Bitcoin, Ether, Dogecoin with New Potentials for New Highs

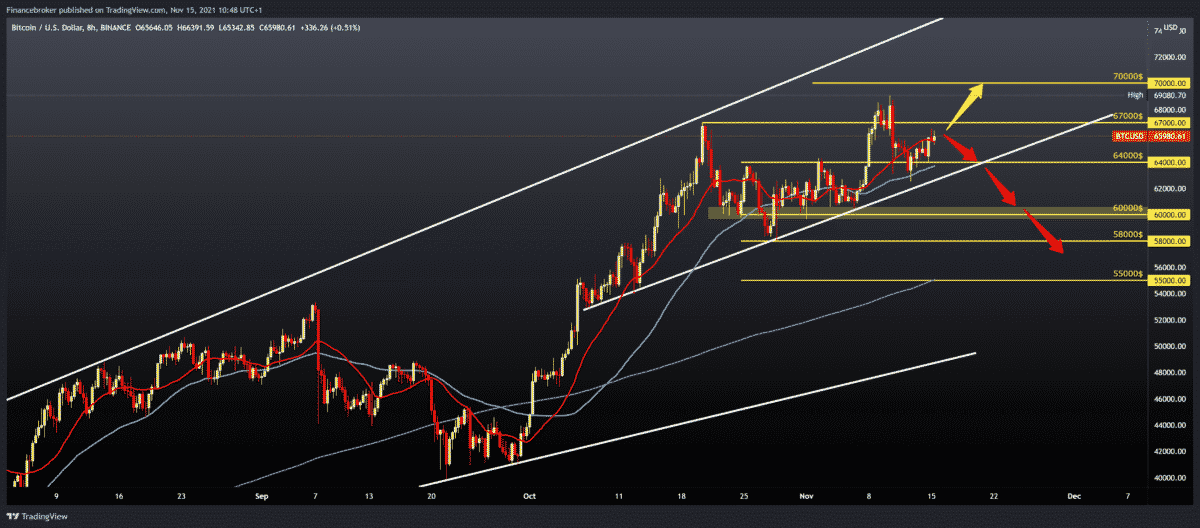

The price of Bitcoin last week made a new historical high at $ 69080, after which the price dropped to $ 62,500. Positive consolidation has brought us back above the $ 64,000 zone, and we are now turning onto the bullish side again. Increased optimism we will reach a new historic high can happen if we climb above $ 67,000.

Bullish scenario:

- The price must be kept above MA20 and MA50 to stay in the bullish trend.

- Additional support is our lower trend line.

- Our first resistance is at $ 67,000 October higher high, and our next resistance is the previous historical high at $ 69,000.

- Our potential new high is at $ 70,000.

Bearish scenario:

- We need a pull below the MA20 and MA50 moving averages.

- A further break below leads us to test the bottom trend line, and a break below us can drop us into the previous consolidation zone of about $ 60,000.

- Our next support is at $ 58,000; then in the MA200 zone, the moving average is at $ 56,000.

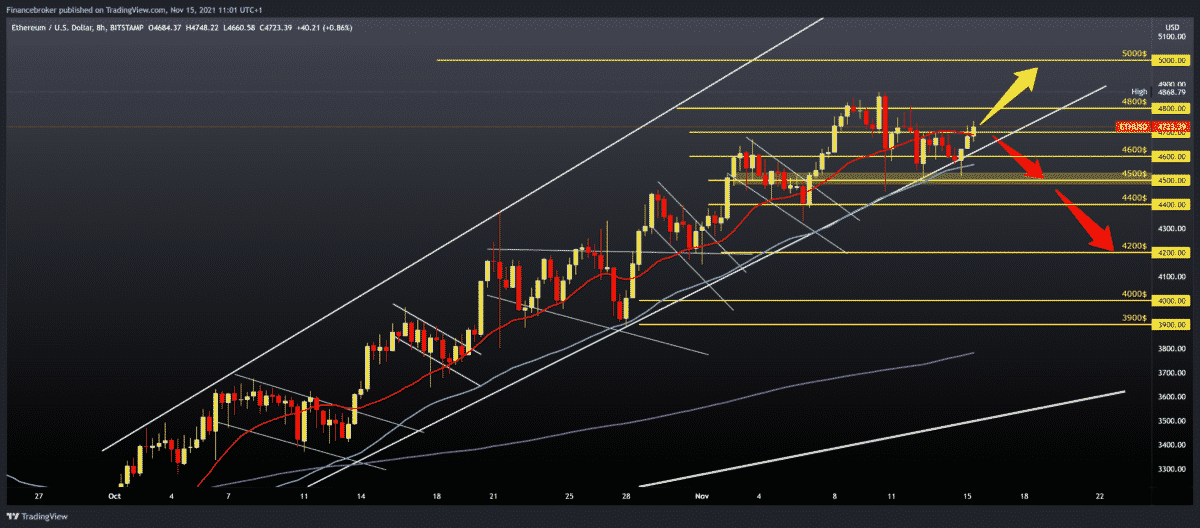

Ethereum chart analysis

After reaching a new all-time high of $ 4,868 last week, the price made a pullback to the $ 4,500 zone. Price has found support and is now at $ 4,725 in a new attempt to jeopardize the previous higher high.

Bullish scenario:

- We still need the support of the MA20 and MA50 moving averages along with the bottom trend line.

- Around $ 4,800, we have the first potential resistance, and here we can expect the next consolidation.

- The next resistance is at $ 4868, and the break above us climbs maybe above $ 4900.

Bearish scenario:

- We need a price withdrawal below MA50 and a lower trend line.

- Further pressure can make a breakthrough below, where we get into a situation to re-test the $ 4500 zone.

- We are looking for the next support at $ 4400, then the next bigger support at $ 4200.

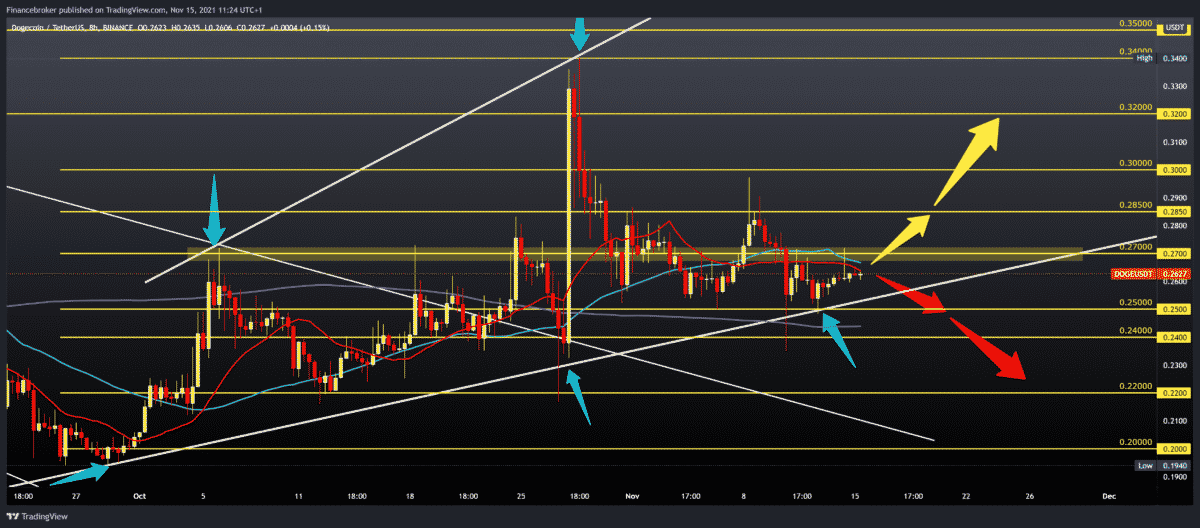

Dogecoin chart analysis

The price of Dogecoin is still in consolidation below the essential zone at 0.27000. During November, the price movement is in the range of 0.25000 -0.28500. We have been in a smaller bullish trend for the last few days, and we need a more concrete jump above 0.27000.

Bullish scenario:

- The price should break above the MA20 and MA50 moving averages.

- A break above 0.27000 can lead us to the next resistance at 0.28500; then, our next 0.30000 is the psychological level.

Bearish scenario:

- We need a negative consolidation that will bring us down to the lower October support line.

- With the breakthrough below, we the descent to test the 0.25000 zone.

- The next lower support is on 0.24000 in the zone of the MA200 moving average.

- A further drop in prices requires additional support at 0.22000 October higher low.

Market overview

Popular on-chain analyst Willie Wu reveals critical factors that prevent bitcoin (BTC) from growing and printing new top values of all time.

In a new interview with Coin Stories, Woo says he looks at a specific metric on the chain that tells him that Bitcoin is not yet ready to rally.

Another factor that delays the transition of BTC to higher prices is the emergence of bitcoin futures trading on the stock exchange (ETF). According to an on-chain analyst, Bitcoin ETFs encourage investors to hold derivative contracts instead of buying BTC.

We’ve also had a lot of changes with approved ETFs, and they don’t actually buy Bitcoin, and they buy futures contracts to be exposed to the price. Finally, Voo says greed and euphoria over the bitcoin market contribute to the stalled rise of BTC.

The other thing is that everyone is very, very bullish at the moment, and whenever everyone is bullish, it’s very difficult for the price to jump up because you get a lot of speculative long positions in the markets, and that makes it very, very profitable. Prevent price increases and effectively take off long positions.

-

Support

-

Platform

-

Spread

-

Trading Instrument