The dollar index is on the positive side above the 103.50

- After the unstable Asian trading session, the dollar index retreated to 103.47, while we saw growth in the EU session.

- On Wednesday, the Fed will decide whether to leave the interest rate at the same level or whether there will be changes.

Dollar index chart analysis

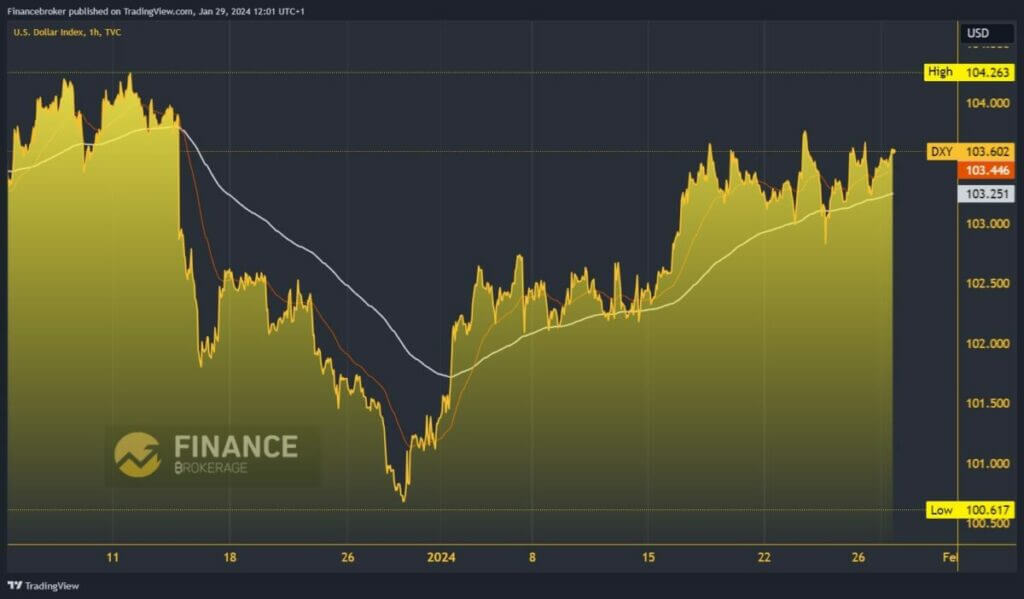

After the unstable Asian trading session, the dollar index retreated to 103.47, while we saw growth in the EU session. After gaining support, the dollar starts a bullish consolidation and rises to 103.63 levels. We could test the previous high from Friday at the 103.70 level for the rest of the day. If we succeed, we will have the opportunity to attack the January high at the 103.82 level. Potential higher targets are 103.90 and 104.00 levels.

We need a pullback to the 103.25 support level and the EMA200 moving average for a bearish option. Pressure in that zone would have the opportunity to move us below and thus form this week’s low. Potential lower targets are 103.00 and 102.80 levels. Last week’s dollar low was in the zone around 102.80 levels.

The Fed and the future interest rate decide the trend of the dollar

On Wednesday, the Fed will decide whether to leave the interest rate at the same level or whether there will be changes. Economists forecast that we will see interest rates at the same $5.50 level even after the report. This would mean that the FED is not satisfied with how inflation moves and is postponing interest rate cuts.

On Thursday, the Bank of England will decide on its interest rate. There are forecasts below that interest rates are expected to remain at the same level. German GDP and CPI on Tuesday and Wednesday could determine the euro’s direction in the coming period. And for Friday, we leave the NFP and unemployment rate reports for the end of the week.