Oil and Natural Gas: turbulent day

- During the Asian trade, the price of crude oil mostly kept solid gains from yesterday, and as we entered the European session, the price began to fall.

- The price reached its new high of $ 9.33 this year but soon retreated to $ 8.53.

- CME Group daily data for crude oil futures markets showed that investors added more than 33,000 contracts to their open interest rate positions on Thursday

Oil chart analysis

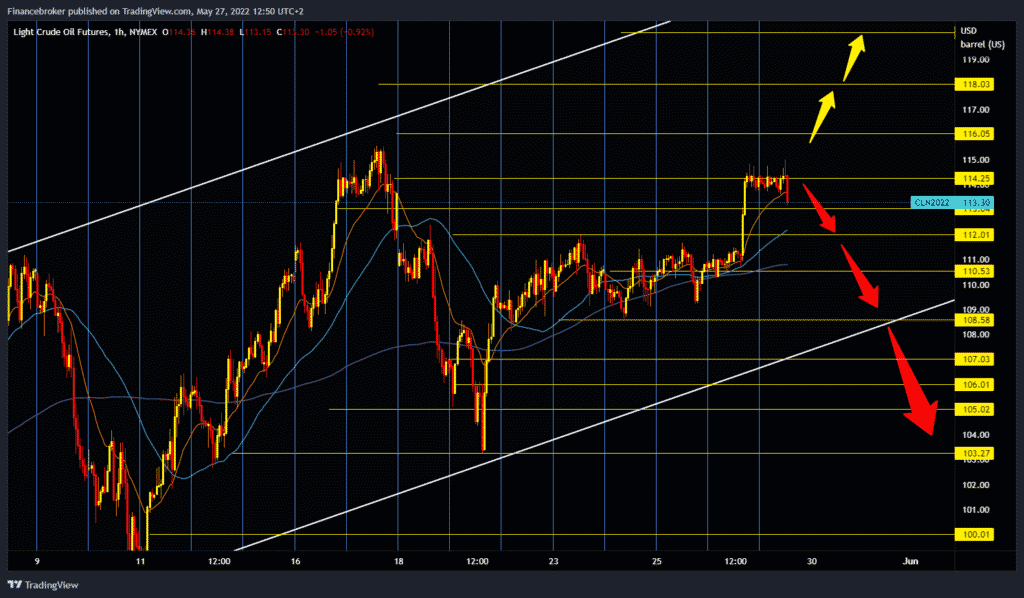

During the Asian trade, the price of crude oil mostly kept solid gains from yesterday, and as we entered the European session, the price began to fall. The beginning of the driving season in the USA this weekend, mostly low levels of oil and derivative stocks with further decline and uncertainty regarding the EU’s decision to impose an embargo on oil imports from Russia, all together pushes the price of oil up. The oil price jumped from 110.00 dollars to 115.00 dollars during yesterday’s day.

Oil is now in retreat at the current $ 113.30. If today’s price pressure continues, we can expect a further withdrawal first towards $ 112.00, and if that level does not support us, we will continue further towards the $ 110.00 support zone. We need a new positive consolidation for the bullish option at the previous resistance zone at the $ 115.00 level. If the price manages to exceed this resistance, our potential bullish targets are $ 115.50, $ 116.00, $ 117.00 and $ 118.00.

Natural gas chart analysis

Yesterday was a very turbulent day for the price of natural gas. The price reached its new high of $ 9.33 this year but soon retreated to $ 8.53. From that moment on, we saw a shorter recovery to $ 8.80, and after that, another pullback was formed by the new four-day low at $ 8.49. We are still in a growing channel, but the pressure is on the bottom line, and there could be a potential break below. The price would go to the $ 7.83 support zone if that happened. We need a positive consolidation for the bullish option that would result in a new bullish momentum and a return above the $ 8.80 level. Our following bullish targets are $ 9.00, $ 9.20 and $ 9.40.

Market overview

CME Group daily data for crude oil futures markets showed that investors added more than 33,000 contracts to their open interest rate positions on Thursday, reaching the second consecutive daily increase. The volume followed that and significantly increased by about 160.6 thousand contracts, reversing the decline from the previous day.

Russia’s Deputy Prime Minister Alexander Novak said late Thursday that “oil production is expected to fall around 500 million tons this year from 524 million tons in 2021.”

Oil growth ignores the strong US dollar, breaking the historical reverse of crude oil with the dollar and giving analysts confidence that it must go further based on current market fundamentals.

A strong dollar usually affects oil prices because it makes goods more expensive for owners of other currencies, potentially damaging oil demand.

Since the end of March, the dollar and oil have been moving in the same direction, when the positive correlation reached its highest level in May 2019. Analysts expect the relationship to survive given the tight oil market and broader risks to the global economy.