Oil prices hits a new high, and natural Gas prices falls

- During the Asian session, the oil price continued to rise, forming a new May high of $ 118.83.

- During the Asian session, the price of natural gas dropped to $ 8.50.

- The embargo on Russian oil by the EU in the already tight oil market has caused fears of a recession in Europe and fears of a reduction in oil worldwide.

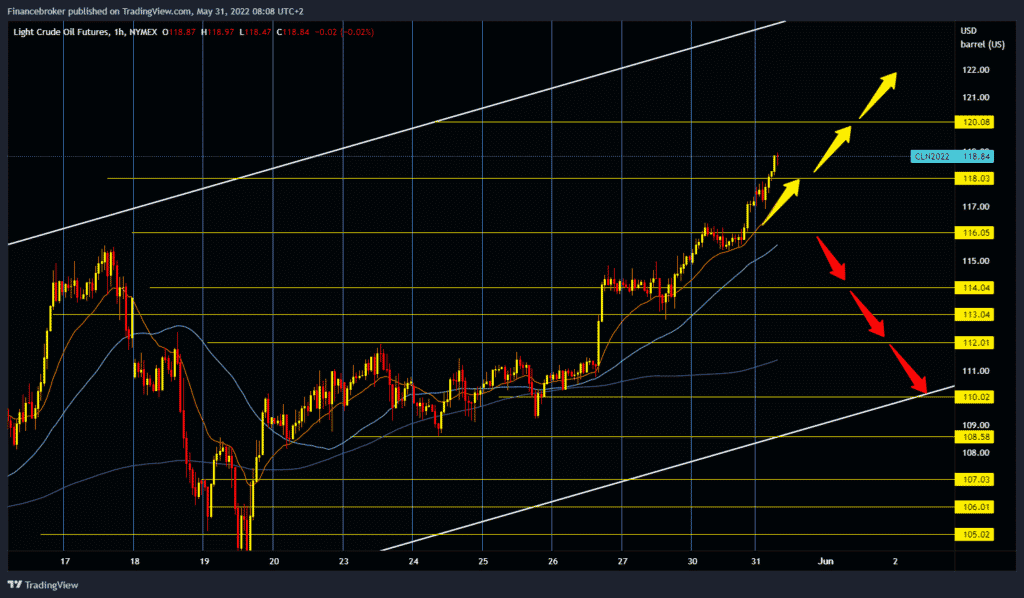

Oil analysis chart

During the Asian session, the oil price continued to rise, forming a new May high of $ 118.83. The price is already in the bullish trend for the ninth day, and this last bullish impulse is the result of new sanctions that the EU imposed on Russia. The European Union has introduced a ban on importing Russian oil by ships, representing more than 80% of the total oil import to the EU, and the import is allowed only through oil pipelines. The heads of state and government of the European Union have agreed to impose an embargo on importing two-thirds of Russian oil, said the head of the European Council, Charles Michel.

“There is an agreement to ban the import of Russian oil into the European Union. “That will immediately cover more than two-thirds of Russian oil imports,” Michel pointed out. The agreed package of sanctions “includes excluding the largest Russian bank, ‘Sberbank’ from SWIFT”. To continue the bullish trend, we need the continuation of this bullish impulse further toward the $ 119.00 price. Potential higher resistance can be expected at the $ 120.00 level. We need a new negative consolidation and a pullback below the $ 188.00 level for the bearish option. After that, support at the $ 116.00 price is very important for the price. If this zone does not provide good support, we can expect a further drop in prices to the lower trend line.

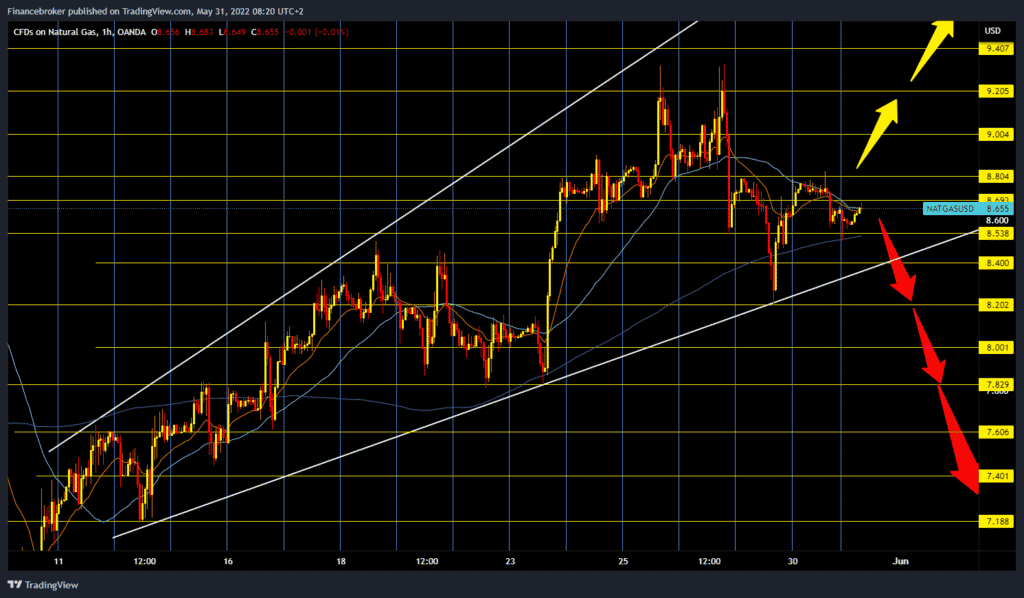

Natural gas chart analysis

During the Asian session, the price of natural gas dropped to $ 8.50. But bullish consolidation and recovery to the $ 8.67 level followed very quickly. The price is still in its bullish trend that started on May 11, and now we can say that we are testing the bottom line of support. If the price fell below this line, it would be critical because then we could move into the bearish trend.

As we said, we need a negative consolidation for the bearish option and break below the bottom line of support. After that, the gas price would drop to test the previous low at $ 8.20. And if we see a break below and the formation of a new lower low, it would be a sign that we can expect further withdrawal of the price of natural gas. The potential following bearish targets are $ 8.00 and last week’s $ 7.80 support zone. For the bullish option, we need a price jump above $ 8.80. After that, we would start a more concrete bullish impulse and potentially threaten the previous resistance zone of $ 9.20-9.35.

Market overview

The embargo on Russian oil by the EU in the already tight oil market has caused fears of a recession in Europe and fears of a reduction in oil worldwide.

On the demand side, the catalysts for China’s reopening and the summer season in the United States will keep the demand for fossil fuels at an elevated level. The Chinese administration announced that the locking measures in Shanghai had been withdrawn and that materials, machines and, of course, men could move now. In the future, the administration will focus on resuming economic activity before isolation, which will boost oil prices.

Oil prices will gain more momentum because they will solve the increased demand for oil due to the arrival of summer in Europe and North America.