USD/CAD forecast for February 11, 2021

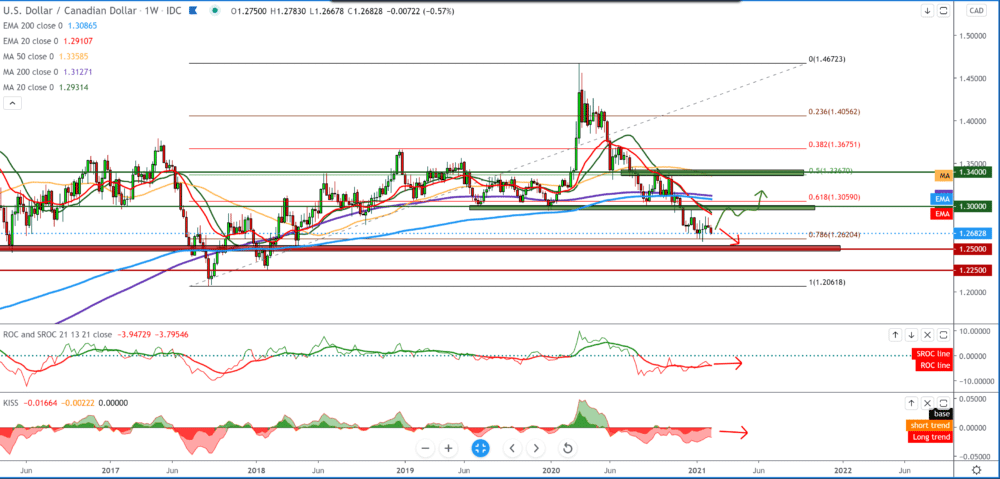

Looking at the USD/CAD pair chart on the weekly time frame, we see a strong bearish trend over the last year. We still see a weak dollar despite this short-lived stalemate at the beginning of the year. Moving averages are on the bearish side and, for now, are a confirmation of the downward trend.

By setting the Fibonacci retracement level, we see a drop below the key 61.8% level and a break below the MA200 and EMA200, pushing down the USD/CAD pair on the Fibonacci 78.6% level to 1.26200. If the dollar’s pressure continues through the Fed’s monetary policy to put more money into circulation with its stimulus package to help the economy, it will have the effect of making the dollar lose its value.

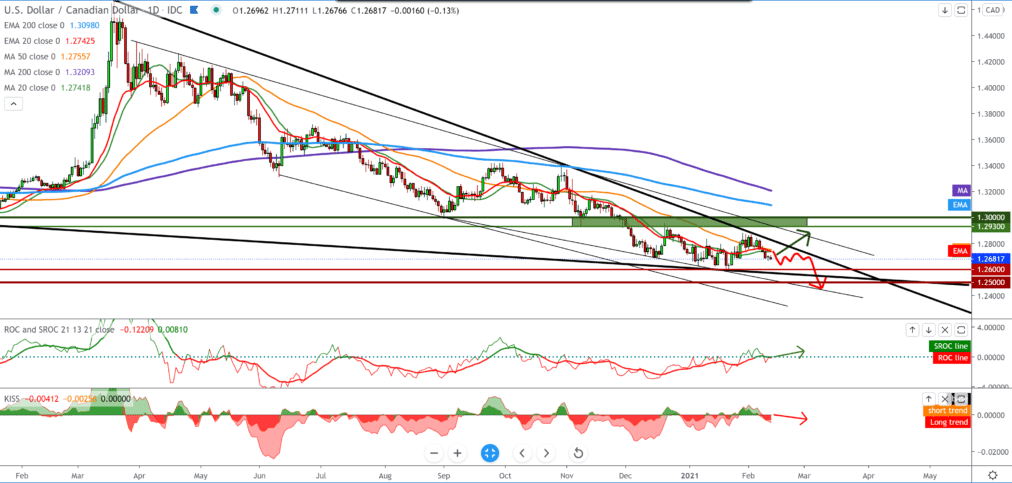

On the daily time frame, we see that the USD/CAD pair fails to make a break above the moving averages MA20, EMA20, and MA50 bounced off of them and headed to the bearish side again.

Based on the fact that the couple is facing the 1.25000 psychological level for this couple.

So first, we can expect a break below 1.26000. For the bullish scenario, we need a break above 1.27500 to support moving averages to have some evidence on the chart for that.

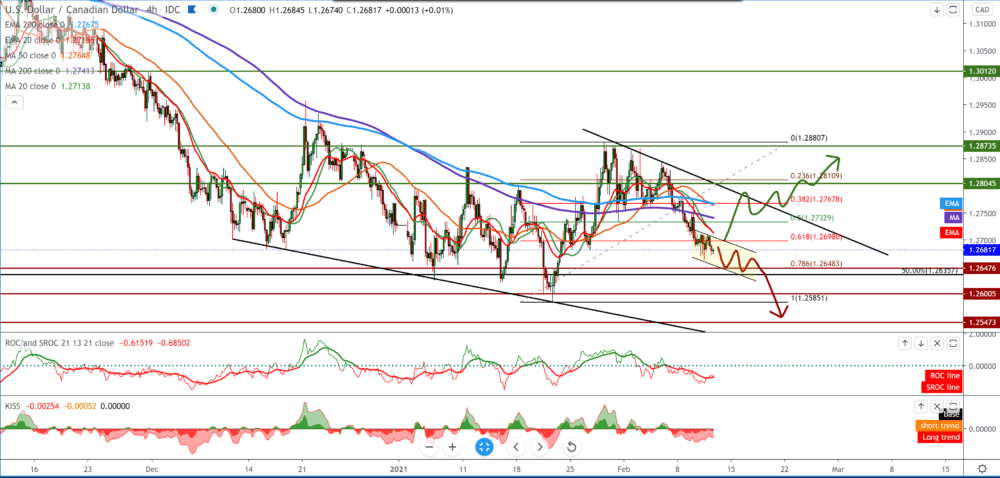

On the four-hour time frame, we see that the couple fails to make new higher highs, but it is now very possible that they will make a new lower low. Looking at the Fibonacci retracement level, we see that the USD/CAD pair made a break below 61.8% level and continues towards 78.6% at 1.26500, where we can expect the next consolidation and the next possible determination the direction of the trend. Moving averages are on the bearish side, and as long as that is the case, the bullish scenario should not be considered.

From the news for these two currencies, we can single out the following: Federal Reserve Chairman Jerome Powell said on Wednesday that maintaining a “patiently adaptable monetary policy” would be important to return to a strong labor market, but stressed that more needs to be done.

During statements at the Economic Club’s virtual event in New York, Powell warned that the United States is still very far from a strong labor market, despite the recovery recorded from the early days of the coronavirus pandemic.

The published unemployment rate fell to 6.3 percent in January. Still, Powell said the actual number is close to 10 percent when the wrong classifications of the Ministry of Labor are taken into account and those who left the labor force since last February.

According to a report released by the Department of Commerce on Wednesday, wholesale inventories in the United States increased more than expected in December. The trade ministry said wholesale inventories rose 0.3 percent in December after coming almost unchanged in November. Economists expected stocks to rise by 0.1 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument