Oil and Natural Gas: Price Slowly Recovered

- During the Asian trading session, the price of oil retreated from its Friday high of $93.45.

- On Friday, the price of natural gas fell to the $6.50 level and found support there.

- Oil prices posted their biggest percentage gains since last March after OPEC+ agreed to cut production by 2 million barrels per day.

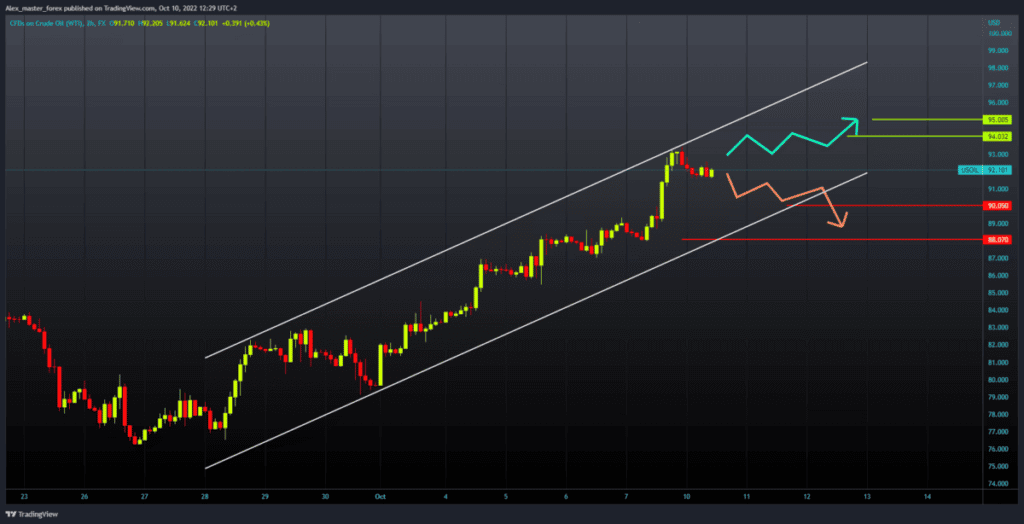

Oil chart analysis

During the Asian trading session, the price of oil retreated from its Friday high of $93.45. We are currently hovering around the $92.00 level, and the price has not made any sudden movements so far. For a bullish option, we need a positive consolidation and to retest the previous high. If we succeed, the price could go above and continue its growth. Potential bullish targets for today are the $94.00 and $95.00 levels. For a bearish option, we need a negative consolidation that would bring us down to the $90.00 level and the lower line of this ascending channel. A potential lower target if we do not find support at $90.00 is the $88.00 level, also the previous low from Friday.

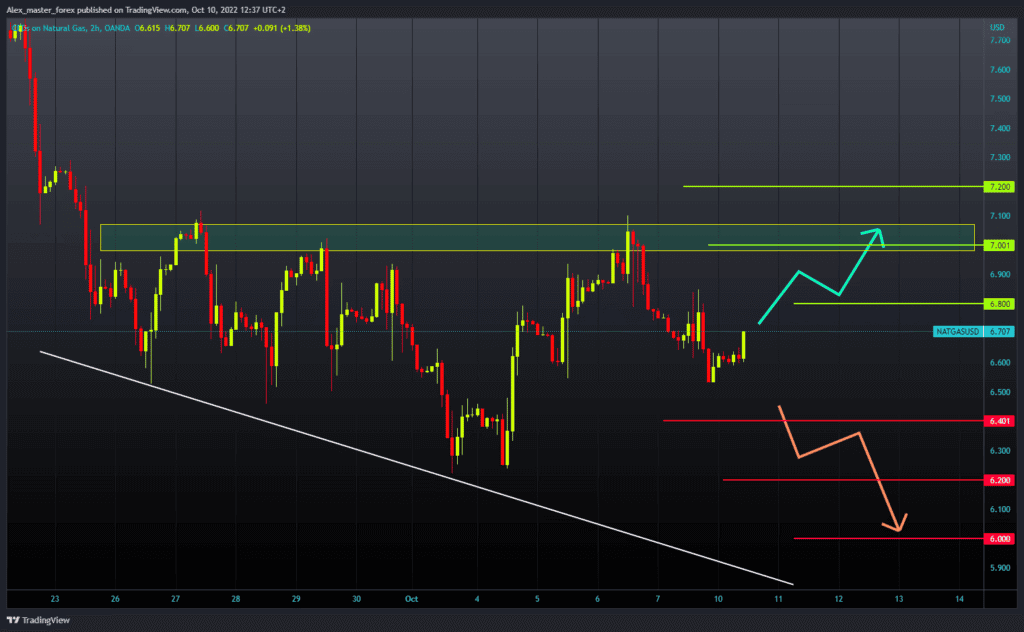

Natural gas chart analysis

On Friday, the price of natural gas fell to the $6.50 level and found support there. During the Asian trading session, the price slowly recovered to the $6.70 level, and if it continues at this pace, it could climb to the previous high at the $6.80 level. There we could expect the next potential resistance or a break above for continued price recovery. Potential higher targets are the $7.00 and $7.20 levels. For a bearish option, we need a negative consolidation and a drop to retest the previous low at $6.50. Increased price pressure would likely have a negative impact and further lower the price of natural gas. Potential lower targets are the $6.40 and $6.20 levels. If we were to go down to a lower target, the gas price could test the $6.00 level.

Market Overview

Oil prices posted their biggest percentage gains since last March after OPEC+ agreed to cut production by 2 million barrels per day. Production cuts by OPEC+ will reduce production in an already overexerted market. EU sanctions against Russian oil and oil derivatives will enter into force in December, at the latest in February. A possible easing of restrictions against COVID-19 in China in the fourth quarter of this year and in the first part of 2023 could lead to a recovery in oil demand and a further rise in oil prices.