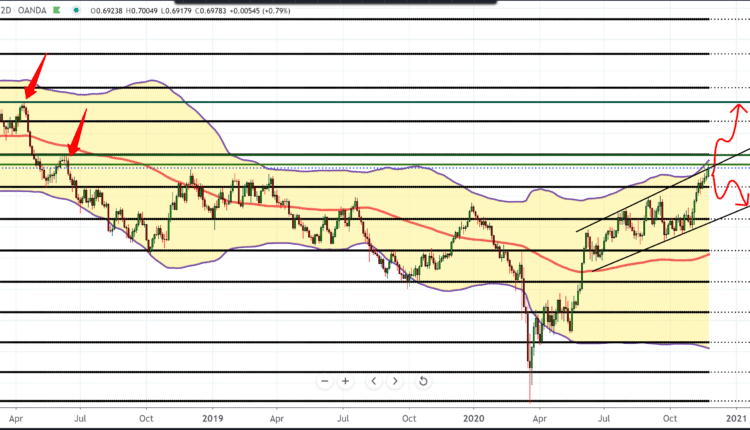

NZD/USD forecast for November 24,2020

NZD managed to climb to 0.70000 level from June 2018; this is also the psychological level for NZD. Above we have a stronger level of resistance at 0.76000, and at the bottom, we have support at 0.68500.

Finance Minister Grant Robertson wrote to RBNZ Governor Adrian Orr to consider changing the bank’s jurisdiction to include house price stability as a monetary policy factor. He is worried that a prolonged period of low-interest rates combined with a housing shortage could pressure prices and jeopardize financial stability.

He stressed that it does not propose any changes to the RBNZ policy mandate or independence that could put more pressure on RBNZ to put more weight on house price stability when setting monetary policy in the future.

Bloomberg reported that overnight swap markets now have just ia a 25% chance of a rate cut by the end of 2021.

The outlook for negative rates is becoming increasingly remote for NZD. The dollar recorded sales in early European trade on Tuesday, as clarity emerged over the U.S. political transition.

Wiretapping Janet Yellen for the next finance minister boosted expectations of an expansive fiscal policy under newly elected President Joe Biden. Growing coronavirus cases in America and the chances of restrictions in several countries could limit the dollar’s gain.

Positive vaccine updates could continue to encourage risk aversion and strive for a safe dollar. Uncertainty over the U.S. government’s stimulus program after December could fuel market aversion. Conclusions and implicit lack of activity in other large economies can affect the demand for safe havens like the dollar.

-

Support

-

Platform

-

Spread

-

Trading Instrument