Market News and Charts for October 02, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

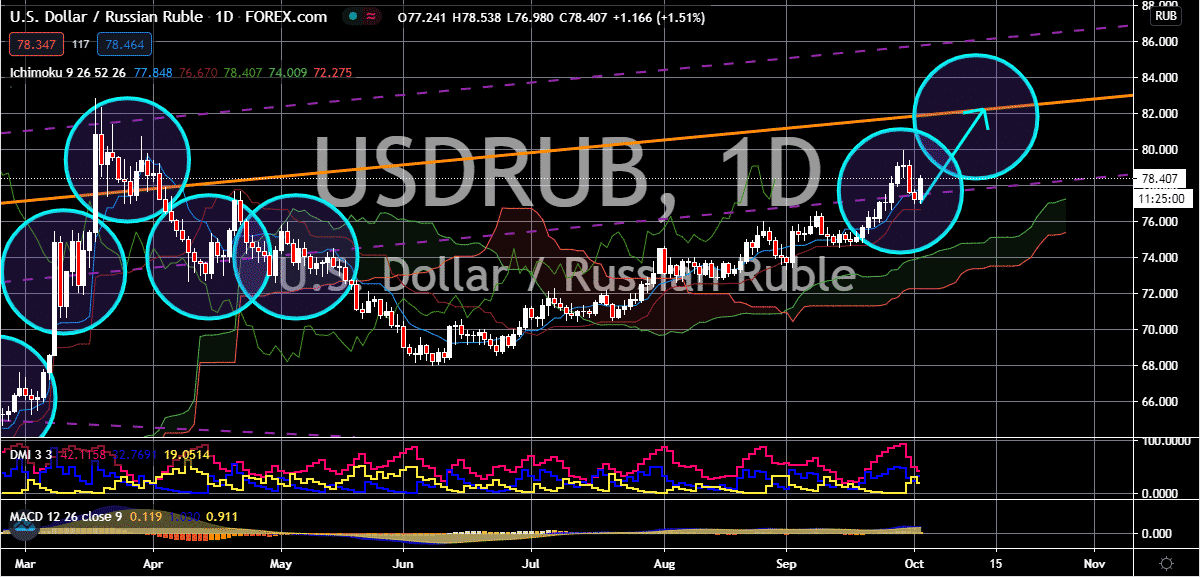

USD/ILS

The US dollar sees a huge window of opportunity to force the USDILS trading pair higher, erasing the recent gains of the Israeli shekel in the coming days. It is forecasted that the exchange rate’s prices will climb up to its resistance level, hitting ranges last seen back in May. The reason for this is the bright and shining safe-haven appeal of the greenback that has been further boosted by the latest news about the United States president himself. See, two days after his debate with opposition candidate Joe Biden, Donald Trump tested positive for the deadly virus, casting a greater cloud of uncertainty for the market. Meanwhile, the Israeli shekel might finally see losses after it has impressively floored the greenback in the past few trading sessions. Looking at the bigger picture, it appears that the shekel has closed the month of September on a rather strong note and that it is still in good grounds even if the buck pushes the exchange rate to its resistance.

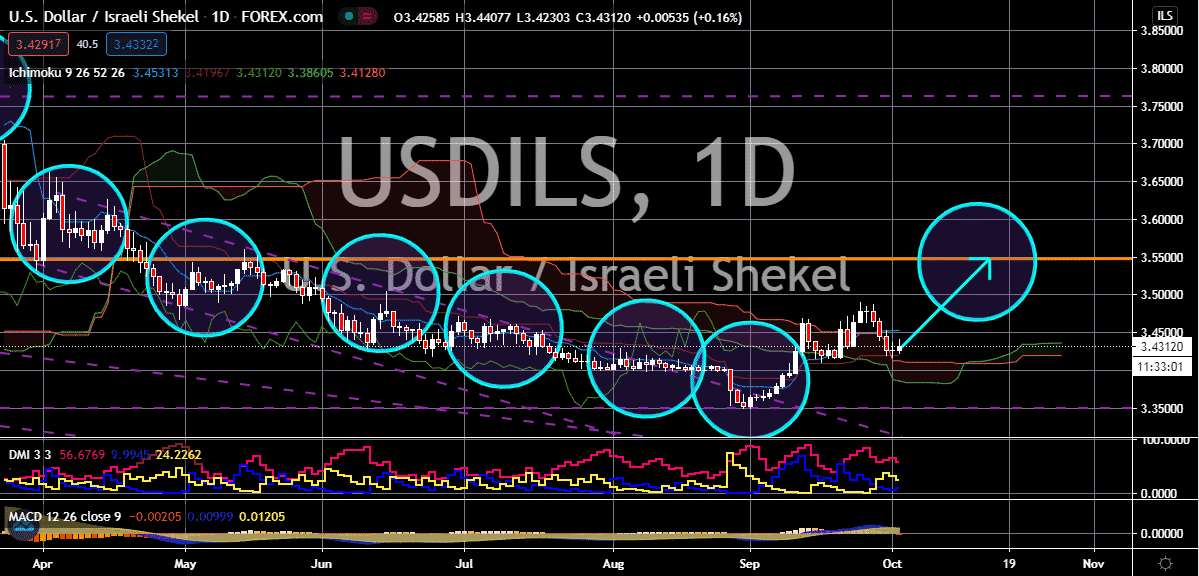

USDSEK

The Swedish krona holds onto its gains despite the recent surge of strength of the US dollar following the breaking news that President Donald Trump and his first lady, Melania Trump testing positive for the coronavirus. It clearly looks like the safe-haven appeal of the US dollar isn’t working well against the Swedish krona and the exchange rate’s prices are bound to crash to its support level in the coming days. Most experts believe that the krona is exploited as one of the strongest currencies in the market right now, well, at least in the short-term outlook it’s undeniably strong. Also, the Swedish krona remains unfazed despite the dovish remarks of the Swedish central bank’s meeting minutes. Recent reports say that Riksbank is willing to deliver further monetary policy adjustments and stimulus which failed to weigh on the nerves of bearish investors. The interest rates of Sweden’s central bank are already sitting on negative territories.

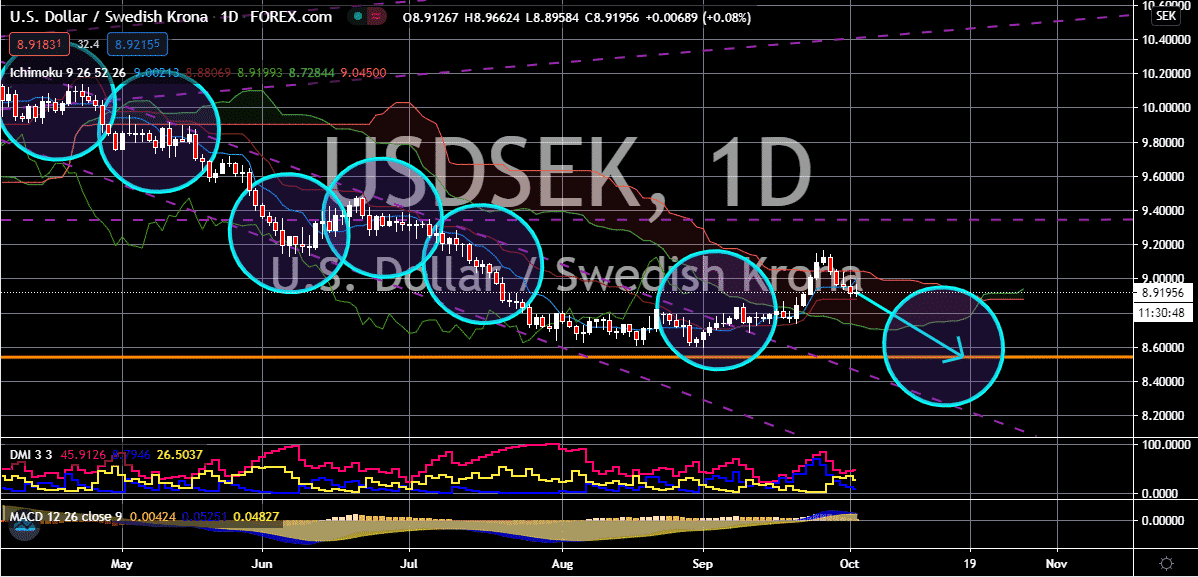

USD/ZAR

The South African rand loses its footing in the trading sessions as the risk aversion in the global market intensifies after the breaking news about US President Donald Trump. The US dollar to South African rand trading pair is bound to go up to its resistance level in the coming days thanks to the uncertainties that have come when it was reported that President Trump contracted the coronavirus. However, there is still a possibility that the US dollar could slip, and the South African rand could see a window of opportunity to break out in the sessions. Investors are currently flocking towards safe-haven currencies, and the South African rand lost its footing against most major developing and emerging market players. The financial market is now uneasily waiting for the unknown outcome as the 74-year-old leader of the biggest economy in the world catches the fatal coronavirus. And unfortunately, the mortality rate for that age group is already at 6%.

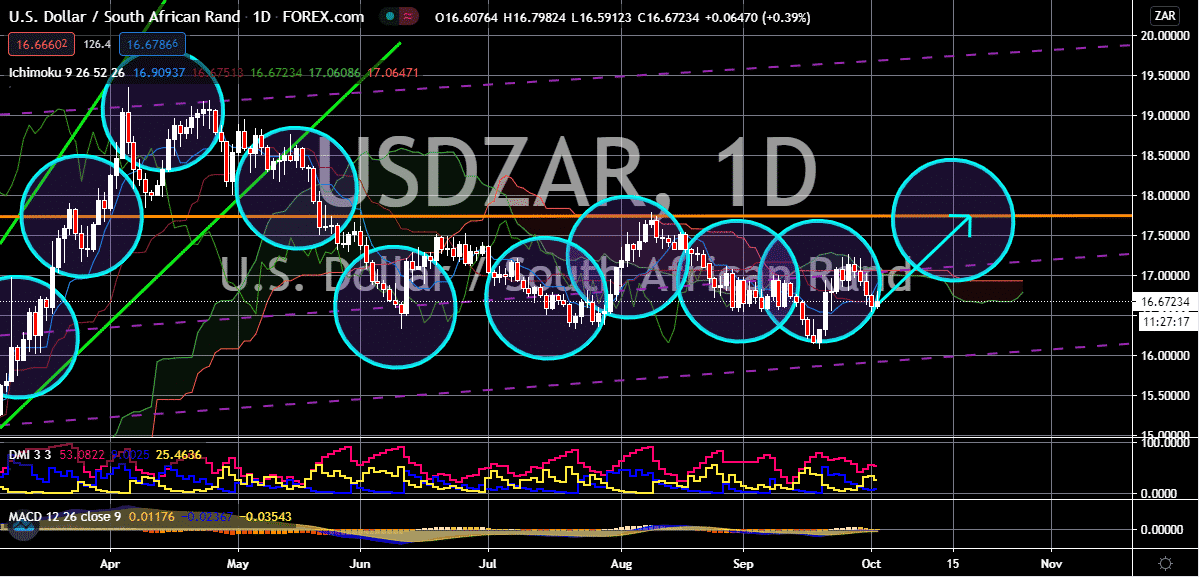

USD/RUB

The beloved US dollar topples over the Russian ruble and aims to force the USDRUB exchange rate’s prices towards its resistance level. It is believed that bullish investors will continue to hold their dominance in the coming days as the US dollar gets more powerful thanks to the woes brought by the recent news about US President Trump. See, the markets are running towards safety as the leader of the world’s biggest economy catches the deadly coronavirus. Looking at it, the Russian markets started this Friday’s trading on a rough footing thanks to the news. This means that not only the Russian ruble but also the main stock market of the country was in shambles. And to make matters worse, the political tensions surrounding Russia isn’t helping the currency’s cause. In fact, it is one of the primary reasons for the ruble’s weak stance in the foreign exchange market. Unfortunately for bears, the crude market can’t help it defend itself this time around.