NZD/USD forecast for February 11, 2021

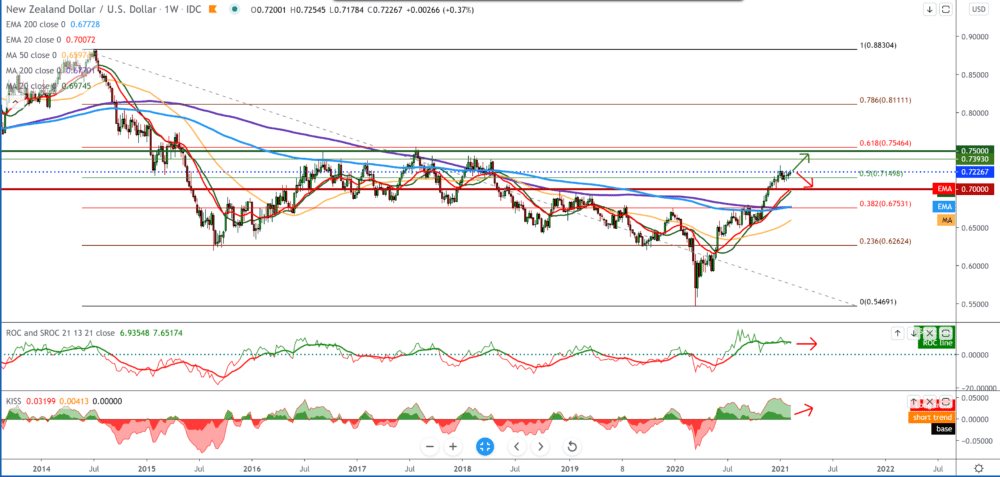

The weekly time frame chart shows that the NZD/USD pair is still in the bullish trend, making a shorter consolidation between 0.71000-0.73000. by setting the Fibonacci retracement level, we see that the NZD/USD pair has currently made a break above 50.0% level. For now, according to the signs on the chart, there is a high probability that it will continue towards a 61.8% level at 0.75454. From moving averages, we can track MA20 and EMA20, which are for now the closest support candlesticks on the chart. If we see a break above the previous peak, our target is 0.73900 from April 2018.

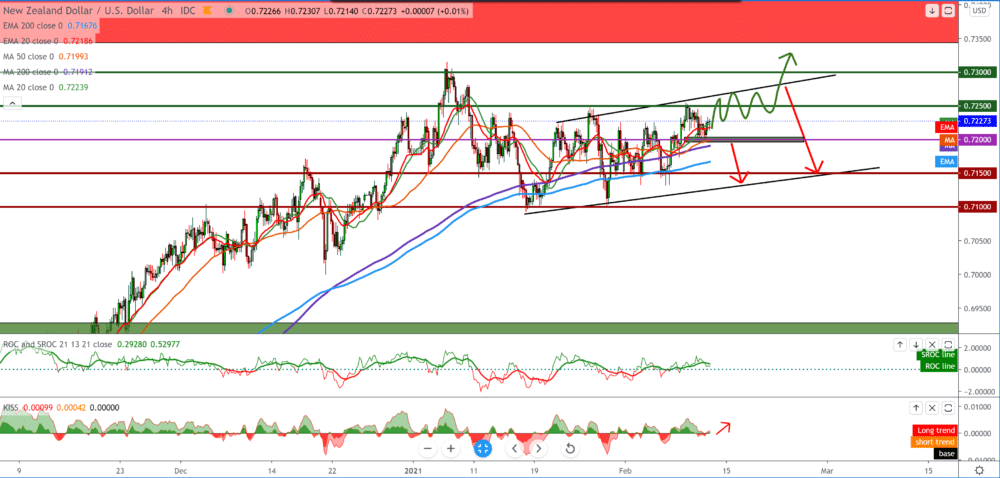

In the daily time frame, we see that the NZD/USD pair moves in a growing parallel channel to support moving averages for the lower sides. From the moving averages, we follow the MA20, EMA20, and MA50, which for now provide adequate support to the NZD/USD pair in this growing trend. During January, the pair is consolidating by going down from 0.73200, making a pullback to 0.70800 and now to the current 0.72200. According to all the chart parameters, we can expect continued growth of the trend and climb to higher levels on the chart.

In the four-hour time frame, we see that the NZD/USD pair moves upwards, but with currently greater volatility in the market, oscillating around moving averages. For now, all this is happening with the support of MA200 and EMA200 from the bottom. In the afternoon, we have important news from the US market, and we can also expect significant shifts in the chart. Based on the current situation, we should see a break above 0.72500 and the potential to continue further towards 0.73000. We need a pair below 0.72000 from a specific combination of candlesticks to confirm a further descent on the chart for the bearish version.

From some important news for these two currencies, we will single out the following:

The total value of electronic card transactions in New Zealand decreased seasonally by 0.4 percent monthly or by 24 million New Zealand dollars in January, New Zealand statistics announced on Thursday – after 19, 2 percent jump in December.

Consumption in the basic retail industry fell by 0.7 percent monthly, or 39 million New Zealand dollars. On an annualized basis, the consumption of electronic cards in retail increased by 1.9 percent – slowing from 3.5 percent in the previous month. We have today after the news about the Initial Jobless Claims measures, the Fed Monetary Policy Report, and the US Federal Budget report for the dollar.

-

Support

-

Platform

-

Spread

-

Trading Instrument