NZD/USD testing zone around 0.72000

Retail sales in New Zealand exceeded estimates, which stabilized the New York dollar. Total retail sales in New Zealand increased seasonally adjusted by 2.5 percent compared to the first quarter of 2021. New Zealand statistics announced on Monday – after a revised contraction of -2.6 percent in the previous three months (first -2.7 percent). The United States has reiterated its suspicion of China’s role in the global spread of coronavirus (COVID-19), citing three doctors from the Wuhan laboratory. Further, Iran’s reluctance to expand the International Atomic Energy Agency’s (IAEA) approach to camera images of its nuclear sites increases risky sentiment represents an additional burden on market sentiment. Also Wednesday, RBNZ will give its report on interest rates.

The dollar is grateful for the optimistic American data and the comments of the Federal Reserve officials, who suggested before, and not later, a discussion about certain moves due to the signs of rising inflation.

On Friday, Atlanta Federal Reserve Chairman Raphael Bostic said he was worried about rooting inflation, while the Philadelphia Fed, Patrick Harker, noted that the Fed should start talking about tightening. Also, Dallas Central Bank President Robert Kaplan reiterated that they see a lot of uncertainty regarding inflation. The picture is not yet crystal clear, which moves important decisions about possible moves by the Fed.

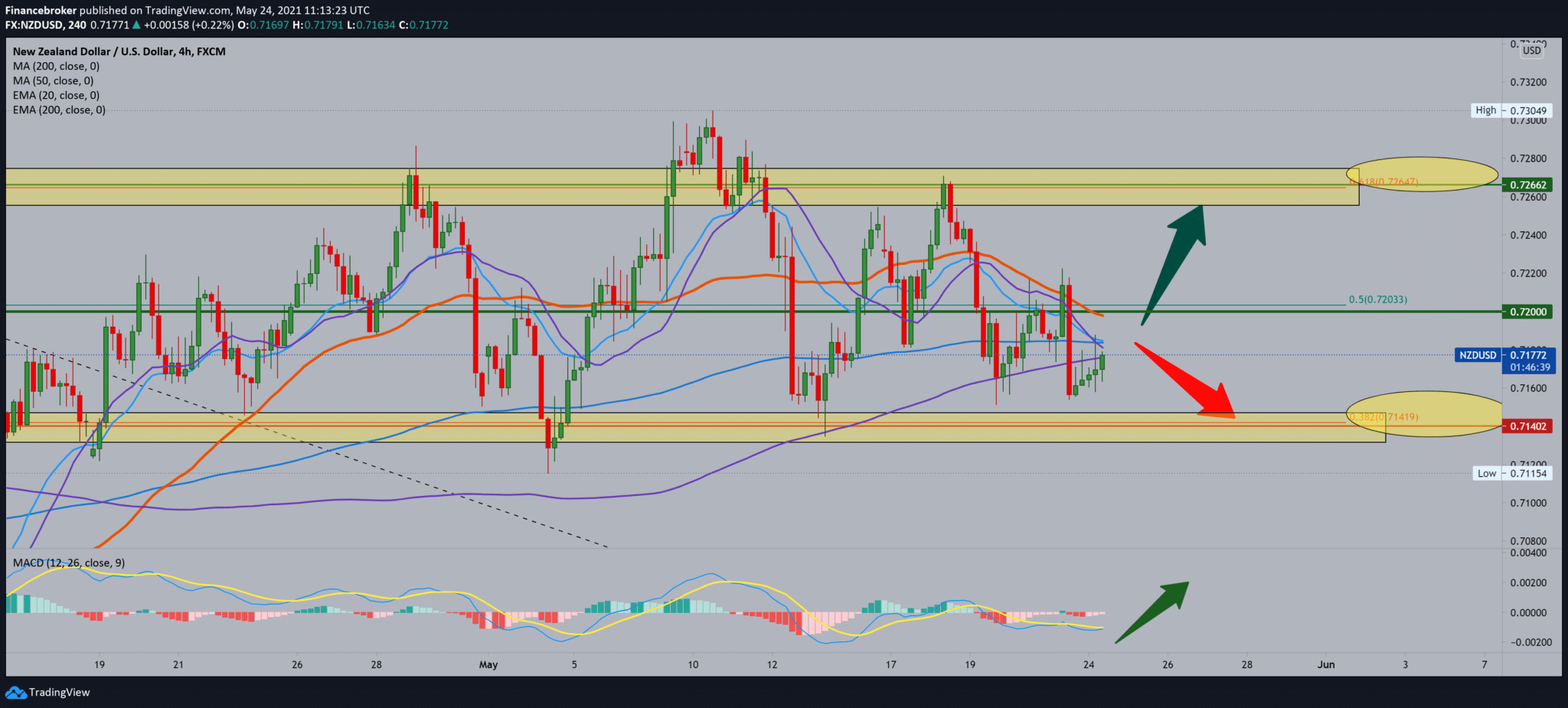

Following the chart, we see that we are still moving in lateral consolidation on the four-hour time frame. On Friday, the NZD/USD pair again found support at 0.71500, and after that, the NZD recorded smaller gains, climbing to the current 0.71770. Looking at moving averages, we see that they are all grouped just below 0.72000 and 50.0% Fibonacci level, and if a break occurs above, we can easily climb to 0.72500, close to 0.72600 at 61.8% Fibonacci level. The MACD indicator is generally a bit neutral but leans to the bullish side, which can be psychological support to our bullish scenario.

-

Support

-

Platform

-

Spread

-

Trading Instrument