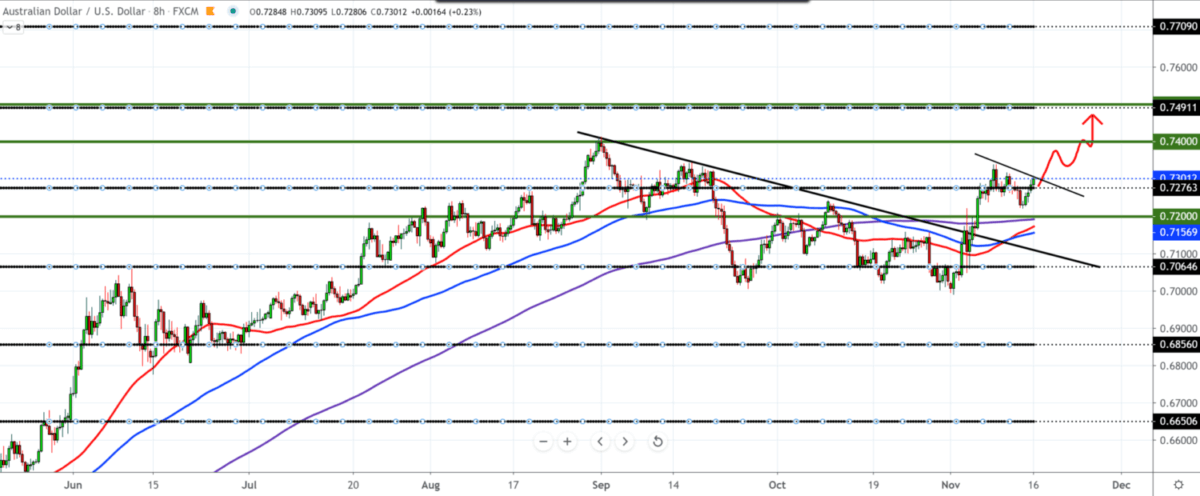

AUD/USD forecast for November 16, 2020

We can see that the price chart of the AUD/USD pair is at a crucial turning point on the way to the potential level of 0.75000. It is currently in the zone around 0.7280-0.7300; as support from the bottom, we have MA50, MA100, MA200. The dollar started weak this week, while the Australian dollar has been good momentum since late last week.

Commenting on the prospect of negative interest rates as a policy option, the governor of the Reserve Bank of Australia said negative rates in Australia are still extremely unlikely, and Negative rates would lead until the pressure on the Australian dollar, only used to switch to Negative rates only if all the world’s largest banks had negative rates.

EUR/USD forecast for 16 November, 2020

Economic growth depends on keeping the coronavirus situation under control, said the governor of the Reserve Bank of Australia; his comments are: that lower population growth will lead to slower nominal GDP growth, as that the Chinese economy is growing quite strongly, in favor of the Australian dollar, possible problems with Australian-Chinese trade are hoped to succeed well.

From the economic news this week for AUD, we have tomorrow the Reserve Bank of Australia meeting on Thursday, the Employment Change for October, and the Retail Sales measure on Friday. These events will have an impact on your couple for sure.

The dollar weakened in early European trade on Monday, and positive economic data from Asia boosted optimism for a global recovery, even given the continued rise in new Covid-19 cases. The number of newly infected in America is at a record level, and the number has exceeded 150 thousand newly infected.

Pandemic-related headlines (vaccine updates, number of cases in major economies, the outlook for stimulus) will continue to influence AUD’s intra-week trends. Other news from other major economies, US retail, UK CPI, etc., may also affect Austrian trading during the day, as US election, viral, and stimulus uncertainty may continue to weigh on the dollar and boost high yields Aussie, throughout the week.

-

Support

-

Platform

-

Spread

-

Trading Instrument