Market News and Charts for May 07, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

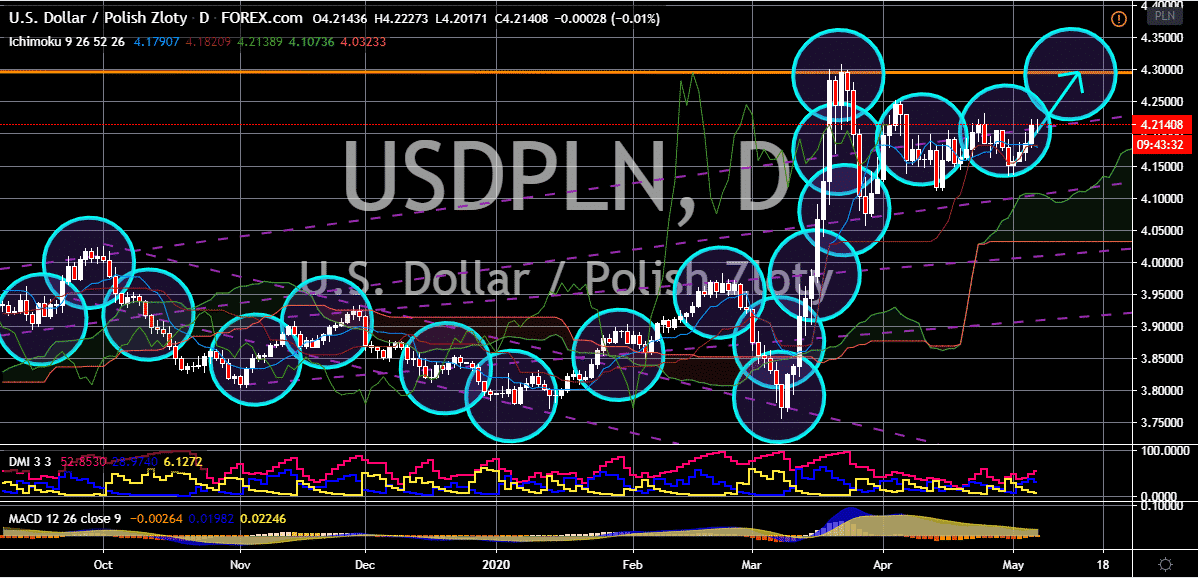

USD/HUF

The US dollar is feeling the intense pressure of the struggling US labor force. The US dollar to Hungarian forint exchange rate is bound to hit its resistance as investors of the buck start to get more and alarmed about the health of the US economy which is dramatically struck by the coronavirus pandemic. See, the more jobless Americans should mean that the safe-haven appeal of the US dollar would glow, right? But that will not be the case as it could prompt the US authorities to unleash more stimulus to support businesses. And more stimulus would be costly to the strength of the greenback. Also, the Hungarian forint is seen doing considerably well amidst the gradual bond-buying program of the Hungarian National Bank. And the fact that Hungarian forint is able to hold itself against the greenback despite stimulus from Nemzeti Bank gives bearish investors more and more hope that the pair would eventually go down.

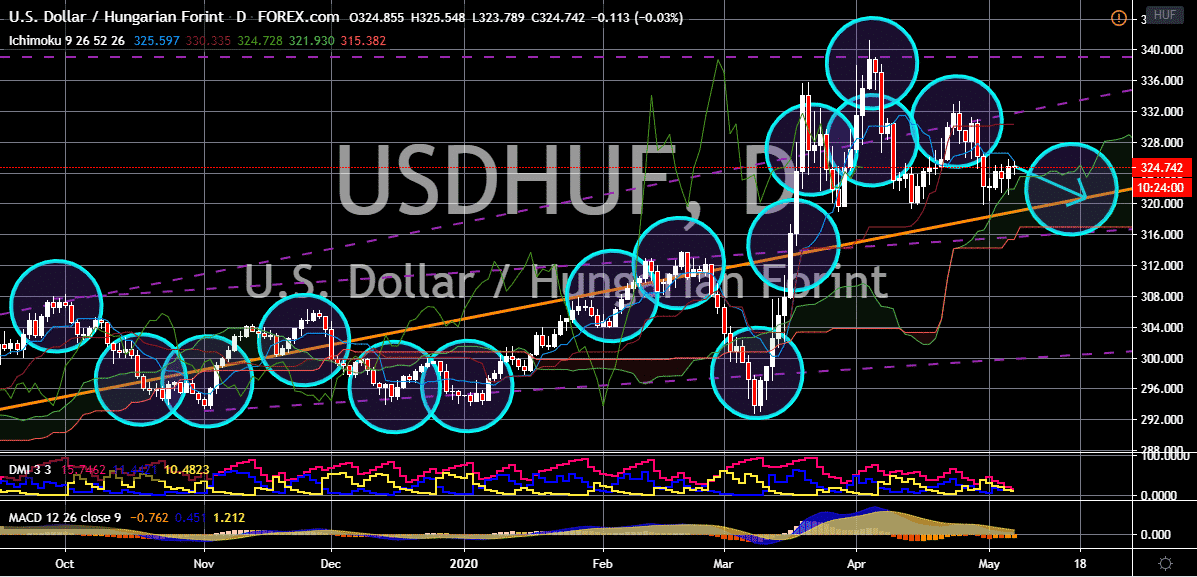

USD/MXN

Bearish are finally bound to feel a sigh of relief in the coming sessions as the US dollar is widely projected to buckle in the coming sessions thanks to the dwindling US labor force. Despite the news about a poll finding the US dollar will remain dominant for three more months, that may not be the case soon as potential stimulus from the Fed could cause the safe-haven appeal of the currency to falter. Since March, it appears that bullish investors have held a firm grip on the direction of the pair. However, things will turn around as the more jobless Americans get reported, the chances of further stimulus from the US government or the US Federal Reserve also gets higher. Bearish investors are hoping for further support from the scheduled reports due today such as the consumer confidence and consumer price index for April. If the figures turn out better, the peso’s chances to recover goes up as Mexico’s economy emerges better than expected on the Q1.

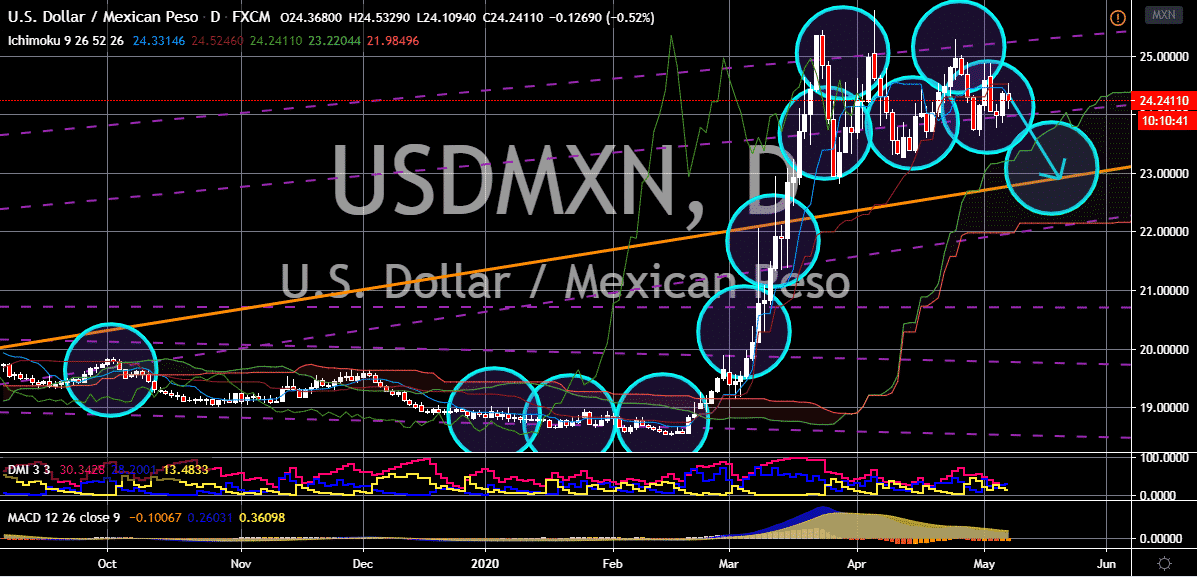

USD/NOK

Experts are betting on a bearish trajectory for the USDNOK exchange rate for several factors. First, currencies that aren’t closely linked to the conditions of the commodity market and crude prices are most likely the ones who can successfully and efficiently recover against the greenback. The Norwegian krone isn’t a commodity-linked currency thus raising the chances for bearish investors of the pair. Second, the safe-haven appeal for the US dollar that is also projected to allow it to be dominant for at least three more months will falter if the United States government or the Federal Reserve ramps up their support for the economy. And looking at the status of the US economy and the labor force, chances that the authorities to unleash more support gets greater. This means that the US dollar to Norwegian krone is bound to gradually decline to its resistance thanks to the news that pressuring bullish investors in sessions.

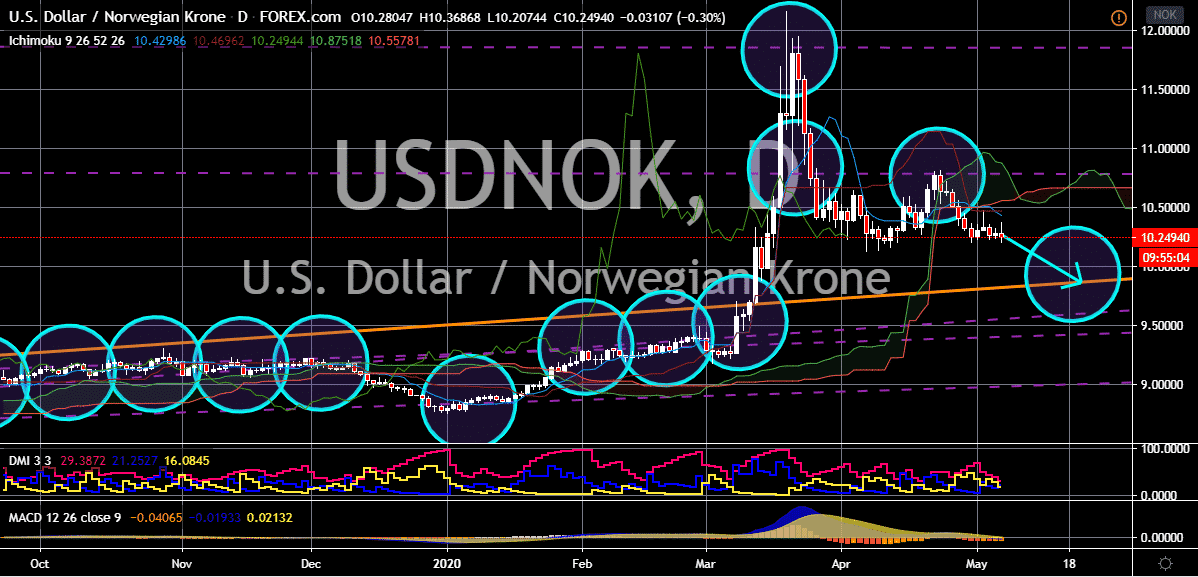

USD/PLN

Unfortunately for the Polish zloty, it won’t be heading on the same recovery track along with other currencies in the region. Thanks to the unnecessary rate slash from the Polish central bank, the zloty is deemed as undervalued in the foreign exchange market now. This leaves room for bullish investors to maneuver, pushing the pair higher back towards its resistance. Although the broader weakness of the US dollar is slowing down the pair’s rally. Nevertheless, the pair widely anticipated to reach its resistance once again this month. However, the question of whether the bulls could break through the resistance area remains standing as the greenback also faces several hindrances mainly regarding the increasing number of unemployed citizens. The United States’ private sector reported an employment change of -20.2 million yesterday. A drastic drop thanks to the coronavirus brought lockdowns that ultimately forced companies to cut workers.