Market News and Charts for March 12, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

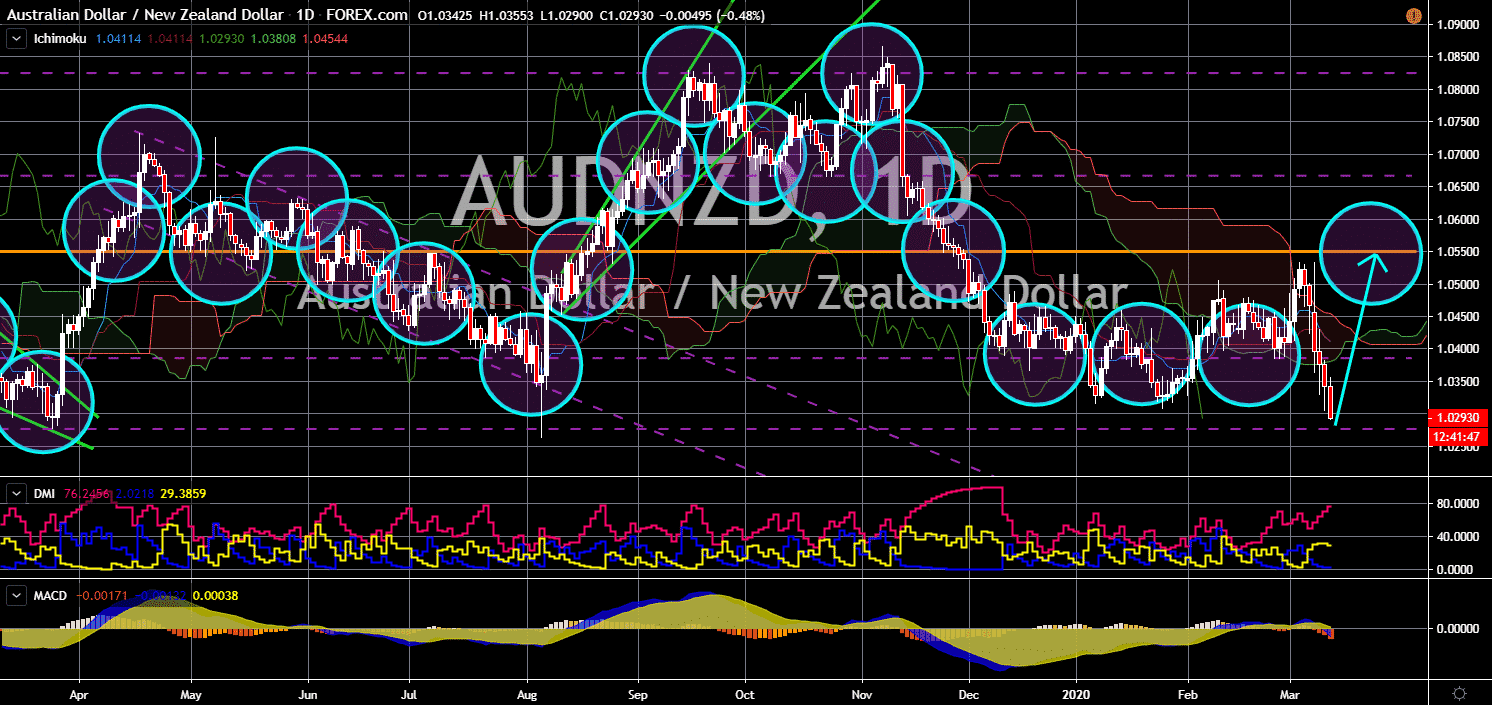

USD/CNH

The pair bounced back from a critical support line, sending it higher towards an uptrend resistance line. The United States and China were in another brawl following a tweet by US President Donald Trump. The COVID-19 became a platform for the two largest economies to continue their economic fight following the trade war. On his post on the social media platform, Trump referred to the deadly coronavirus as the “China virus”, which angered Beijing. Analysts see the action taken by the US president as a countermeasure on the negative sentiments surrounding the American economy. Since last week, indices are recording significant drops. The reason for the decline in the index was a combination of coronavirus and volatility in the global oil market. As the US publishes negative figures for critical reports, China is silent. The absence of public records from China is making investors worry about the overall health of the second-largest economy.

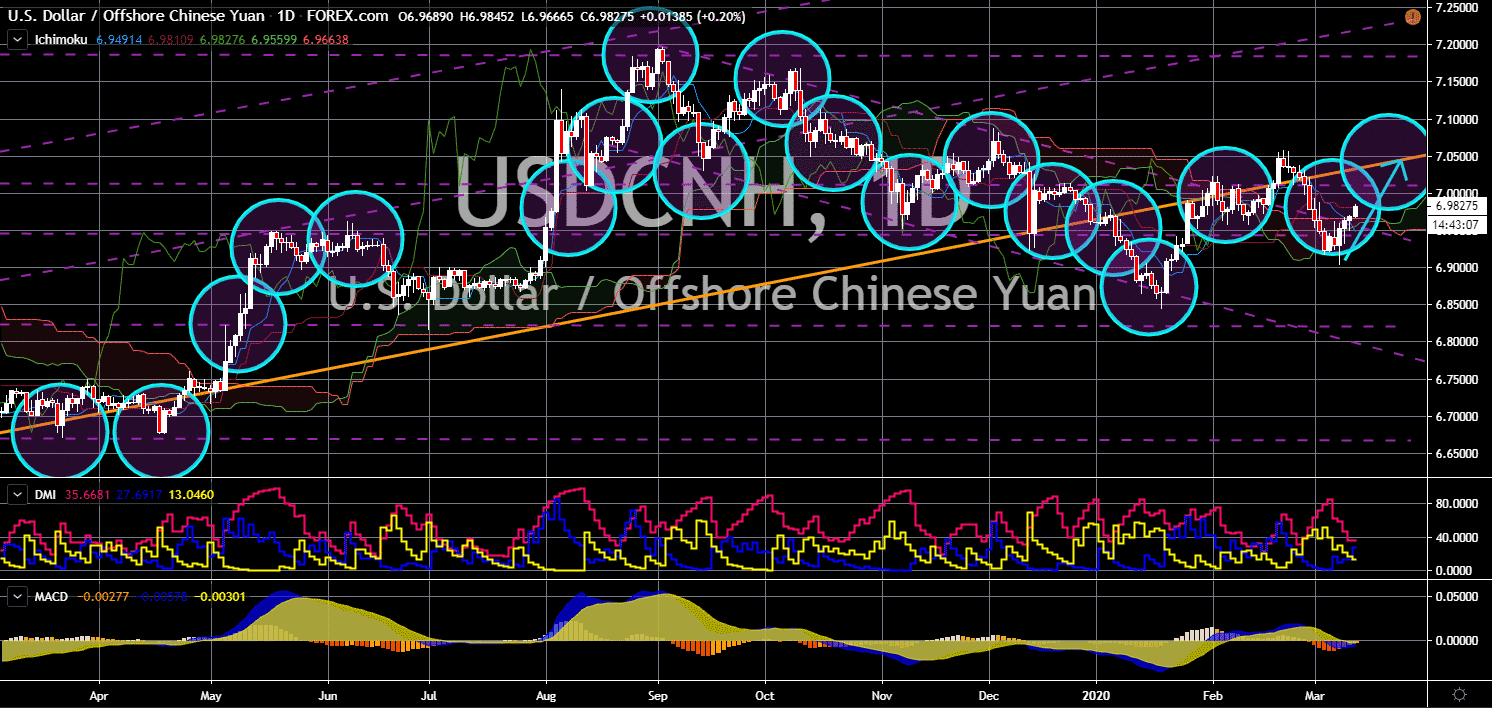

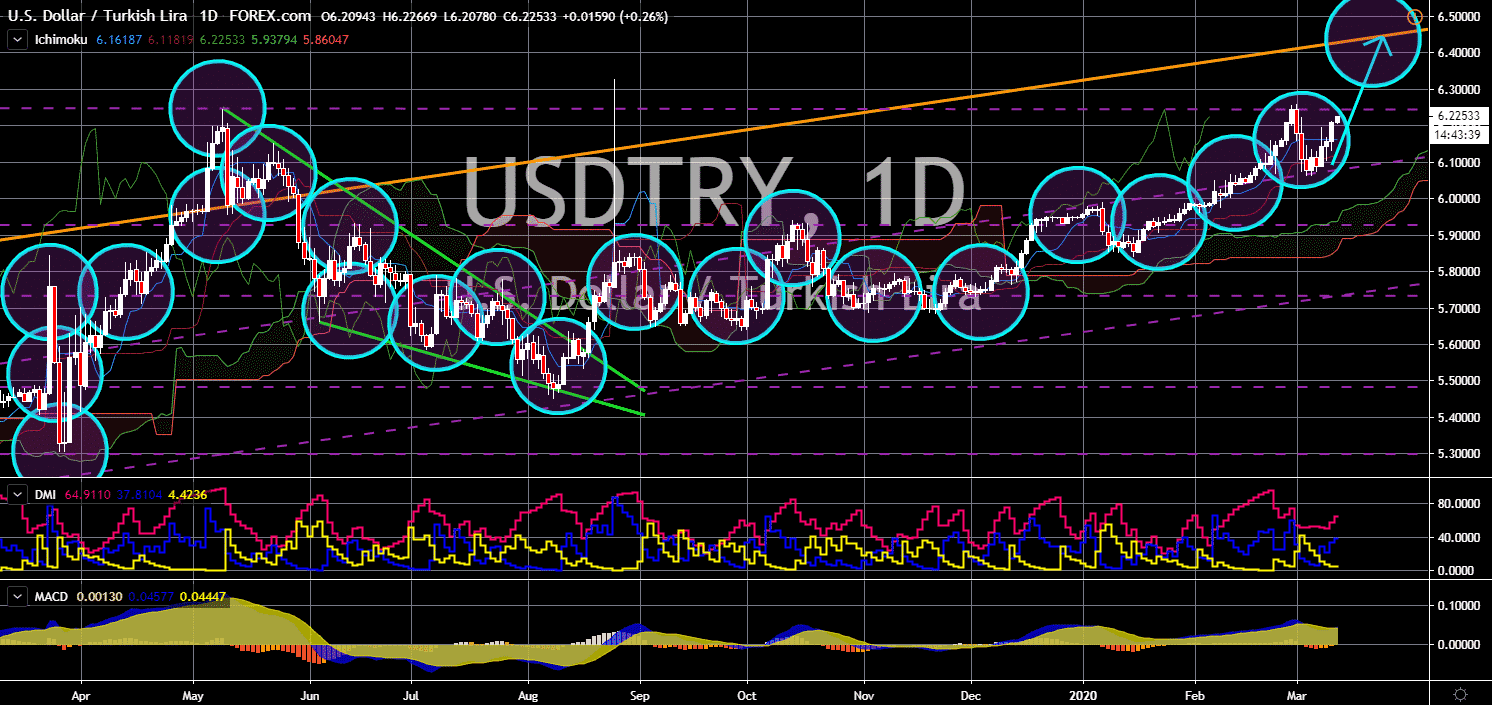

USD/TRY

The pair will continue to move higher in the following days towards an uptrend channel resistance line. As of writing, the COVID-19 has infected 119 countries. Yesterday, March 11, Turkey confirmed its first case of coronavirus. However, analysts are not convinced that Ankara has only one reported case of the virus. The number is too low is considering that Turkey is home to more than 50 million people. The number of cases in the United States, on the other hand, surpassed the 1,000 mark. In response to this, US President Donald Trump announced a travel ban from European countries. The action taken by the president will have a short-term negative impact on the US economy but will have a positive effect on the US dollar. With Turkey, the under-reporting of cases and the lack of an immediate plan will take a hit on the lira. In other news, Turkey’s Current Account report posted a deficit for the month of February for the third consecutive month.

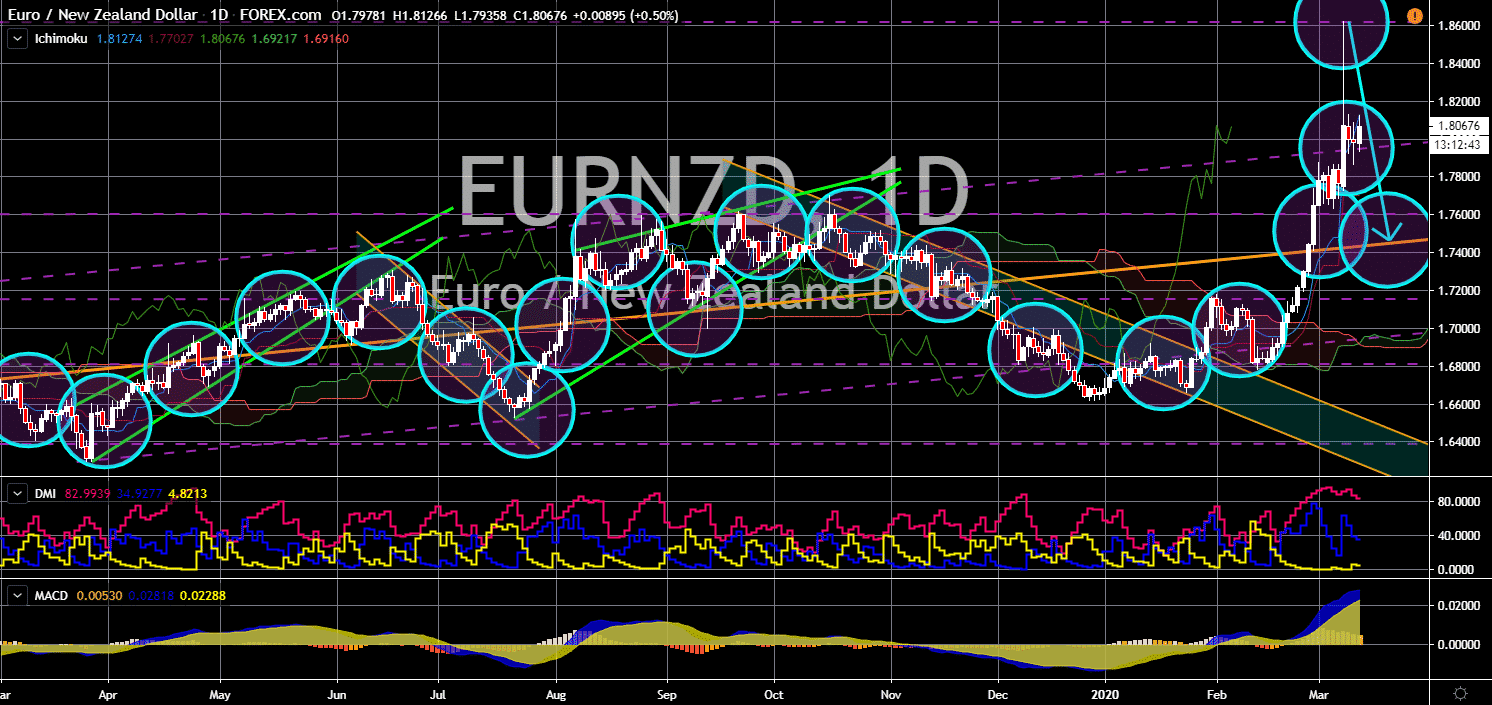

EUR/NZD

The pair will reverse back after it failed to break out from a critical resistance line. The New Zealand dollar will experience some weakness in the previous days following the comments made by the RBNZ governor. Adrian Orr said that a negative rate is at hindsight for the country to counter a possible recession. He further added that the Royal Bank of New Zealand is making alternative tools to ease the country’s economy. Central banks around the world have cut their benchmark interest rates amid the economic threat posed by the COVID-19. The Federal Reserves, the Reserve Bank of Australia (RBA), the Bank of Canada (BOC), and the Bank of England (BOE) already held their cuts this month. The next to make its decision is the European Central Bank (ECB). The ECB will release its statement today, March 12. President Christine Lagarde said the coronavirus could take the whole economy back to the 2008 Global Financial Crisis.

AUD/NZD

The pair will reverse back from its 12-month low towards a key resistance line. Leaders around the world are trying to contain the economic impact of COVID-19 through different measures. Major central banks from the US, Canada, and the United Kingdom have already cut their benchmark interest rate. However, Australia and New Zealand are doing non-traditional measures. The RBNZ (Royal Bank of New Zealand) governor said he sees the country’s interest rate dipping below zero percent. Prime Minister Jacinda Ardern also gave her signal for a travel restriction. Australia is one of the countries that slashed its interest rate. In addition to that, Prime Minister Scott Morrison introduced a stimulus package of $17.6 billion. His action failed to calm investors and traders, resulting in a 7.36% drop in the Australian index. The Australian dollar will continue to fall until investors see a substantial measure to protect the economy.