AUD/CAD forecast for February 2, 2021

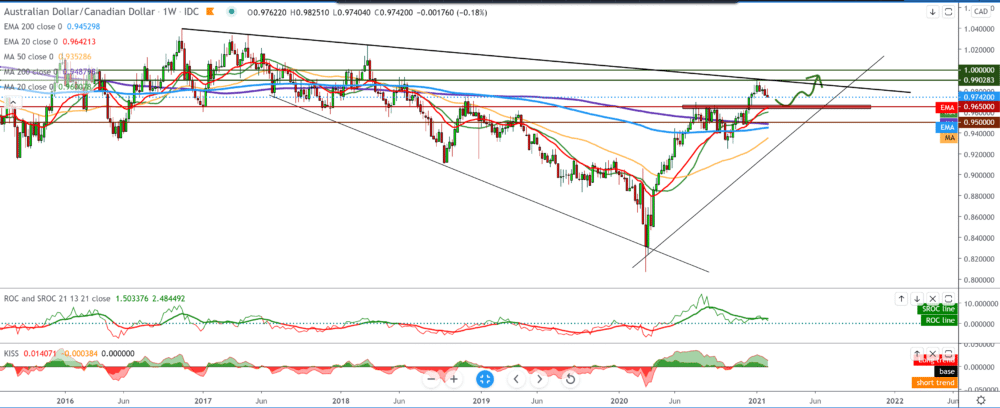

Looking at the chart on the weekly time frame, we see that the AUD/CAD pair has a resistance of 0.99000 reached the high of June 2018, but after that, a real pullback. We can look for the support zone at the breaking point of the previous lower high within the bulls of impulses at 0.96500, the psychological level below is at 0.95000. Following the moving averages, they are on the bullish side, and for now, they are still supporting from the lower side.

On the daily time frame, the AUD/CAD pair has fallen below the moving average of the MA20 and EMA20 and is now testing the MA50 from the bottom up at 0.97000. After the rise in the price of oil, the Canadian dollar gained strength, and in this case, the pair descended to lower levels of support. If the bearish momentum continues, we can look at potential support for the MA200 and EMA200 at a psychological level of 0.95000. We can expect support and consolidation before the next move up or down.

AUD/NZD forecast for February 2, 2021

On the four-hour time frame, we see that the AUD/CAD pair managed to make a break below MA200 and EMA200, so now all the indicators are from the top, confirming the bearish momentum in the coming period. We can ask for support at 0.96000-0.96500; a break below that support takes us to 0.95000. For the bullish scenario, we need to break the above moving averages first.

From the news for these two currencies, we can single out the following: The main points of the RBA were: The KE Bank program has been expanded, and an additional AUD 100 billion for purchases at the rate of AUD 5 billion per week begins in mid-April when the current program ends. The bank has given guidelines that it does not expect that the conditions for raising the cash rate will be established by 2024 at the earliest. The Australian Reserve Bank’s policy committee, headed by Governor Philip Love, decided to leave its cash rate unchanged at a record low of 0.10 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument