Market News and Charts for November 16, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

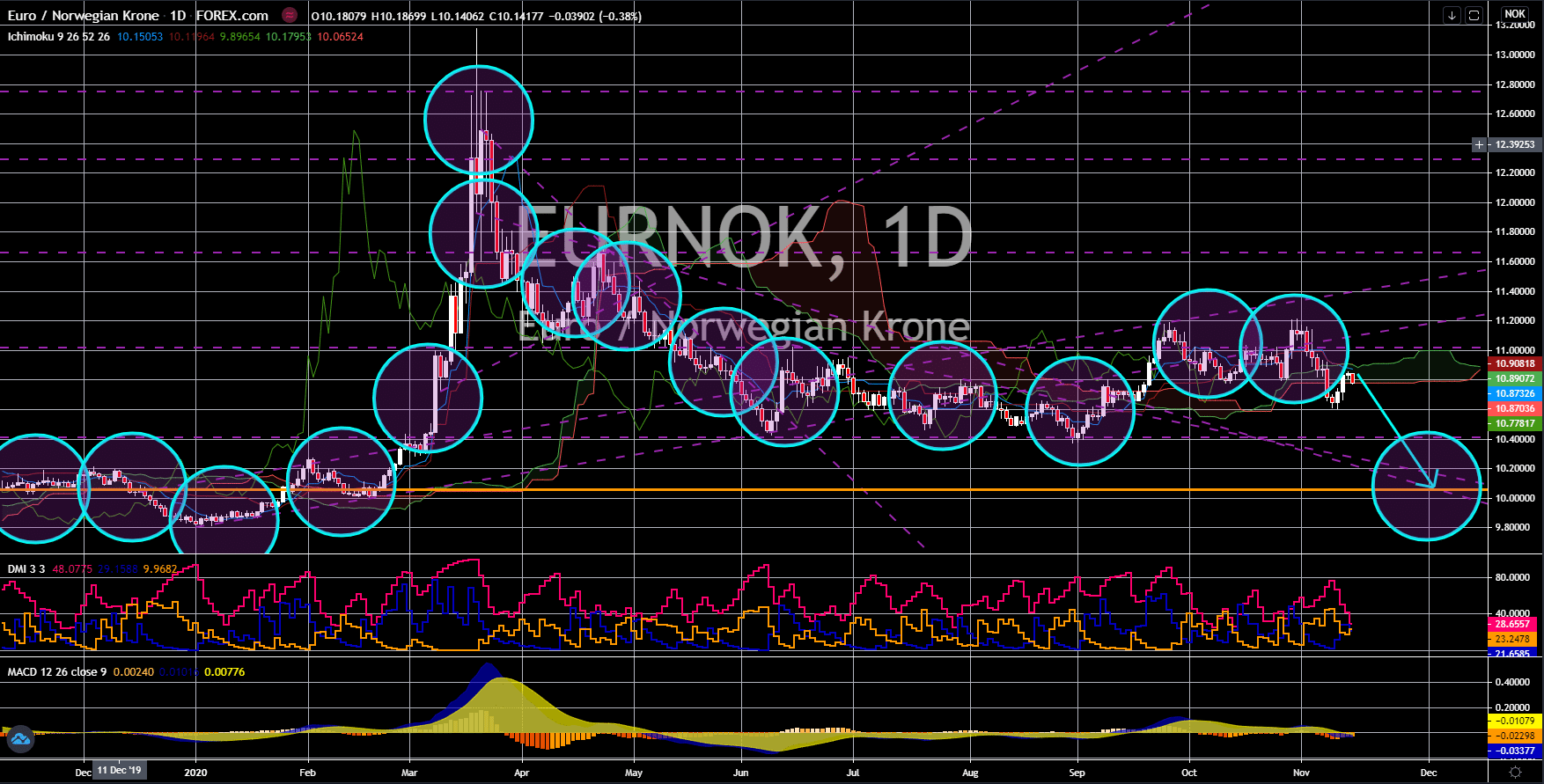

GBP/BRL

The pair will continue to move higher in the following days towards the 8.0000 resistance level. The United Kingdom managed to advance against its previous reports while the rest of the EU posted stagnant results. Britain cut back some of its losses in the second quarter after it posted its Q3 GDP growth. The figure was 15.5% QoQ compared to the -19.8% decline in Q2. Meanwhile on a year-on-year basis, gross domestic product growth was -9.6% or almost twice lower than the -21.5% figure in the prior month. Construction Output report posted 2.9% growth, slower than the 3.8% figure last month but better than analysts’ expectations of 2.1%. The services sector was still leading the UK’s economic growth with the sector’s index doubling its recent number of 7.1% to 14.2% in this month’s report. Investors should also keep an eye to the looming end of the Brexit transition. Analysts see the likelihood of a no-deal Brexit.

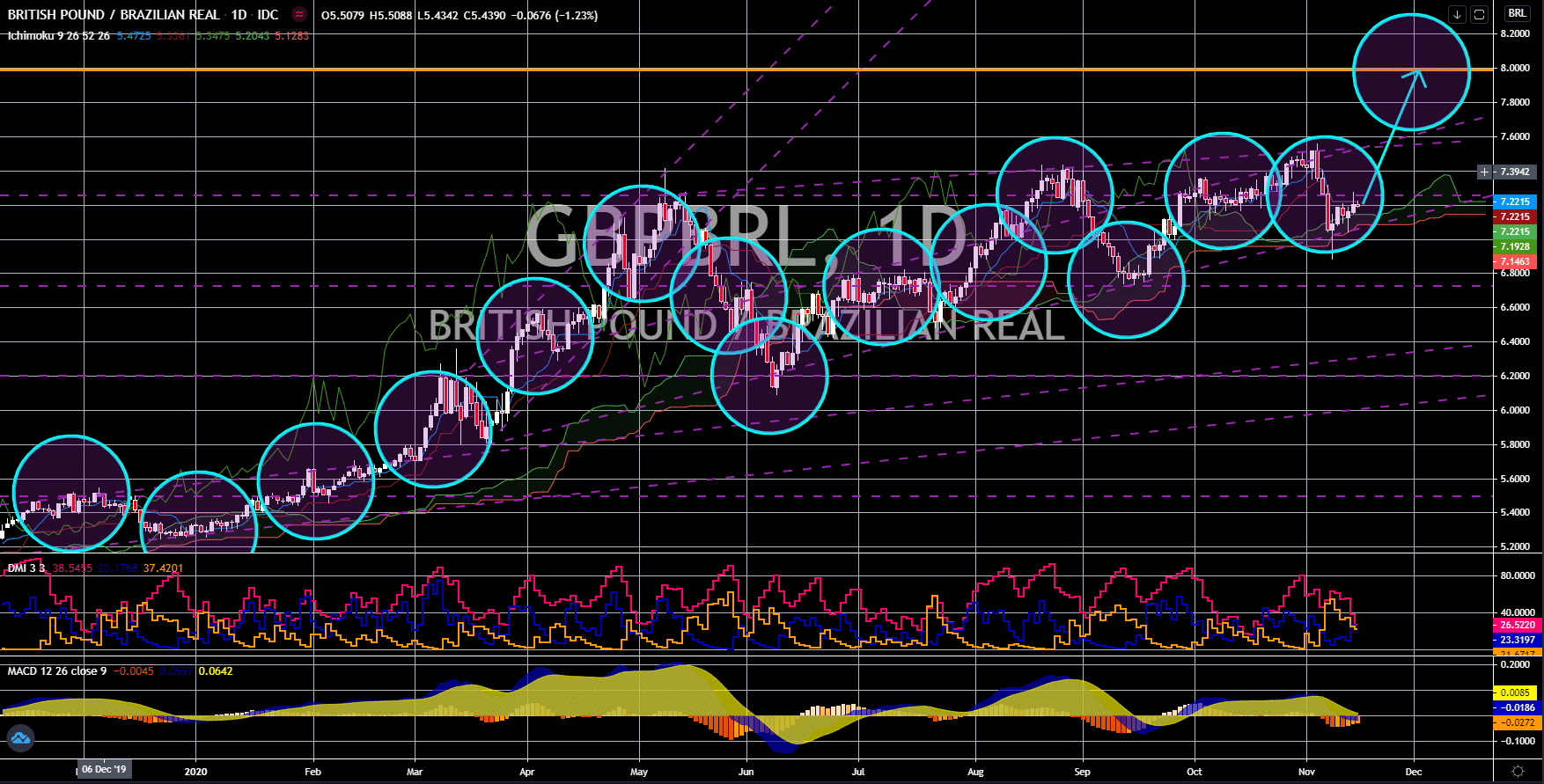

USD/BRL

The pair bounced back from a major support line, sending the pair higher to retest its previous high. Analysts are expecting Brazil to get out of recession in the coming months backed by a strong economic activity in the third quarter. Activity in September went up by 1.3%, bringing a total of 9.5% increase in economic activity from January to September 2020. That leaves only 2.5% in remaining percentage growth before Brazil goes back to its pre-coronavirus level of economic activity. As a result, analysts expected the Q3 GDP figure to increase by 7.3% compared to their previous estimates of 6.7%. Meanwhile, the forecast for the annual GDP growth was raised to -5.5% against the earlier forecast of -5.8%. Despite the overall positive outlook in Brazil’s economy, investors are still expected to choose the USD as their investments. This was due to the COVID-19 vaccines developed by the US pharmaceutical companies.

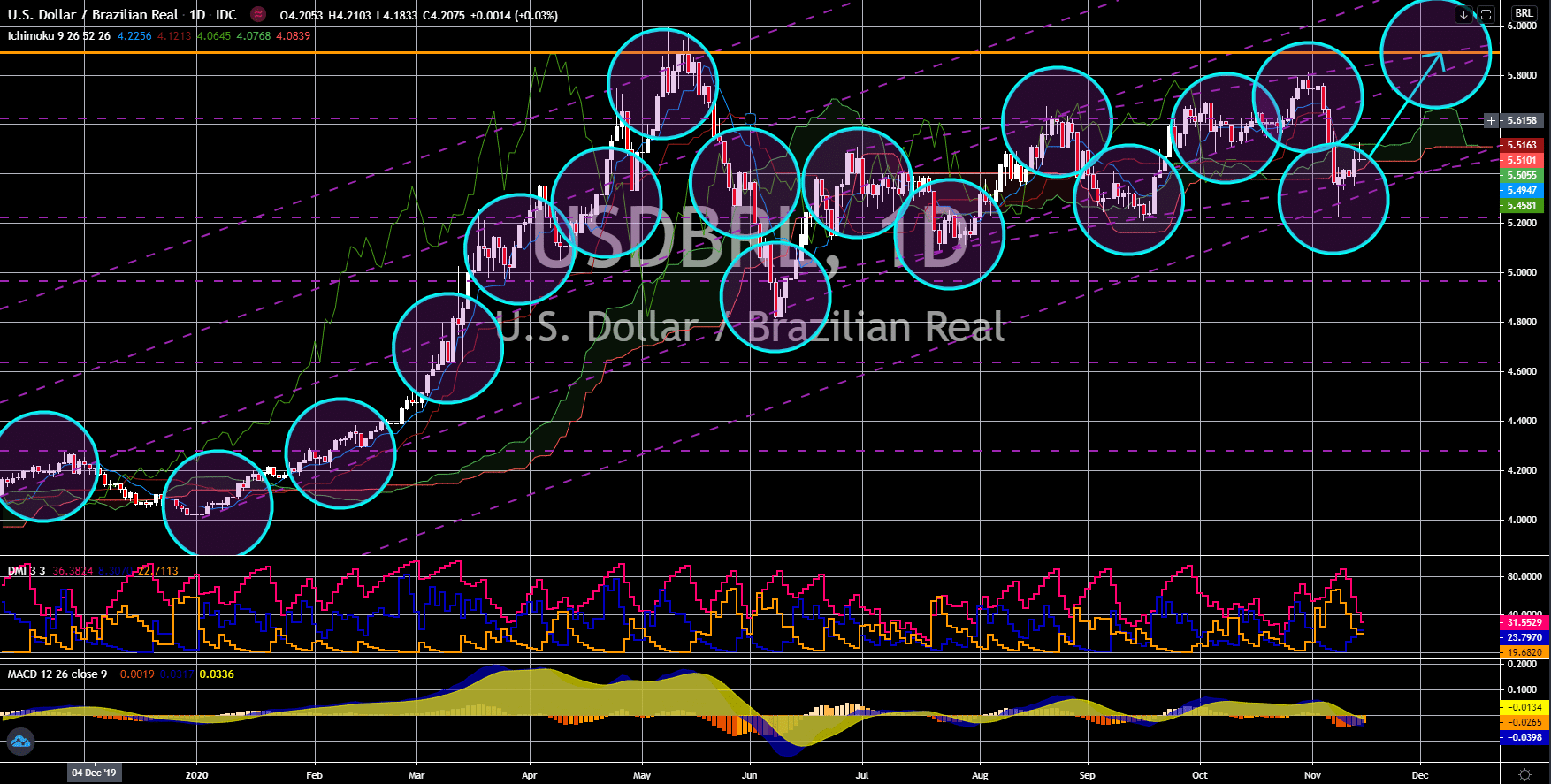

USD/RON

The pair is expected to bounce back from its support line to complete the “Triple Bottom” formation. All eyes are in the United States right now due to three (3) reasons. First, US pharmaceutical companies Pfizer and BioNTech developed a vaccine with 90% effectiveness based on its Phase 3 trial. Once approved by the Food and Drugs Administration (FDA), these vaccines will dominate the market and will push the US economy higher. Second, president-elect Joe Biden is planning to increase taxes on foreign profits, which might force US companies operating abroad to go back and conduct business in America. And third, a possible stimulus law is expected to be approved before the inauguration of Biden as the 46th President of the United States. The $2.2 trillion bill is expected to further decrease the number of unemployment claimants which was now at its lowest of 709,000 since COVID-19 became pandemic in March.

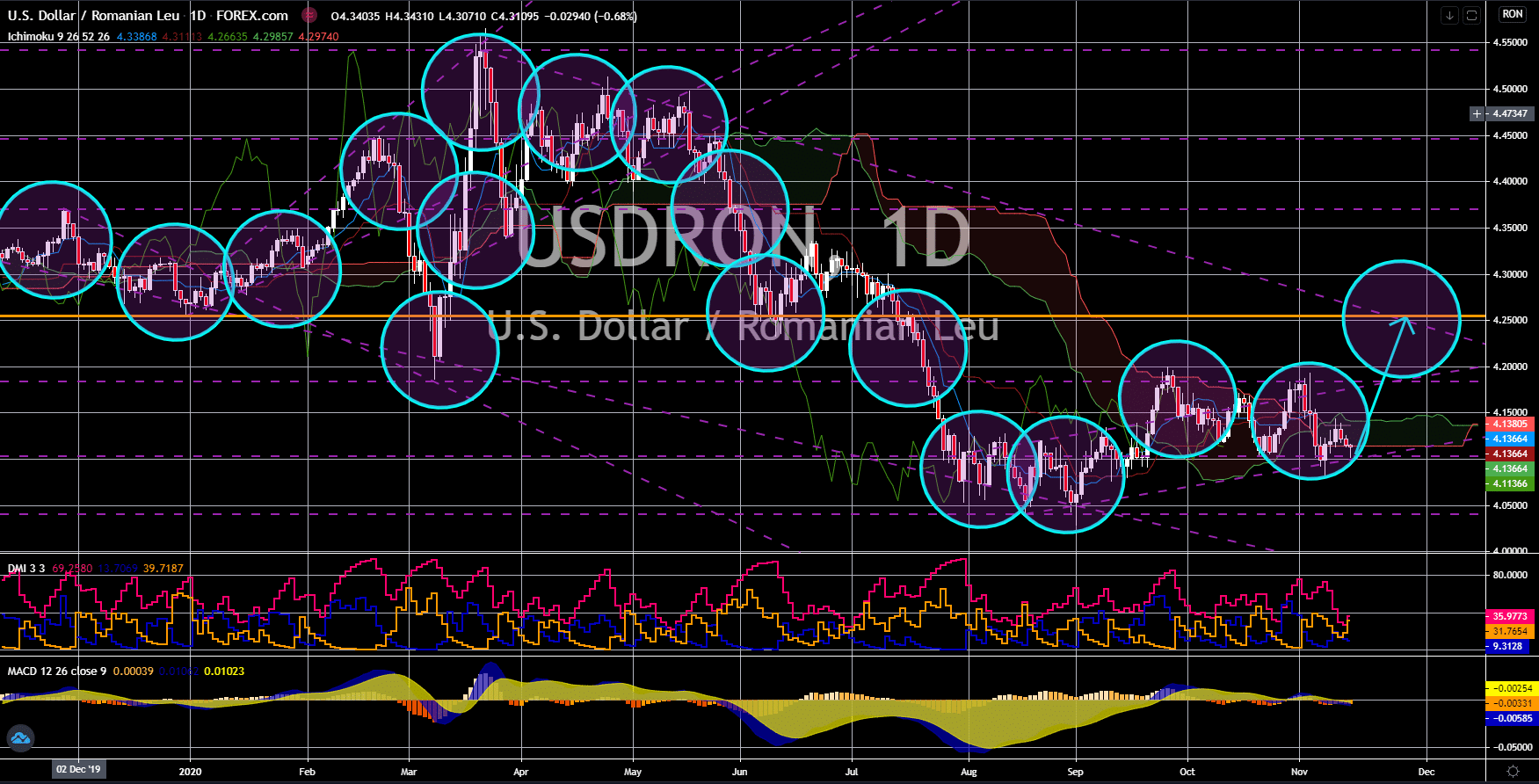

EUR/NOK

The pair failed to breakout from a resistance line, sending the pair lower towards its previous low. Norway’s sovereign wealth fund reached a historic high on Friday, November 13. The world’s largest sovereign wealth fund is now valued at 10.93 Norwegian kroner or $1.2 trillion. This gives each Norwegian citizen about $220,000.00 each from the fund. The increase in Norway’s oil fund increases the country’s liquidity, which, in turn, can be used to offset the impact of the second wave of COVID-19 in the country just like what happened in the previous month. Norway withdrew $37 billion in May from the fund to be used as a stimulus for individuals and businesses affected by coronavirus. However, the gains of the sovereign wealth fund from its investments in US stocks. It was reported that the fund made $44 billion in profits from the tech rally in the previous months, bigger than its withdrawal back in May.