EUR/GBP forecast for November 24, 2020

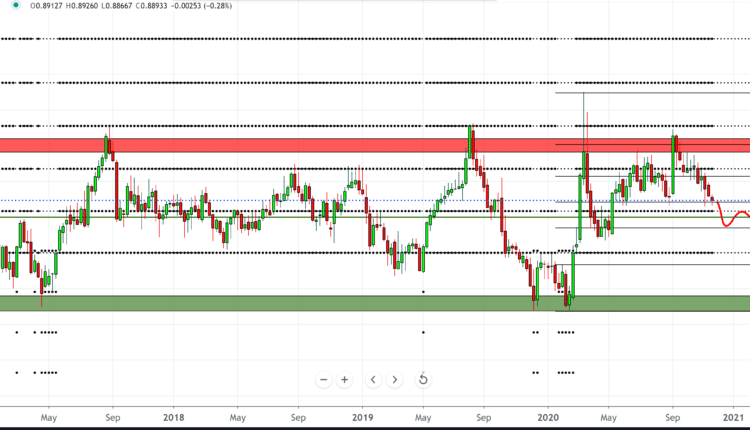

At the beginning of the year, the Euro moved fiercely towards all currency pairs, made higher highs, and after that, it started to slow down. The EUR/GBP pair has ranged from 0.82750 to 0.93000 since the beginning of the year. 0.93000 seems to be a difficult obstacle for the Euro to continue towards the above targets.

Following the current chart, we see that the trend is declining and that it is very likely that the EUR/GBP pair will continue until the end of the year.

News of vaccine progress and lockdown in Europe and the UK puts more pressure on the Euro than on the British pound. In the last month, only the dollar has weakened against the Euro, struggling with the US election, a record number of new coronavirus infections, and the turmoil in Congress over a new package to help the economy recover from its effects coronavirus.

German business confidence weakened in November, the institute’s research showed on Tuesday. The business climate index fell to 90.7 in November from a revised 92.5 in the previous month. The reading is projected to decline to 90.1 from its original estimated value of 92.7 in October.

The current conditions index reached 90.0 versus 90.4 a month ago. Economists predicted that the result would fall to 87.0. The expectation index fell to 91.5 in November from a revised 94.7 in October. That was well below the economists’ forecast of 93.5.

After easing the Covid-19 cap, the German economy recovered faster than expected in the third quarter, offsetting much of the massive decline in the second quarter, revised Destatis data revealed on Tuesday.

The gross domestic product grew 8.5 percent in a row in the third quarter, reversing the 9.8 percent drop in the second quarter caused by the coronavirus pandemic. French production sentiment deteriorated in November in the context of a second national blockade, the results of a survey by the statistical office showed on Tuesday.

The production confidence index fell less than expected to 92 in November from 94 in October. The expected reading was 91. However, the result was significantly below its long-term average of 100. The industrialists worsened their opinion about their personal production prospects. The related balance fell to -10, the lowest level since May 2020, from +5 in October.

The Prime Minister of the United Kingdom, Boris Johnson, announced the end of locks across the country in December. Still, the localized system of levels will probably be stricter than the previous one.

Moreover, it is still unclear whether London, one of the world’s financial cities, will be under serious restrictions.

The case curve in the UK is falling, but mortality remains high. Negotiations on Brexit remain around ’95 % done’, but the lack of progress on the most contentious issues becomes worrying as the clock moves by the end of the year when the transition period expires.

The headlines range from hints of an imminent agreement to the talks’ collapse, so it’s not over yet.

-

Support

-

Platform

-

Spread

-

Trading Instrument