Market News and Charts for September 13, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

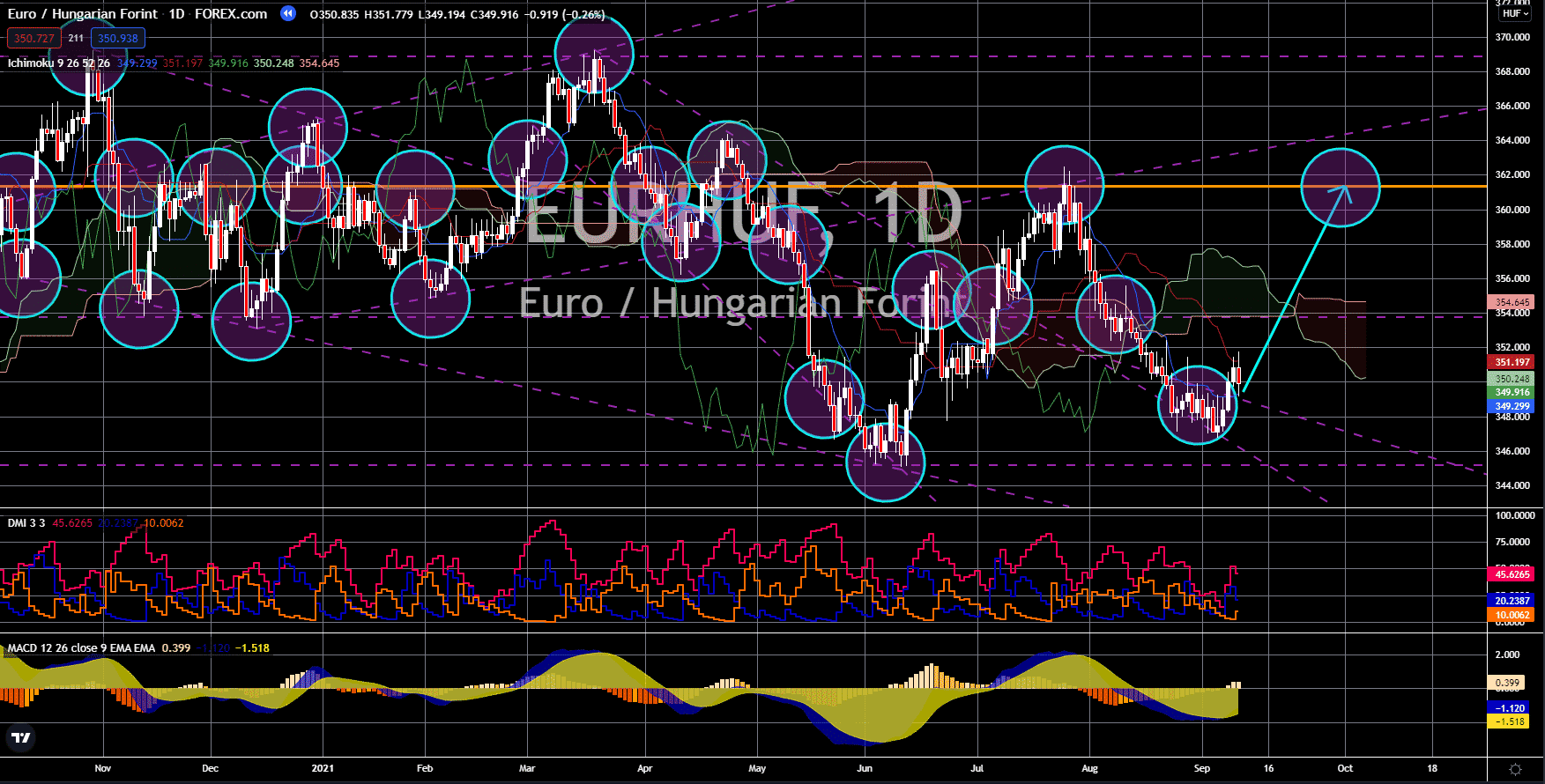

EUR/HUF

The pair will recover in the short term to retest its previous high at 361.000. The upbeat economic data in Hungary resulted in the readjustment of the debt deficit. The government is planning to issue additional euro and dollar-denominated bonds to boost economic growth further. The euro bonds with 7-year and 20-year maturity equate to 1.58 trillion Hungarian forints. Previously, the target for fiscal 2021 was only 644.00 billion. The euro-denominated bonds will push the euro higher against the forint. However, analysts expect a turnaround in recovery once Hungary releases its interest rate decision on September 21. Analysts expect a 25-basis points hike from the benchmark of 1.50%. The increment is lower against the first three hikes starting on June 22, with a 0.30% jump in each meeting. On the other hand, ECB’s Lagarde clarified the recent move by the central bank. Lagarde said the 20 billion euros cut in monthly bond purchases is not tapering.

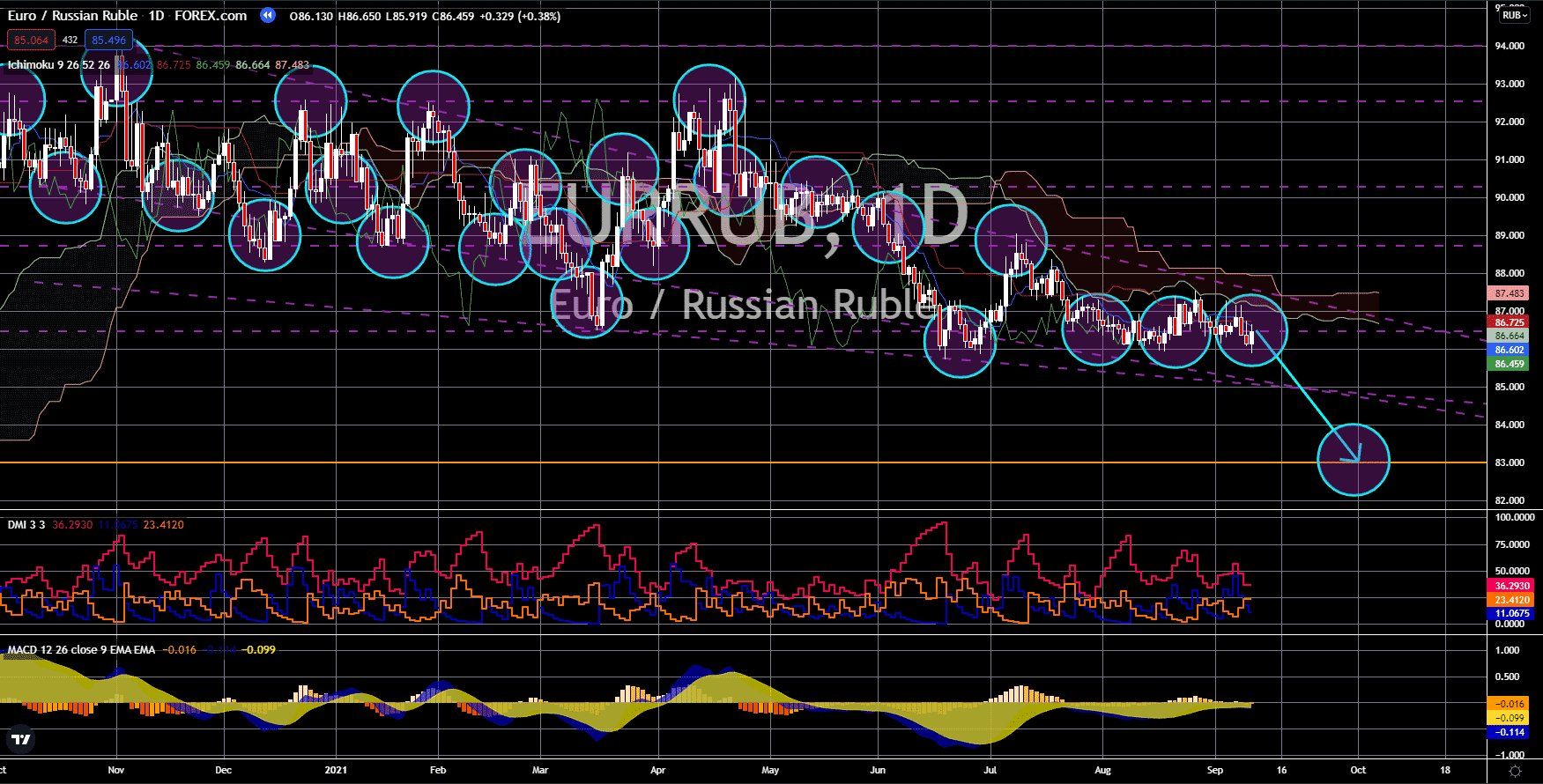

EUR/RUB

The euro will continue to underperform against the Russian ruble in sessions. Russia raises interest rate by 25-basis points to 6.75%. The data is lower than market expectations of 7.00%. Despite this, the hike still puts Russia ahead of the emerging economies. Russia is the second developing country to reintroduce monetary tightening in fiscal 2021 on March 19 with a 0.25% increment. Since then, the country’s central bank has continuously raised rates in each meeting. Another indication of a strong economy is GDP. For the second-quarter GDP, Russia’s economy advanced 10.5% year-on-year. Analysts expect a 10.3% increase. The improvement is the highest in seven years. Also, the net exports increased by 23.19 billion. The market is expecting a decline to 17.00 billion from 18.30 billion previously. Adding to the ruble’s strength is the increase in the US dollar reserves, currently at 620.80 billion. The previous record shows the USD reserve at 615.60 billion.

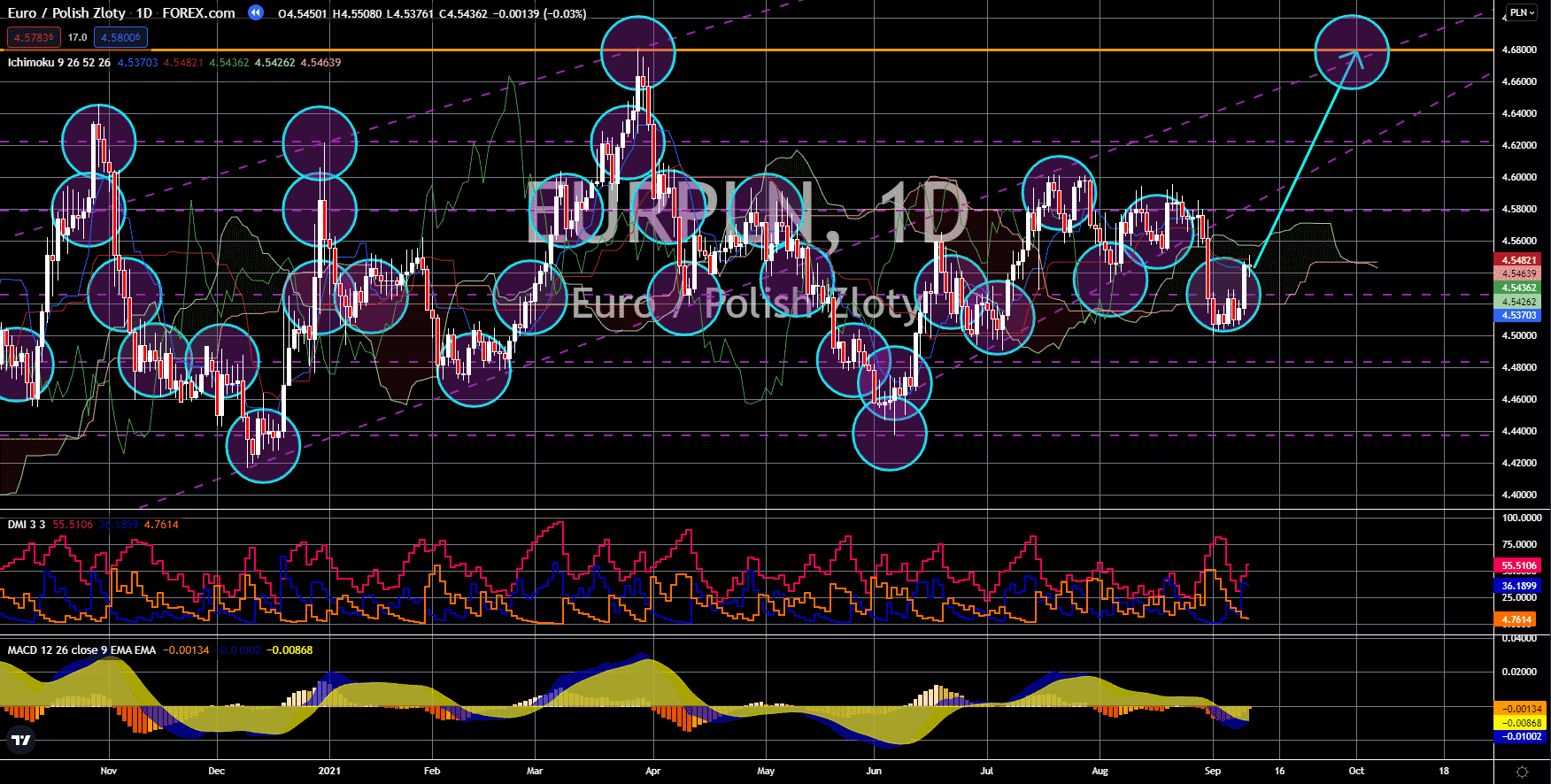

EUR/PLN

The bulls defended the 4.50000 price zone with a short-term price target of 4.68000. Germany’s consumer price index jumped 3.9% year-on-year in August. The result is higher compared to the previous data of 3.8%. The figure is the highest in almost 25 years. The soaring inflation suggests the need for the German government and the European Central Bank to tame prices. On a month-on-month basis, the CPI is flat zero. Meanwhile, the Harmonised Index of Consumer Prices (HICP) also jumped by 3.4% on an annualized basis. Other news from last week includes the interest rate decision of the ECB. The central bank maintains a zero percent interest rate, while the savings and lending rate is at -0.50% and 0.25%. In addition, the European Central Bank cut the monthly bond purchases to 60 billion from 80 billion previously. ECB chief Christine Lagarde said the slash in the PEPP program is not a sign of tapering, which the bullish investors expect on September 09.

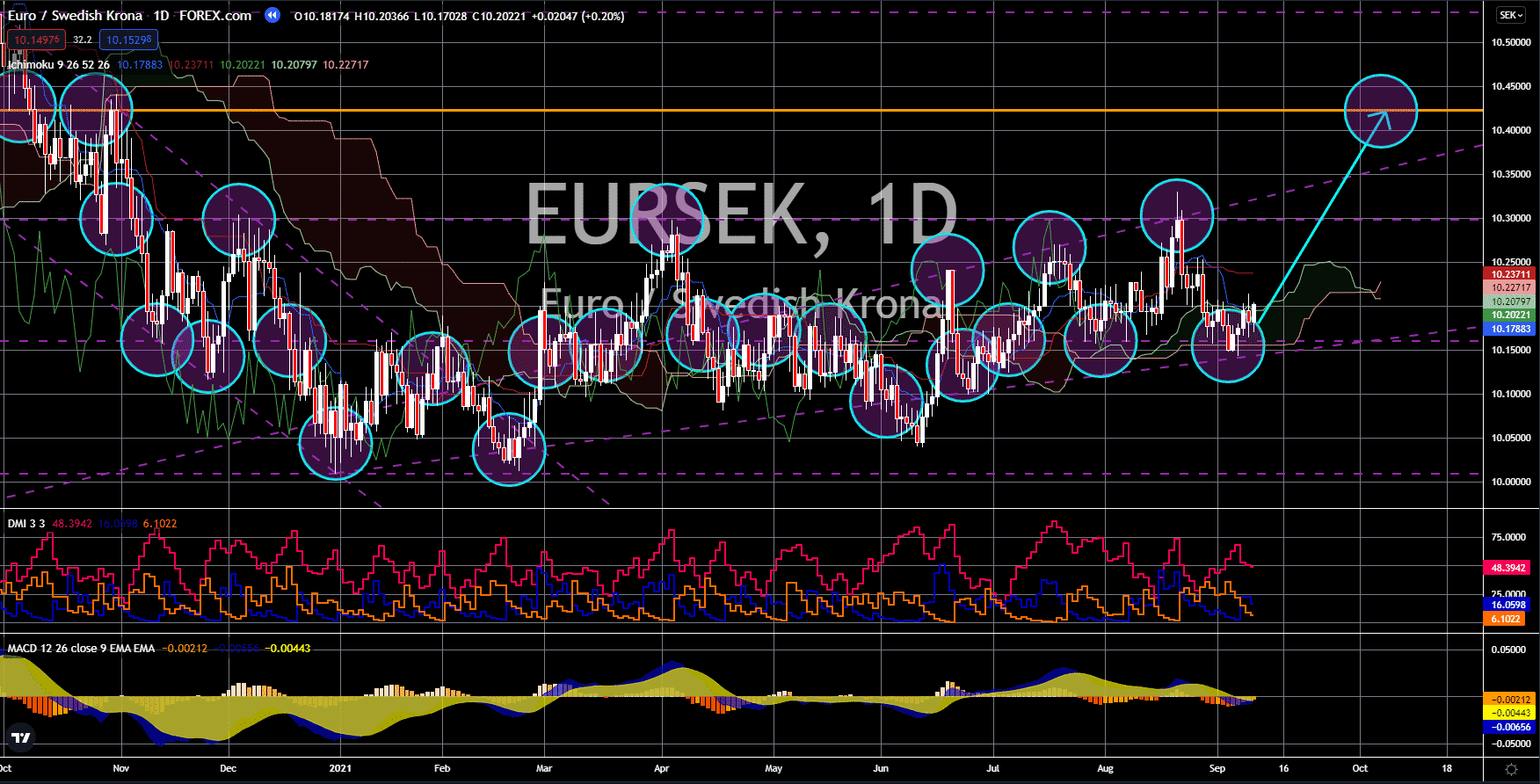

EUR/SEK

The pair will rebound from support to revisit the 10-month high at 10.42500. Investors are betting on high-risk stocks in the Swedish stock market. Sweden is currently one of the best-performing equities markets in Europe, with total listings of 1,000 companies. Most of the publicly listed firms are small caps, which means that valuations are under 1 billion. The less stringent lockdown in the country encourages many businesses to raise money from Sweden. The government now plans to fully reopen the economy by the end of September. Meanwhile, the coalition government nears in passing a budget. The Democrats agreed on a finance bill, although the 112 votes in the parliament are still lower than the Social Democrat-Green Party’s 116 seats. On the other hand, the euro is still backed by the European Central Bank’s monetary policy. The bulls prepare for a possible start of tightening after the central bank decided to reduce its purchases, boosting the single currency.