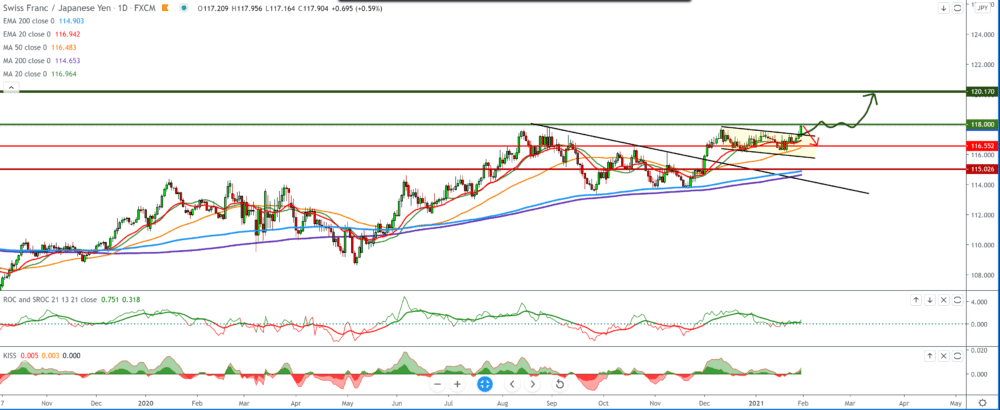

On the daily time frame, we also see a bullish trend with good support for moving averages. The last consolidation formed a smaller consolidative parallel channel, and today we see that the CHF/JPY pair made a break outside that channel and are now testing the level at 118.00. In previous cases, we are talking about from June 2017, that level was very strong resistance, and now we are testing it again. If the CHF/JPY pair fails to cope with the pressure and slides down support, we can seek support first at 117.00, where the chart encounters moving averages. Looking at the bigger picture, the bullish trend is still in force in the coming period.

Check-out FinanceBrokerage’s Comprehensive Review on Libertex

On the four-hour time frame, we see that the CHF/JPY pair is one step closer to 118.00, but currently, there is a lot of pressure, and if CHF succumbs to that, we can see a pullback to 117,500 first line of support. Moving averages are down to 117,200, which gives enough room for a pullback. As in the previous time frame, the trend is bullish, and for now, it is best to wait for the end of the pullback for a new entry into the continuation of the bullish trade.

From today’s economic news, we can single out the following: Data on Japanese housing fell further in December, data from the Ministry of Land, Infrastructure, Transport and Tourism showed this morning. The data also showed that construction orders received by the big 50 contractors in December fell 1.3 percent year-on-year, after falling 4.7 percent in November. Japan’s consumer confidence fell to its lowest level in five months in January, cabinet data showed this morning, with a consumer confidence index falling to 29.6 in January from 31.8 in December. The latest index was the lowest since August when it was 29.3.

-

Support

-

Platform

-

Spread

-

Trading Instrument