What Is the Sweep Account?

In the world of finance, ensuring that every dollar is working efficiently is essential for maximizing earnings and minimizing cash drag. One tool that individuals and businesses can use to achieve this is the sweep account.

Understanding the Sweep Account

A sweep account is a type of bank or brokerage account. It automatically transfers any excess cash above a specific limit. This excess cash goes into a more profitable investment. This investment is typically a money market fund. The transfer occurs at the end of each day.

This reduces the amount of cash that is not earning interest by using accounts that offer higher interest rates. It allows the account holder to earn the most interest with the least effort. Though convenient, a sweep account service may come with fees that could make it less attractive on a net basis.

How Sweep Accounts Work

The auto-sweep feature in a sweep account automatically moves funds to and from your checking and investment accounts based on a preset minimum and maximum. For instance, if you have a checking account balance that exceeds a certain amount, the system automatically sweeps the excess money into a more lucrative investment option, such as a money market fund or savings account with a higher rate of interest.

On the other hand, if the amount of money in the checking account falls below a specific limit, the system transfers funds from the investment account back to the checking account to ensure there is enough money available. You won’t have to borrow money from a friend or bank to pay for your daily needs or trade currencies.

Personal Sweeps vs. Business Sweeps

Both individuals and businesses can benefit from sweep accounts, although in slightly different ways. Brokerages generally use personal sweeps to hold money, such as dividends or cash from sell orders, until the client decides on future investments. Typically, the system sweeps the funds into high-interest holding accounts or money market funds in the interim.

Business sweeps, on the other hand, are a common tool for small businesses with a need to maximize earning potential on sitting cash reserves while ensuring daily liquidity. If a business’s main checking account exceeds a certain balance, the excess funds go into a higher-interest investment product. Conversely, funds are swept back to cover expenses if the account balance falls below a certain threshold.

Benefits of Sweep Accounts

Sweep accounts offer several benefits for both personal and business finances. Business sweep accounts are beneficial for preventing money from remaining unused in a low-interest account, as it has the potential to generate higher interest rates in more flexible cash investment options. These accounts are ideal for businesses that require regular access to cash while also seeking to earn interest on their unused funds.

In a broad sense, one can get the following benefits from a sweep account:

- An auto sweep account eliminates the hassle for customers who would typically have to make frequent visits or calls to banks for regular transfers.

- These accounts ensure the savings account consistently maintains the set threshold limit.

- Sweep allows individuals to enjoy the benefits of high-interest accounts efficiently.

- Small companies can effectively utilize sweep accounts for timely loan repayments.

- Excess funds in a savings account are efficiently utilized through sweep accounts, ensuring they are not lying idle.

- Investors have the advantage of swiftly liquidating their investments made through sweep accounts.

It’s important to think about the costs of sweep accounts. Fees from banks or brokers could cancel out the advantages of earning more money. So, you need to check fees before opening an account, examine bank offers and maybe consult with a financial advisor.

The Different Types of Sweep Accounts

Different sweep vehicles are available to meet varied financial needs. For instance, a company could utilize a credit sweep to transfer surplus funds for the purpose of reducing outstanding lines of credit. The ability to be flexible enables businesses and individuals to effectively handle their finances, making sure that extra money goes into generating interest instead of being idle.

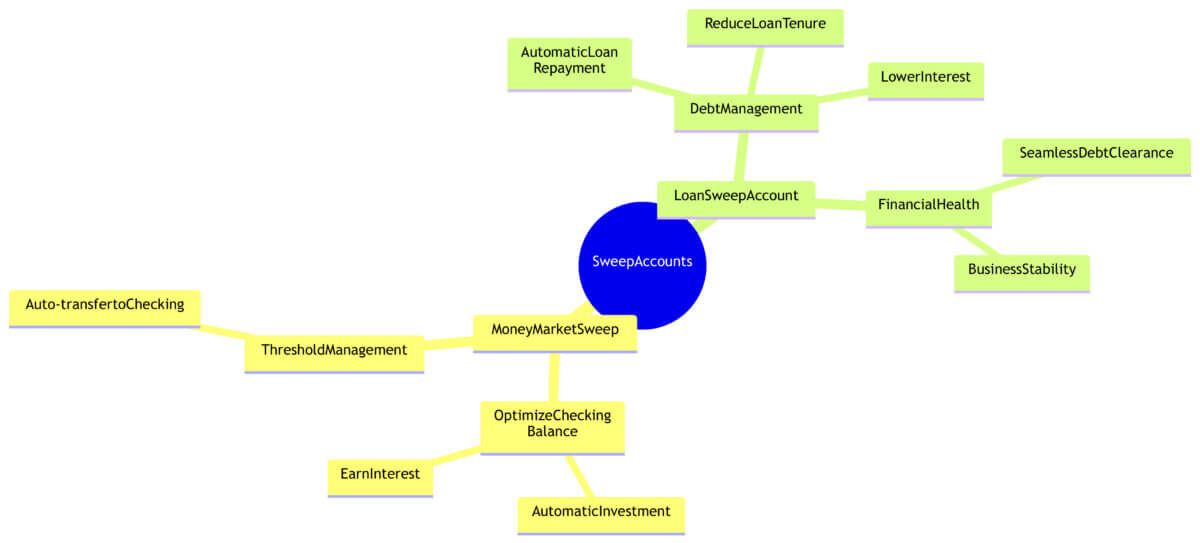

Based on the distinct functionalities, sweep accounts can be broadly classified into two categories:

1. Money Market Sweep

A money market sweep account allows you to optimize the surplus balance of your checking account by automatically investing it for increased earnings. This arrangement ensures that your funds are not lying idle but are earning interest in a money market account.

When the amount of money in your checking account falls below a set limit, the system moves the funds from your sweep account back into the checking account automatically. This is done to keep the necessary balance, ensuring that you have enough money available and your finances remain stable.

2. Loan Sweep Account or Credit Sweep Account

A Loan or Credit Sweep Account is another variant which greatly benefits business owners aiming to manage their debts effectively. In this arrangement, the surplus balance in your checking account is automatically utilized for the expedited repayment of loans. This not only ensures timely repayments but also aids in reducing the loan’s tenure and the associated interest, thereby helping in efficient debt management.

This proactive financial management tool allows business owners to clear off their debts seamlessly. Hence, it ensures the business’s financial health is maintained and enables a smoother operation devoid of substantial debt burdens.

Both these types of sweep accounts provide a systematic and automated approach to manage and optimize your financial resources efficiently, ensuring that your surplus funds are either invested for growth or utilized for timely debt reduction, contributing to enhanced financial stability and growth.

In Conclusion

In sum, sweep accounts are innovative financial tools that help businesses and individuals efficiently manage their money. A sweep account is an account provided by a bank or brokerage firm that moves any excess cash funds above a specified amount into a more profitable investment option, like a money market fund, at the end of each working day, manage their funds, ensuring that excess cash is not laying idle but is invested in higher-interest-bearing accounts.

Whether it’s personal sweeps for individual investors or business sweeps for small companies, sweep accounts maximize the earning potential of every dollar, making them a valuable addition to any financial strategy.

Before opting for a sweep account, assess the associated fees and choose a bank or brokerage that offers the most attractive terms for your financial situation, ensuring that the benefits outweigh the costs. The sweep process, generally set daily, should also be evaluated to avoid delays affecting liquidity needs adversely.

Understanding how sweep accounts work allows individuals and businesses to make informed decisions. This ensures that their surplus funds are utilized wisely.