Oil and Natural Gas: The Oil Price Lost 2.0% of its Value

- During the Asian trading session, the oil price lost 2.0% of its value, falling from $85.80 to $82.65.

- At the same time, the gas price fell to $4.80, forming its seven-month low.

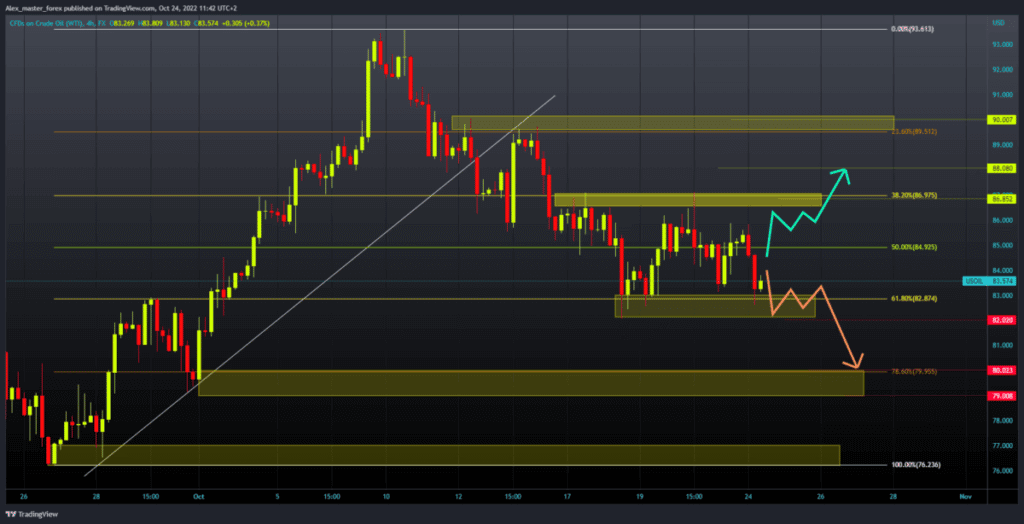

Oil chart analysis

During the Asian trading session, the oil price lost 2.0% of its value, falling from $85.80 to $82.65. Last week, the oil price was in that zone, but it managed to consolidate and recover to the $87.00 level. Currently, the price has managed to stop the decline, and now we see a recovery to the $83.60 level.

For a bullish option, we need a positive consolidation and price recovery to the $85.00 resistance zone. Then we need a move above and the formation of a new higher high above the $87.00 level. After that, we need to stay there and continue the recovery of the oil price with a new impulse. Potential higher targets are the $88.00 and $90.00 levels.

For a bearish option, we need a negative consolidation and a break below the $82.00 support level. After that, we could expect a further price drop. Potential lower targets are the $80.00 and $79.00 levels.

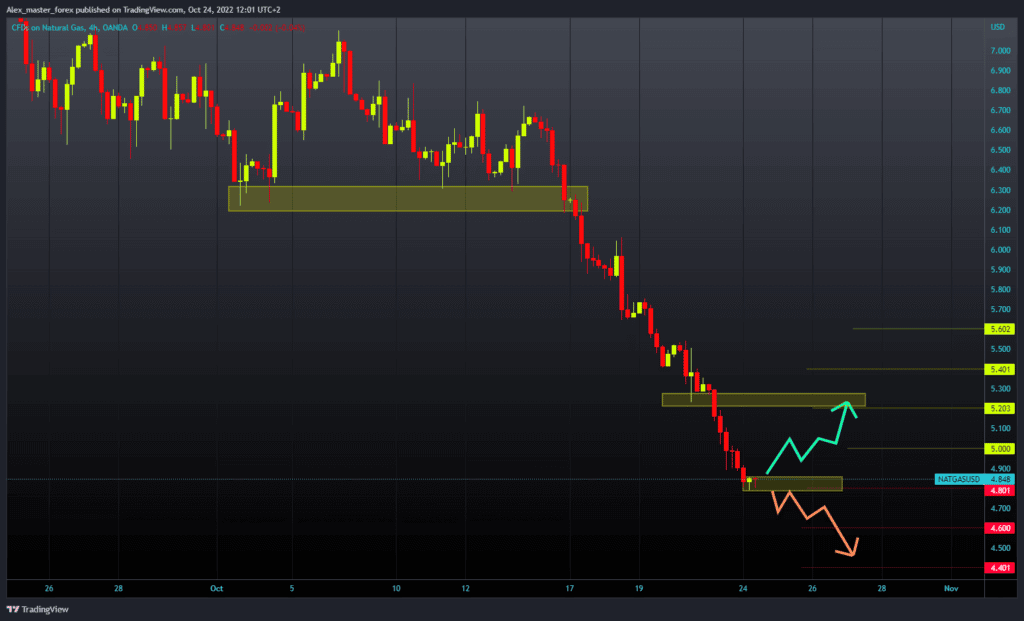

Natural gas chart analysis

During the Asian trading session, the gas price fell to $4.80, forming its seven-month low. The price of gas has been in free fall since October 6. At the moment, it is not visible where the gas price could stop. We currently have a consolidation of around $4.80, but this is probably only temporary.

For a bearish option, we need a negative consolidation and a further decline in gas prices. Potential lower targets are the $4.60 and $4.40 levels. For a bullish option, we need a new positive consolidation and a return to the $5.00 level.

Then we need to hold on there and, with a new bullish impulse, start the continuation of the recovery. Potential higher targets are the $5.20 and $5.40 levels.

Market overview

A two-day summit of European Union leaders was held in Brussels last week on the issue of limiting gas prices in order to combat the energy crisis, which was caused by Russian President Vladimir Putin’s invasion of Ukraine and his strategy to cut off supplies to Europe arbitrarily.

The EU’s traditional partners Germany and France are on opposite sides this time, with Berlin expressing doubts about plans to cap prices while most are in favor. The Netherlands also said it feared that if the price cap were too large, supplies could bypass Europe and be shipped elsewhere.

The issue of a possible limit on gas prices for months becomes one of the key ones as the energy crisis worsens, and 15 countries advocate such direct intervention.