Market News and Charts for November 12, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

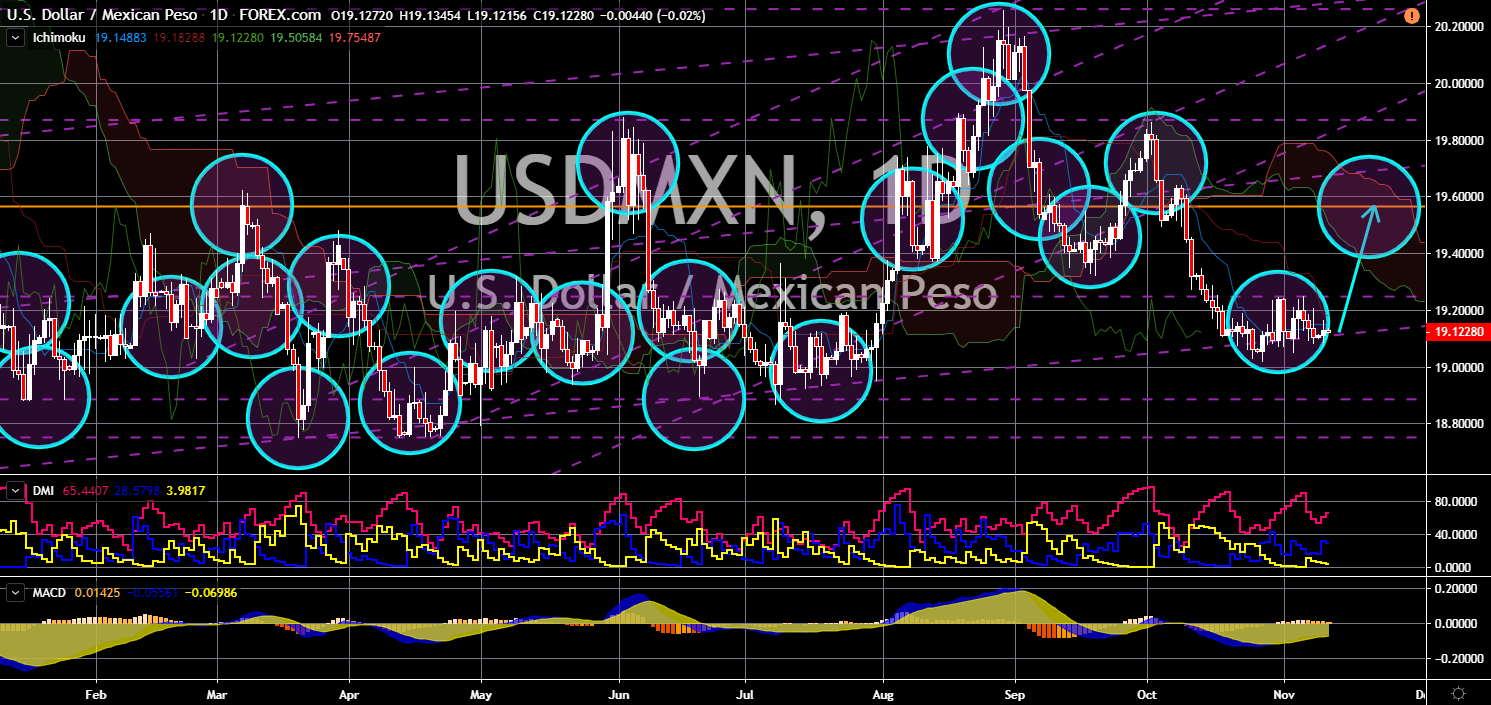

USD/MXN

The pair is expected to bounce back from its current support line after a series of weak candles. The U.S-Mexico relationship was stormed following an ambush that resulted in the death of at least nine (9) Americans. In line with this, U.S. President Donald Trump offered to send the U.S. army to which Mexican President Andres Manuel Lopez Obrador rejected. However, the Mexican government invited the FBI (Federal Bureau of Investigation) to investigate the ambush. In other news, U.S. House of Representatives Speaker Nancy Pelosi confirmed that the U.S. Congress is near in passing the USMCA (United States-Mexico-Canada). The USMCA will replace the 25-year old NAFTA (North American Free Trade Agreement). This is expected to help boost U.S. agriculture, which suffered from that tit-for-tat trade war between the United States and China. The ratification of the USMCA is a key policy of the Trump administration.

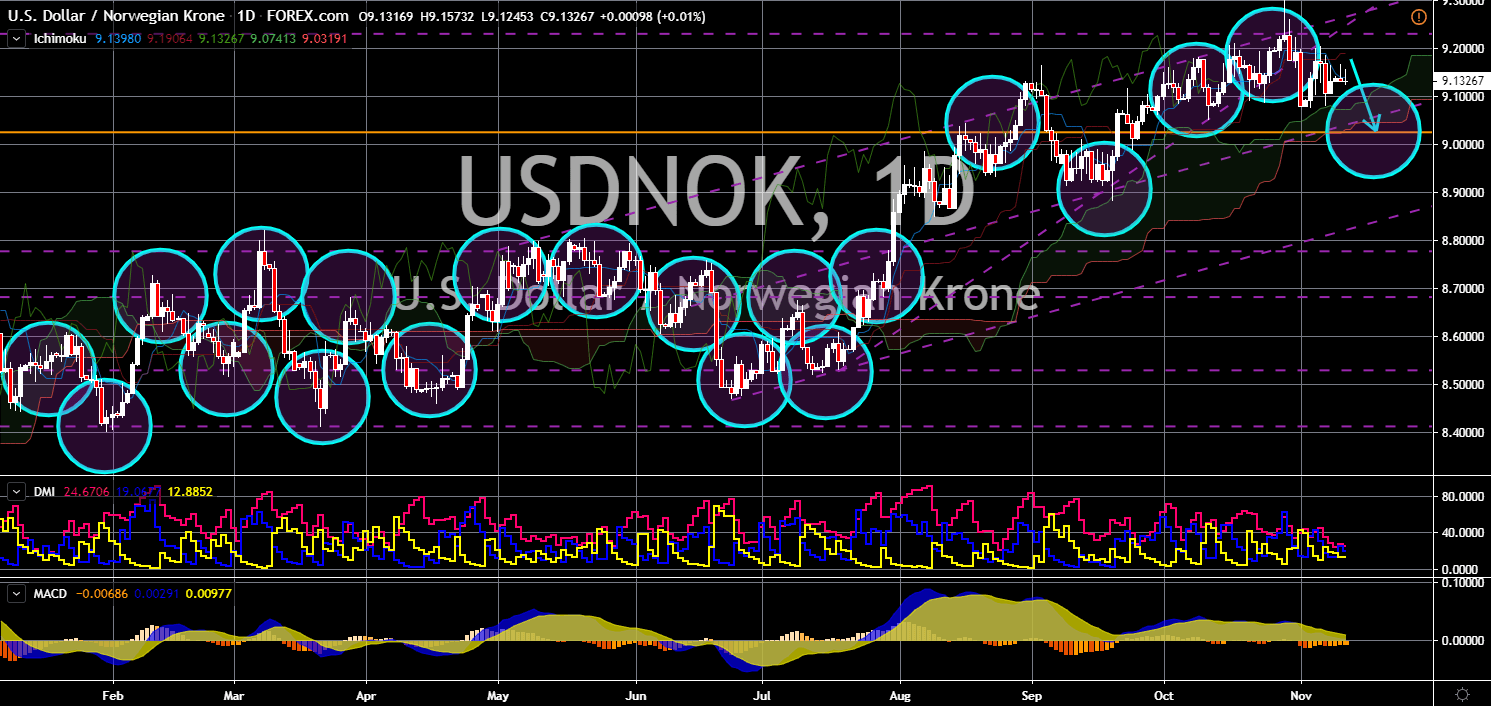

USD/NOK

USD/NOK

The pair will continue to move lower after it failed to break out from a key resistance line. Norway’s 1 trillion sovereign wealth fund grew on last week’s trading amid the rising global stocks and the strength of the U.S. Dollar and the Euro. The SWF is now worth $1.09 trillion (10 trillion Norwegian crowns). The massive sovereign wealth fund of Norway accounted for at least 1.80% of the total stocks trading in all stock exchanges around the world. 70% of its funds are invested in global equities while 28% of the portfolio was allotted to fixed-income instruments. The Norwegian government announced earlier that it is divesting in the European region amid an economic slowdown and uncertainty with the Brexit. Aside from this, Germany, the European region’s biggest economy, is on the verge of recession. The fund is looking to increase its exposure to North and South America and in Asia.

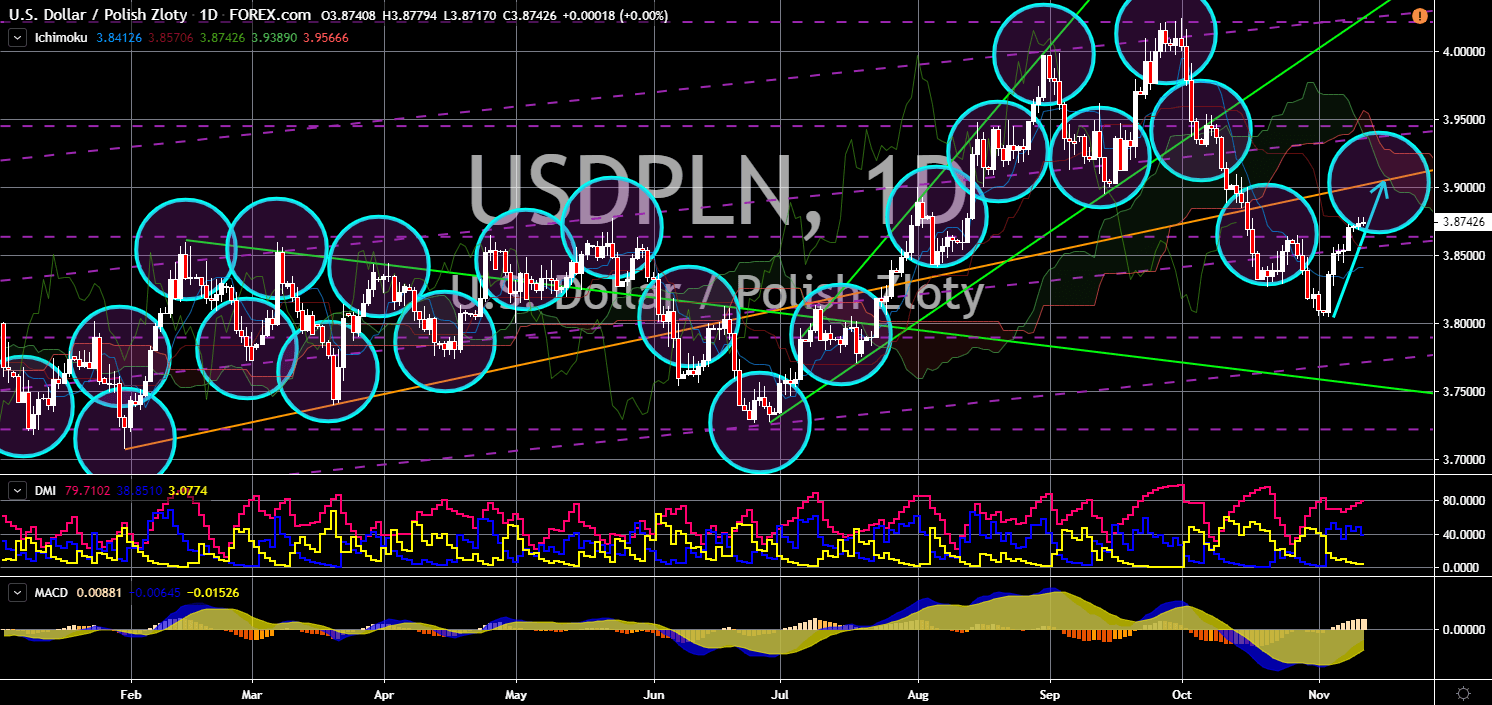

USD/PLN

USD/PLN

The pair will continue its rally in the following days and retest its nearest resistance line. Poland became the 39th country to become a member of the U.S. Visa Waiver Program (VWP). The move by the United States was a response to the strengthening U.S.-Poland relationship. The United States is deploying its military personnel in Poland. Along with this were the deployment of THAAD (Terminal High Altitude Area Defense) and a possible sale of the U.S. F-35 fighter jets. Poland’s Law and Justice Party (PiS) also received strong support for Polish people during the recent election. Along with the U.S. militarization of the eastern bloc, French President Emmanuel Macron cast doubt whether the U.S. will honor Article 5 of the NATO (North Atlantic Treaty Organization). This was amid Macron’s proposal to build a European army to minimize if dependency of the U.S.-led NATO alliance.

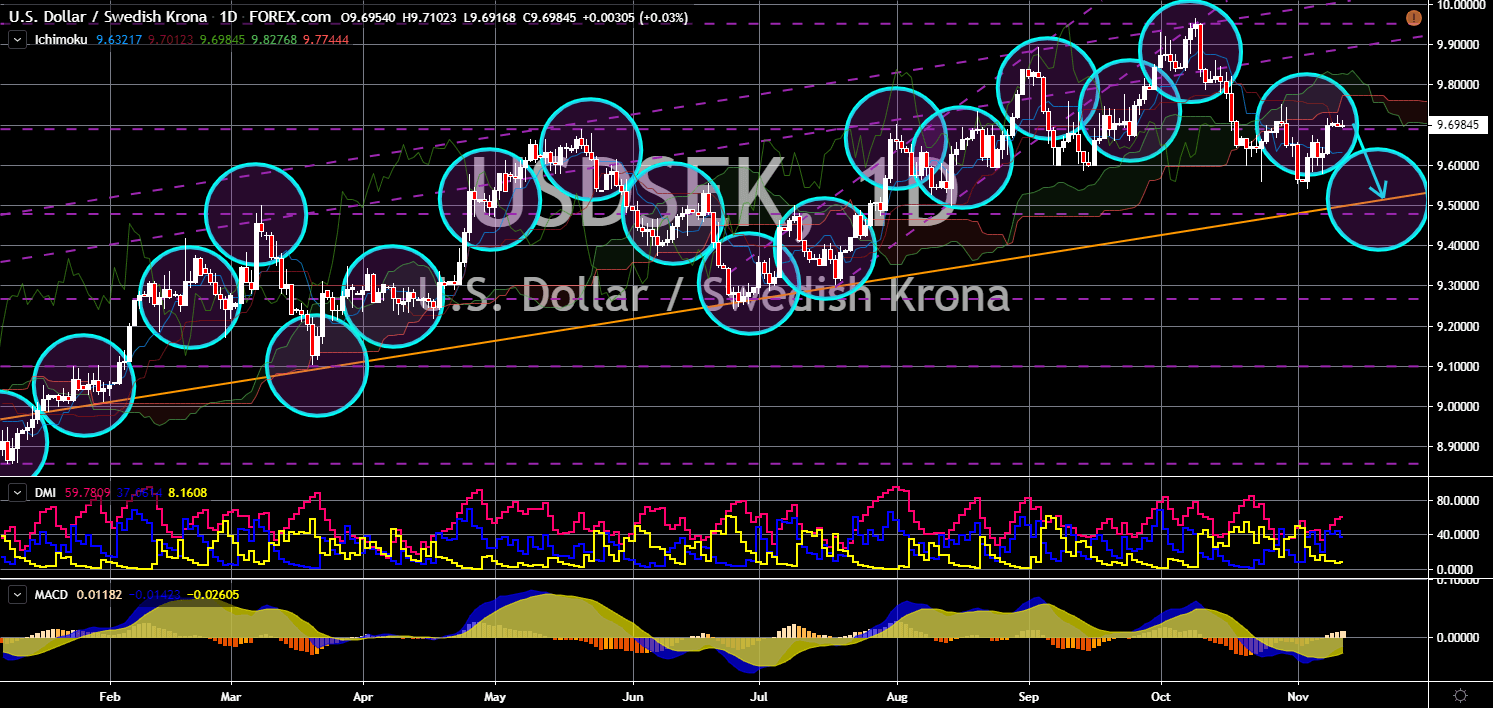

USD/SEK

USD/SEK

The pair will fail to break out from a major resistance line, sending the pair lower towards a major uptrend line. Nordic countries’ economic growth is expected to experience a slowdown in 2020 as trade tensions increased. The export-dependent region, which was home to fashion retailer H&M and logistics giant Maersk, has for decades benefited from globalization. But the U.S.-China trade war is expected to increase protectionism among economies and will hit export-reliant countries. The European Union particularly warned Sweden, in which GDP growth is expected to drop by 1% next year. In line with this, the Swedish central bank is expected to move its negative rates to zero (0) percent by December. The country said the phase one trade deal between the United States and China could positively impact exporting countries. Sweden is one (1) of the only four (4) countries with a negative interest rate.