Bitcoin miners raise the anchor and leave China.

Three bitcoin mining companies have announced plans to discontinue mining in China following stern warnings from Chinese officials. Several large bitcoin miners decided to stop working in China last weekend after the news that the Chinese authorities are planning to suppress the mining of cryptocurrencies. Three basins of bitcoin mines have announced plans to stop activities in China. BTC.TOP, which accounted for as much as 2.5% of Bitcoin’s total hash rate over the past week, said it would close the store on the Chinese mainland and reorient its business to North America. Huobi Cryptocurrency’s representative company, Huobi Mall, also announced on Sunday that it will no longer sell crypto mining platforms in China and that it will suspend mining operations there. Mining company HashCov has said it will stop buying new bitcoin platforms for now.

On May 21, the authorities in Hong Kong announced the upcoming ban on retail trade-in cryptocurrencies, a move that would limit trade only to accredited investors with more than a million dollars in the portfolio. Smaller players sold 1 million BTC in May at 30000 to 35000 dollars and bought it in April at 55 thousand to 60 thousand dollars: a huge loss of about 20 billion dollars. Large owners of Bitcoin are aggressively buying a decline in the midst of the latest price correction, raising optimism that a coordinated departure could be completed. The crypto hedge funds that Bloomberg spoke to also reiterated that they were, in fact, buyers. MVPK Capital and BiteTree Asset Management, both based in London and the Singapore company Three Arrows Capital, bought the dip. As Cointelegraph recently reported, at least one prominent whale that sold BTC at 58,000 US dollars not only accumulated but also added its own property. The unknown entity sold 3,000 BTC on May 9 before buying 3,521 BTC in three separate stores on May 15, 18, and 19.

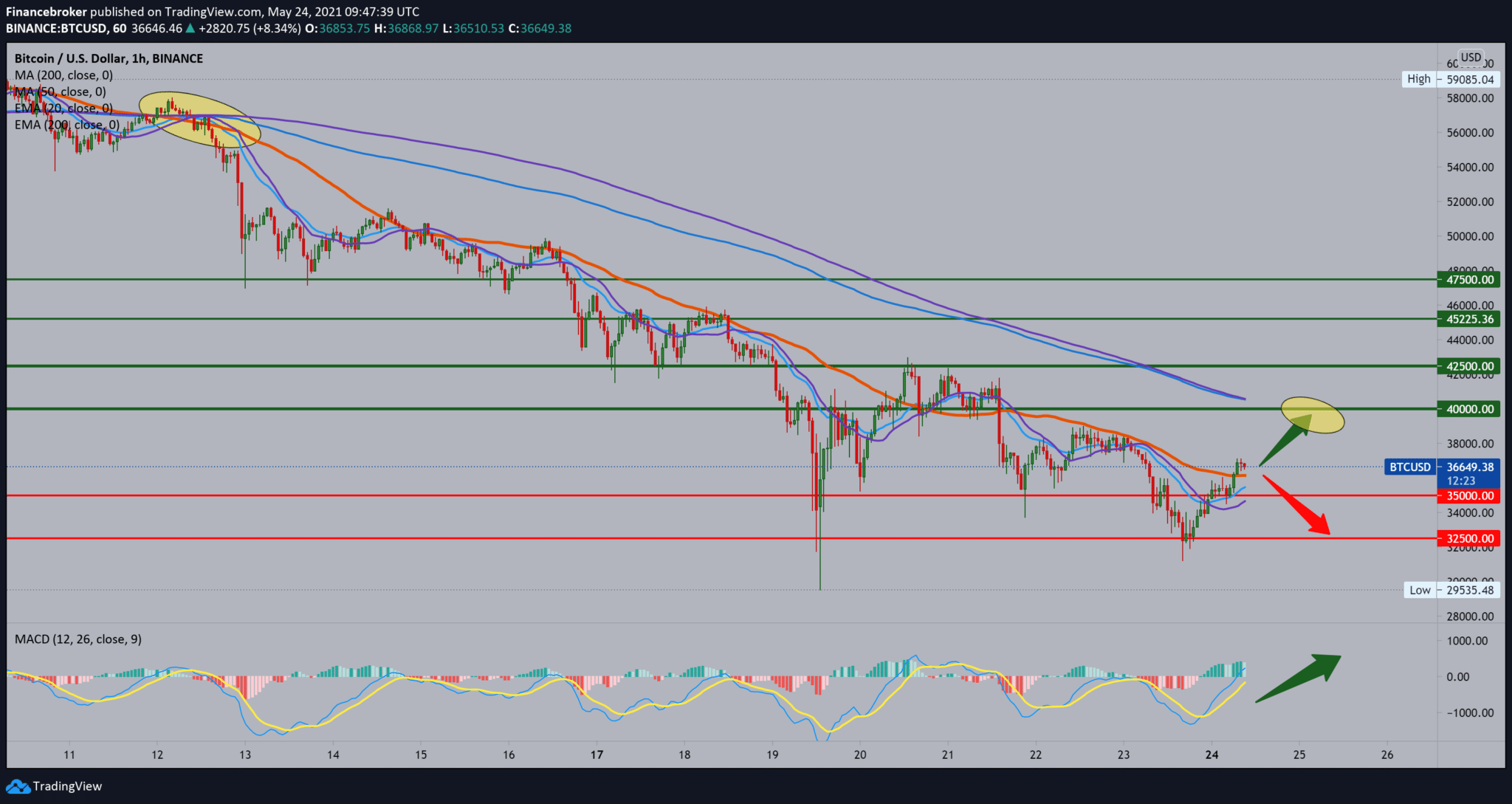

Following the chart, on the one-hour time frame, we see that after yesterday’s low, we are climbing to the current $ 36,800 with support with moving averages from below. And what matters to us now is the support of the MA50, which can push us to the MA200 and EMA200 in the $ 40,000 zone. The MACD indicator is in the bullish signal and, for now, follows this minor bullish trend.

-

Support

-

Platform

-

Spread

-

Trading Instrument