Bitcoin and Ethereum – The Price Gradually Rose

- The bitcoin price has been in the sideway consolidation in the last ten days, between 28,500-31,500 dollars.

- The price of Ethereum should soon reach the resistance zone at the $ 2,100 level.

- India must establish rules on cryptocurrencies to address regulatory uncertainty, protect investors and improve its crypto sector.

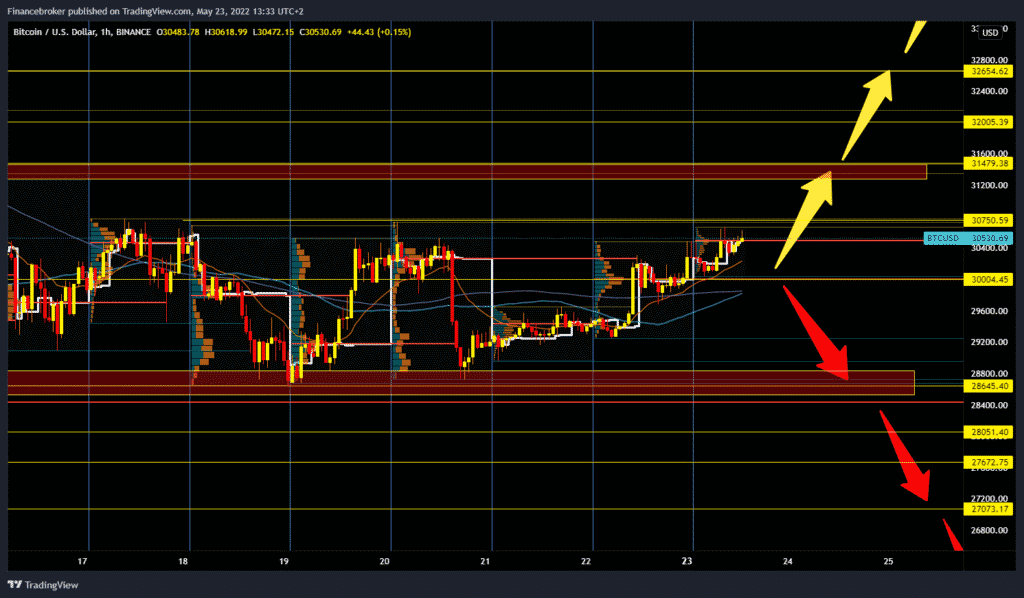

Bitcoin chart analysis

The bitcoin price has been in the sideway consolidation in the last ten days, between 28,500-31,500 dollars. On May 20, the price tested the lower support again and launched a new bullish consolidation. Over the weekend, the price gradually rose, resulting in a break above the $ 30,000 level. We should climb to the $ 31,500 level again in the next period. If the price stays around that level, maybe we could see a break above and a rise to higher levels on the chart. the first next bullish level is $ 32,000, then $ 32,650. We need a new negative consolidation and a pullback below the $ 30,000 level for the bearish option. After that, we can expect re-testing of previous support in the zone of $ 28,500-29,000. The price break below would probably bring us down to testing previous May levels.

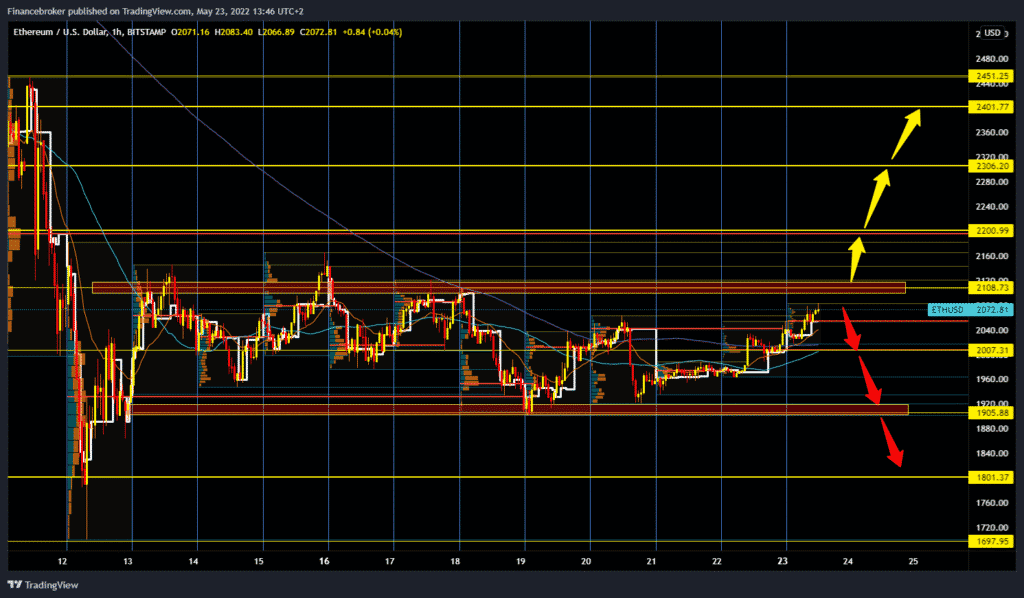

Ethereum chart analysis

The price of Ethereum should soon reach the resistance zone at the $ 2,100 level. We could expect the next resistance at that level if we don’t see a strong break above. We need the price to rise to a minimum of $ 2,200 level in order to create space for a potential correction and then make a new bullish impulse. If the price succeeds, our next bullish targets are $ 2,300, $ 2,400 and $ 2,500 levels. We need a new negative consolidation and pullback first to the $ 2000 level for the bearish option. Then if bearish consolidation continues, we move on to the previous support zone around $ 1900 price. Staying longer in that zone could create bearish pressure that would continue to lower the price further towards 1800 dollars; our May minimum is 1697 dollars.

Market overview

India and problems with cryptocurrencies

India must establish rules on cryptocurrencies to address regulatory uncertainty, protect investors and improve its crypto sector, CoinSwitch CEO Ashish Singal said on Sunday.

Although the Central Bank of India supported the ban on cryptocurrencies due to the risk to financial stability, the transition of the federal government to income tax from them was interpreted by the industry as a sign of acceptance by New Delhi.

Blockchain and cryptocurrency companies have a large presence at this year’s meeting in Davos, which coincides with the period of falling cryptocurrency prices around the world.

India’s central bank has expressed “serious concerns” about private cryptocurrencies. In December, Prime Minister Narendra Modi said that such emerging technologies should be used to empower democracy, not undermine it.