Defining Oversold Stock and Overbought Stock Levels, Chapter 6

What is trade range?

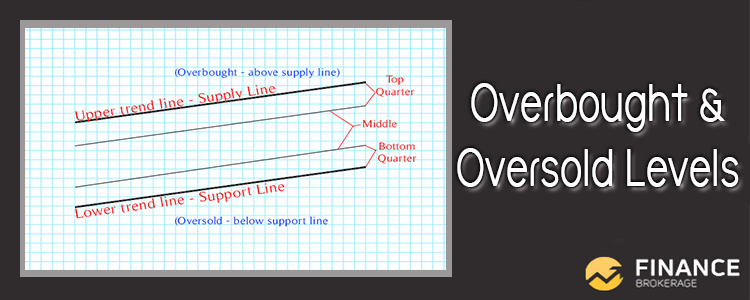

The trading range is the area between the upper and lower trend lines. In VSA terms, when the market trends within its range, it will remain to do so until either selling or buying efforts take place.

The application of our VSA principles will allow a trader to analyze the price action in the upper and bottom quarters of the trading range. Take note that this is important because one can find significant observations that may take place in these areas particularly when the price directs for the support or supply lines respectively.

The area that was found above the supply trend line is commonly called as overbought while the area that was located below the support trend line is known as the oversold. Remember that this could serve as far more reliable indication compared to the traditional methods.

Meanwhile, the mean of the data can be found in the middle of the range. The movement to any direction here has no vulnerability and the price, in theory, can go anywhere.

Bear in mind that the creation of imbalance of supply and demand can be done through accumulation or distribution on the highs or lows. Once this process has been done then the move is weighted to go to the edges of the established trend channel. The vulnerability of reversal can be seen on the hold of the trend at the edges of the trading range. Meanwhile, there would chances of a reversal can be increased in the overbought or oversold areas. However, here the occurrence of a strange phenomenon is possible.

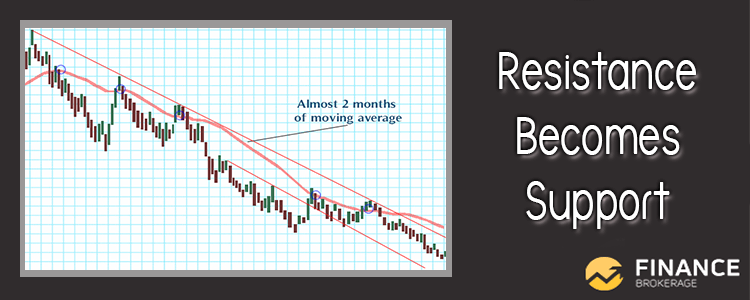

The trend boundary line may appear to provide resistance in both directions. Once there was a penetration of the resistance in one direction and passing through the line, the presence of resistance passing back through the line would be possible with a return into the old trading range.

This can be explained by the market-makers or specialists’ actions. Once that there has been an increased effort to go above the upper trend line (resistance), then professional traders may have taken a bullish view. Take note that this must have been the case so that the price can penetrate the line in the first place.

Although the price comes near the line again from the opposite direction, there’s still a need for you to penetrate the trend line. However, once the specialists or market-makers remained bullish, then there will be no effort to go back down.

The determinant as to when the line will hold is based on the amount of volume. Knowingly that there’s a need for you to penetrate trend line, the manifestation of any low volume as the price comes near the line will serve as an indication that it is dubious to be breached as of this time. This can also be happened to lower trend line.

There are numerous Forex traders who think that engaging in Forex trading is all about buying an uptrend and selling in a downtrend. Well, the truth is, there are several factors that could determine whether there is an end in profit or not in a trade like the overbought and oversold conditions.

Overbought stocks and Oversold stocks?

If there’s a movement of a pair in an uptrend, the pair could reach the point where there would be the absence of buyers on the market. From this, the currency is overbought and a reverse in trend could be possible. This likewise happens to downtrend. If the price is too cheap and there’s absence of sellers on the market, then the currency is oversold. Thus, this will pave the way toward a potential uptrend.

Here’s a basic element you don’t want to miss, the price of a currency is not possible to move in one direction infinitely. At a point, the price is expected to undergo a change in its direction. The occurrence of a change in direction can be seen for many reasons. Take note that one of its important reasons is whether the price is overbought or oversold.

The currency pair which either overbought or oversold is potential to reverse. However, this is the case for the entire time. Remember that the pair may also remain in either oversold or overbought condition for a long time. In determining the existence of price reversal, the use of Oscillators is advisable.

Like any other conditions, you can use these two of the common tools or indicators to determine the existence of overbought and oversold conditions:

What are the indicators?

- Relative Strength Index (RSI)

This is a range bound oscillator which has 0 to 100 scales. If there’s an above 70 reading, the RSI indicates that there’s an overbought situation. Meanwhile, if there’s a below 30 reading, the RSI indicates that there’s an oversold situation. In usual cases, traders can go short if there’s a 70 reading in the RSI while they can choose to go long when there’s a reading of 30 in the RSI. Moreover, the RSI can be utilized in combination with other indicators for best results.

- Stochastic Oscillator

This is a simple momentum oscillator which can help to identify overbought and oversold conditions. Similar to RSI, this has a scale of 0 to 100. When it reads above 80, it indicates that the pair is overbought whereas if it reads below 20, then it indicates that the pair is oversold.

Take note: Although both RSI and Stochastic can be helpful in determining oversold and overbought levels, they differ in underlying theories and methods. The RSI is commonly used in trending markets while the stochastic is more helpful in sideways or choppy markets.

How to Gain a Maximum Profit?

In acquiring the maximum profit out of a trade, the use of overbought and oversold conditions is also significant. You can get the best out trade particularly when you try to buy amid a downtrend reverses or when you try to place a sell order directly at the downtrend’s start. Well, you can develop your own strategies coming from conditions of overbought and oversold. Make thorough researches to fully understand the process of overbought and oversold oscillators and from this, you can start developing yours.