AUD/NZD forecast for February 2, 2021

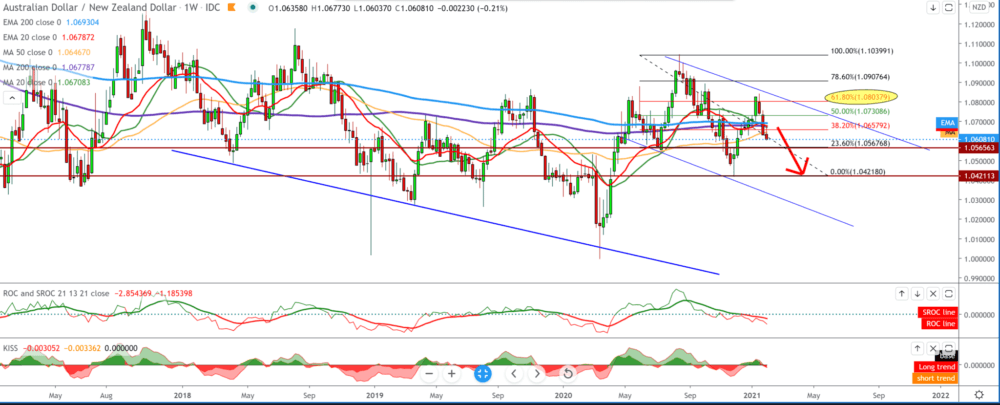

Looking at the weekly time frame graph, we see that the AUD/NZD pair makes a pullback with Fibonacci retracement level 61.8% to lower levels. We are now at the current 1.06080 and under pressure from the top of the moving averages. Based on them, we can assume that the couple will be on the bearish side in the next short term. Following Fibonacci, we can ask for the first support at 23.6% level at 1.05670, and if it does not withstand the support, our target is the previous low at 1.04200. Bearish is currently, and for bullish, we have no characters on the chart yet.

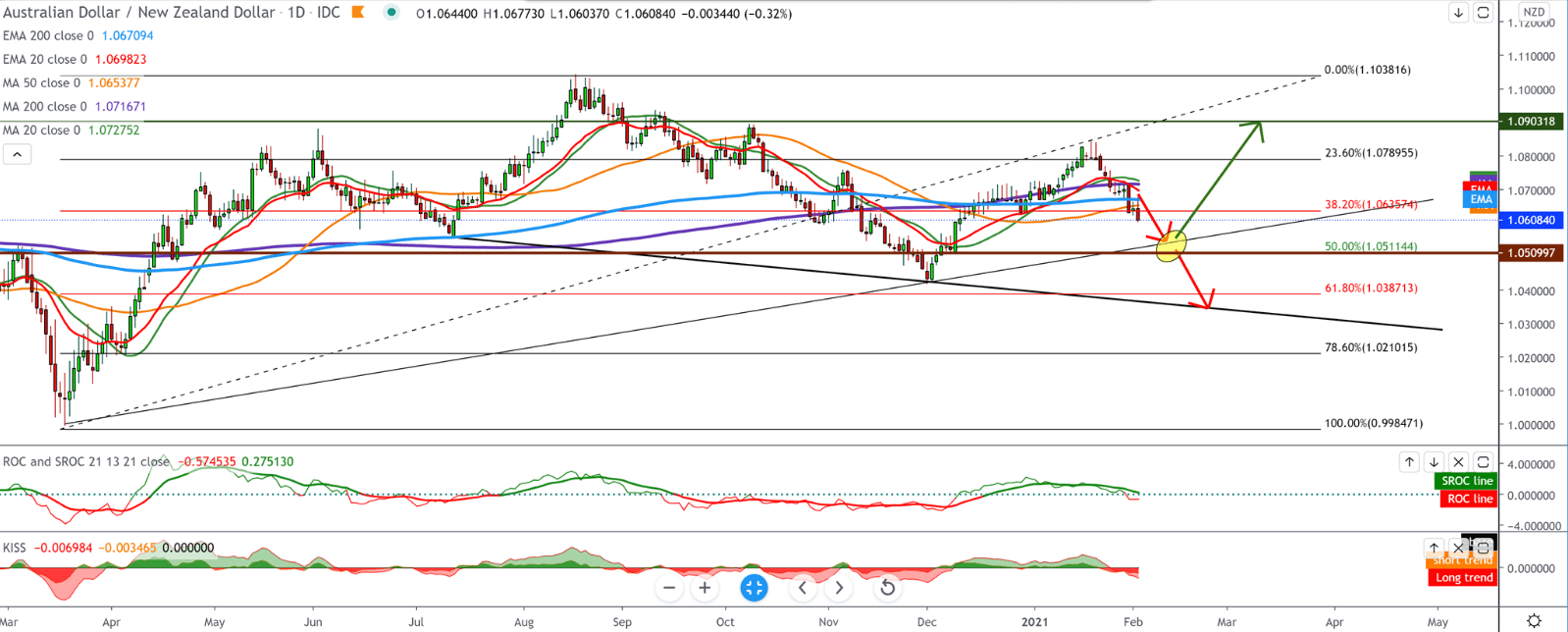

On the daily time frame, we see that the AUD/NZD pair fell below the Fibonacci level 38.2% pressed from above by moving averages tells us that the bearish momentum is in effect in the coming period. According to that, our bearish target is 50.0% Fibonacci retracement level at 1.05100. At the bottom, we have a trend line that we have set by merging previous lows, and it can also be potential support for the trend reversal. Until we get confirmation on the chart, we won’t think about it.

On the four-hour time frame, we see that the end of last week was at 1.05100, but the AUD/NZD pair opened at 1.06280 on Monday and made no GAP, i.e., space pouring out the closed and newly opened prices on the chart. So we can expect that GAP to fill, and therefore we can expect a pair of AUD/NZD to fill that gap. For the bullish scenario, we need a break above 1.070000, some positive signs on the chart with support for at least moving averages MA20 and EMA20, to begin with.

From today’s news, we can single out the following: At its first meeting this year, the Australian Central Bank increased its asset purchase program’s size and indicated that it would not raise interest rates until 2024. The Australian Reserve Bank’s policy committee, headed by Governor Philip Love, decided to leave its cash rate unchanged at a record low of 0.10 percent. Policymakers have decided to buy an additional $ 100 billion in Australian government and state and territory bonds when the program ends in mid-April. These additional purchases will be at the current rate of 5 billion US dollars per week. Both inflation and wage growth are projected to rise, but this will be gradual, with both remaining below 2 percent over the next few years.

-

Support

-

Platform

-

Spread

-

Trading Instrument