Market News and Charts for September 14, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

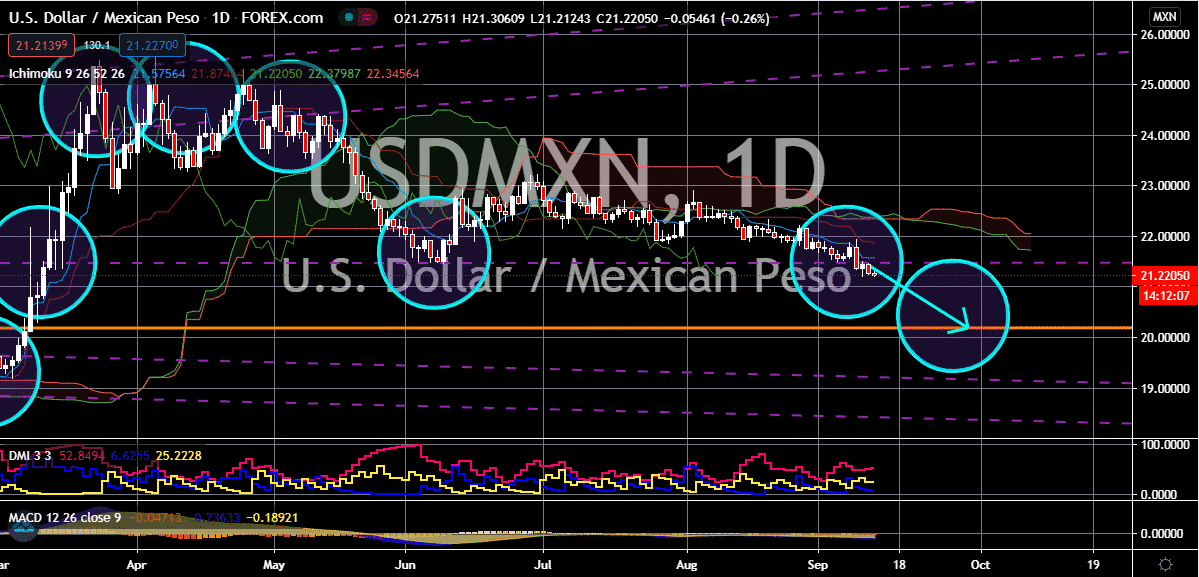

EUR/SEK

The pair will continue to move higher in the following days after it broke out from a downtrend channel resistance line. The European Union’s Industrial Production MoM and YoY reports both posted figures that beat analysts’ estimates. Month-over-Month figure came in at 4.1%, just 0.1% higher from expectations of 4.0%. Meanwhile, Year-over-Year’s result for the month of July was -7.7%, half points higher than the -8.2% expectations. Despite the negative from YoY report of industrial production, analysts commended the growth from these two (2) reports. On the other hand, the stability of reports from Switzerland gave a bearish sentiment for the analysts and investors. With the current climate in the global market, investors are looking for a safe-haven currency with a growth potential. And with the latest figures from Switzerland’s Consumer Price Index MoM and YoY, investors might begin to lose faith on Swiss franc.

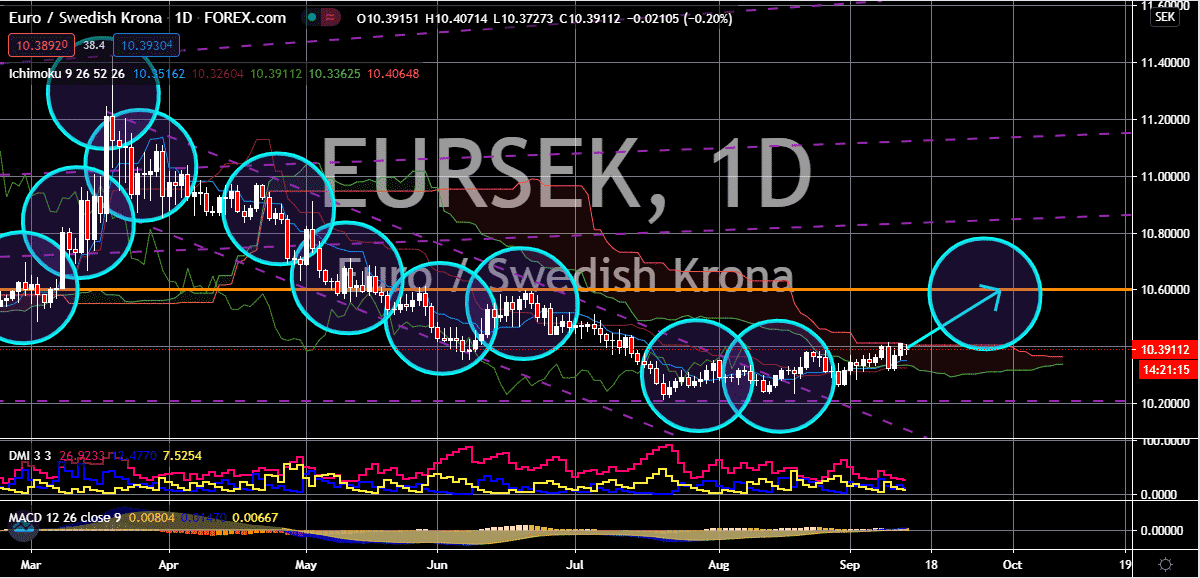

EUR/CZK

The pair bounced back from a major support line, sending the pair higher towards a major resistance line. Both Consumer Price Index reports from Germany and Czech Republic Month-over-Month posted zero percent growth for the month of August. As for Year-over-Year, Czechia managed to post a 3.3% growth compared to Germany’s zero percent growth. With these figures, analysts are expecting a sell-off for the single currency. The stagnant growth in consumer demand is causing pressure not only to Germany but also to other members of the European Union. Aside from this, the stalled negotiation between the EU and the United Kingdom could further derail the expected recovery in the trading bloc. Furthermore, the recent comments by French President Emmanuel Macron on Turkey’s partnership with the EU member states risks escalation. This, in turn, could lead to the withdrawal of membership by Turkey to the EU.

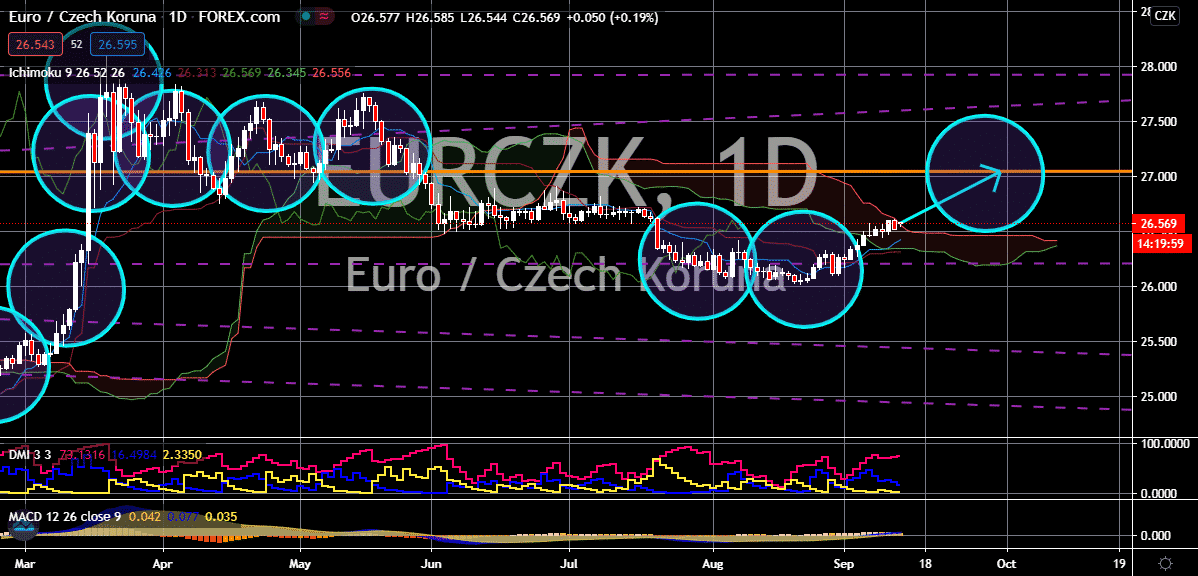

USD/HUF

The pair failed to break out from an uptrend resistance line, sending the pair lower towards its previous low. Despite the strong figures from the initial jobless claims report, investors’ outlook for the biggest economy in the world were still bearish. The US’ report from last Thursday showed claimants grew by 884K. Although this was the country’s second-best figure for the report since the pandemic, analysts are worried that the stimulus used for unemployment benefits might run out in the coming weeks. This, in turn, could lead to a collapse in the US economy. America managed to keep its economy to stay afloat thanks to the $6 trillion stimulus by the US government and the US central bank. However, this was done at the expense of the greenback. A collapse in US stock together with the weak US dollar could end America’s economic supremacy. This worry overshadowed the weak industrial output YoY of Hungary last Friday, September 11.

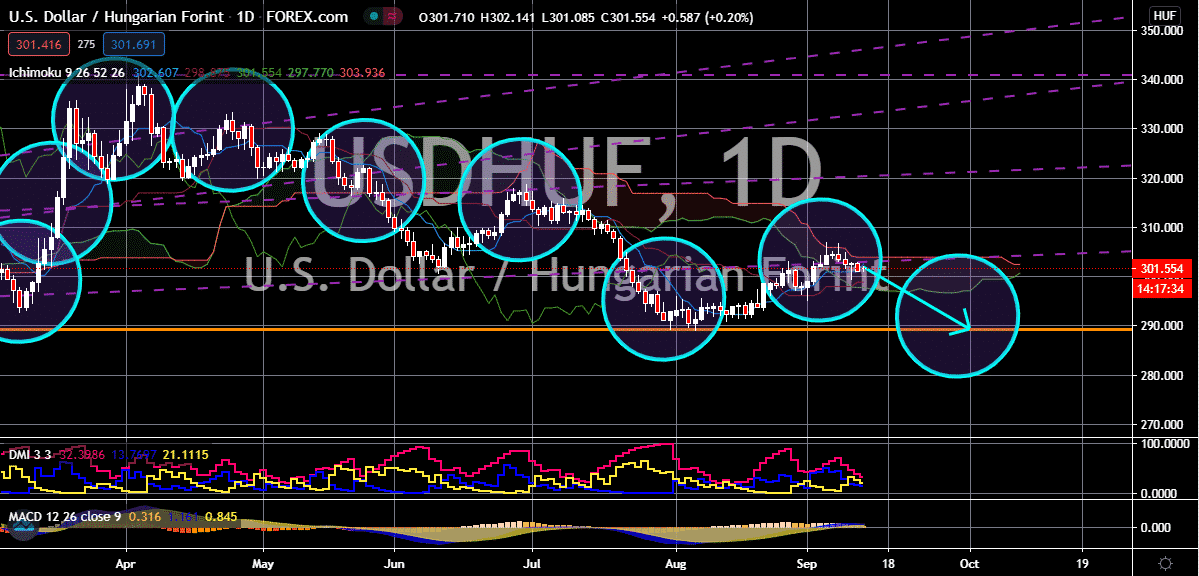

USD/MXN

The pair broke down from a major support line, sending the pair lower towards a key support line. The increase in crude oil inventories from last Thursday’s report will continue to push the US dollar lower. The overflowing inventories coupled by the record-breaking stimulus from the US government and the US central bank are what’s keeping the greenback from reaching new highs despite the increased economic activity from the reopening of most economies. The thrifty president of Mexico, Andres Manuel Lopez Salvador, on the other hand, is keeping the Mexican peso competitive against the US dollar. Despite criticism from investors and analysts of his spending habits, these prove to be beneficial to the local economy. Industrial Production MoM beat analysts estimates after it recorded a 6.9% growth with expectations of only 6.6%. Meanwhile, its YoY report kept its previous figure of -11.3% for the month of July.