Market News and Charts for March 11, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

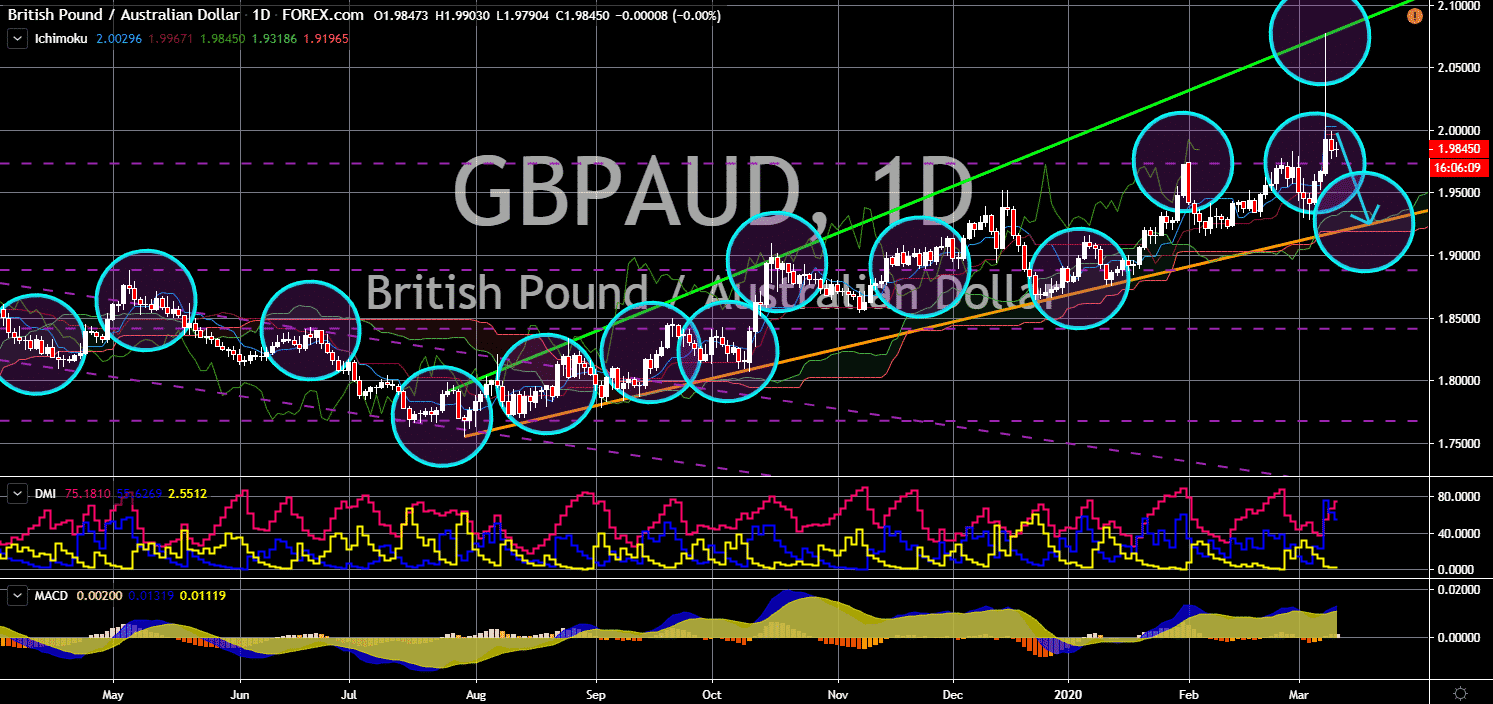

GBP/AUD

The pair will move lower after it failed to break out from the “Rising Widening Wedge” pattern resistance line. For the first time since 1985, the United Kingdom posted a positive figure for its Trade Balance report in January. The recorded $0.85 billion increase was due to the expected withdrawal of the United Kingdom from the European Union. However, there were also some negative impacts on the divorce between Britain and Brussels. The UK’s Manufacturing and Industrial Production report for January was both sluggish. Figures recorded were 0.3% and 0.1%, respectively. On the other hand, its construction output in the first month of the year was 0.4%. The trend on these reports will continue in today’s report for February. Meanwhile, Australia is taking some hits from global economic uncertainty. It is currently at odds with the EU after it signed a post-Brexit trade agreement with the United Kingdom.

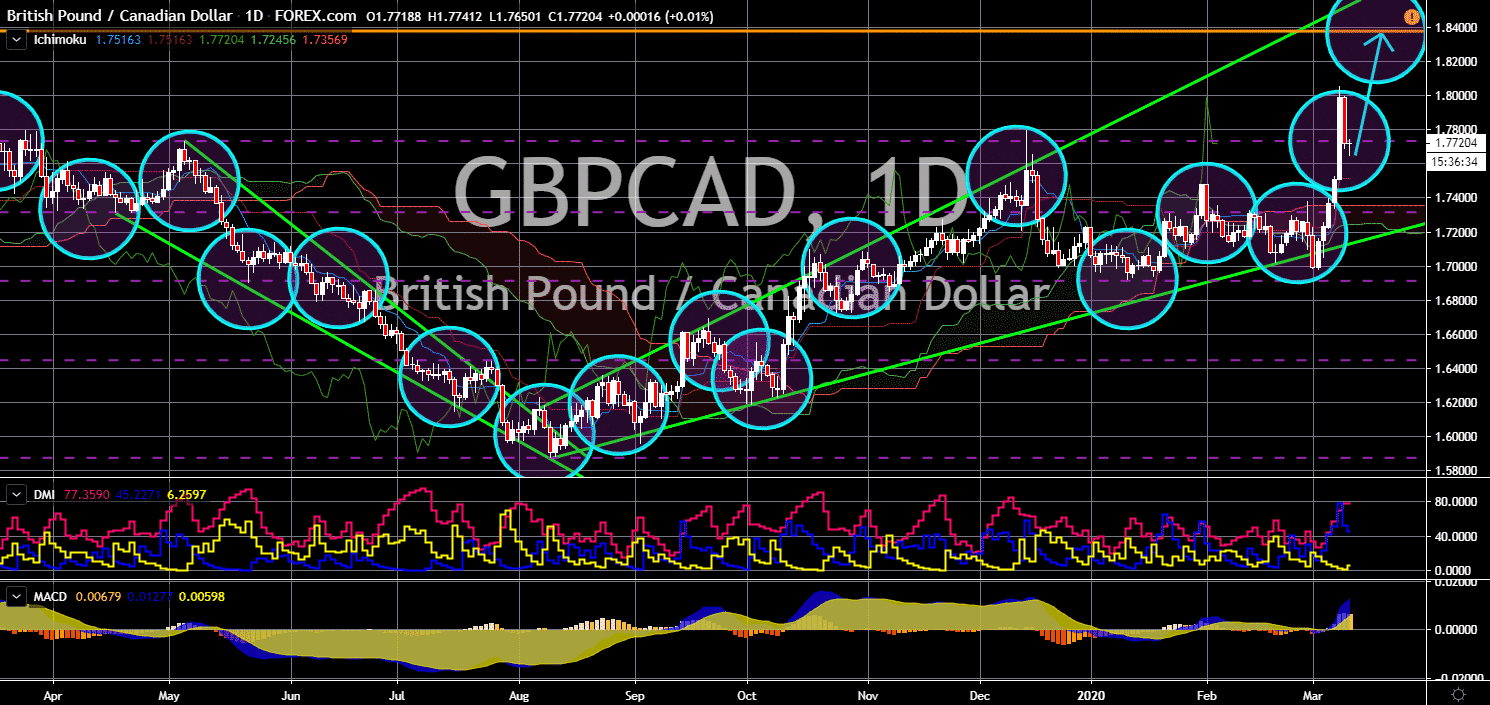

GBP/CAD

The pair will continue its rally after it failed to break out from a primary resistance line. The Canadian dollar is one of the worst-performing currencies for the year. The country recently cut its benchmark interest for the first time since 2015 by 50 basis points. The cut was due to the economic threat posed by the deadly coronavirus. Now, the fifth-largest oil producer in the world suffers due to the decline in crude oil prices. On Monday, March 09, the cost of crude oil plummeted to 31.13 per barrel or 24.59%. The same thing happened to the United States, which is the largest producer and consumer of crude oil. Brent oil prices also had its worst day on Monday. However, the United Kingdom was able to dodge the slump in its currency. The UK is the 19th largest oil producer in the world. The disagreement between OPEC and Russia is weighing on the global economy. Countries exposed to oil supply will take the hit from this volatility in oil prices.

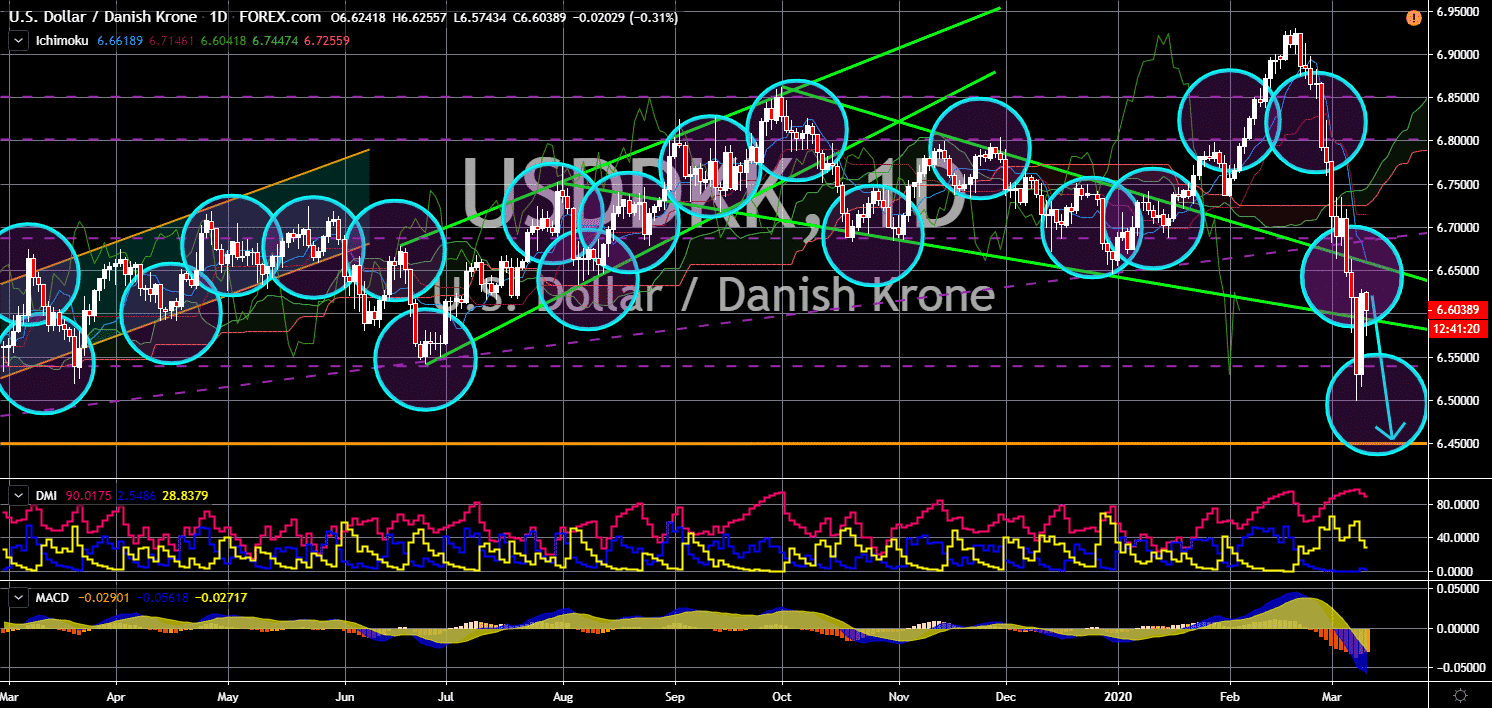

USD/DKK

The pair will continue its steep decline, sending it further lower towards its January 2019 low. Major investment firms warned investors that the world might be facing a global recession. The comments came amid the increasing number of cases of the COVID-19 worldwide. Following the first coronavirus related death in the US, the three major indices have been declining ever since. The US dollar is also under pressure after OPEC and Russia failed to reach an agreement with the production cuts. The double-whammy event has been hurting the US dollar despite positive figures for its critical reports. In response to the poor performance of the USD and the American economy, President Trump introduced a countermeasure proposal. The US president wants to cut the payroll tax rate to 0%. However, analysts were not thrilled over this decision. On the other hand, Denmark hasn’t had any death relating to the virus.

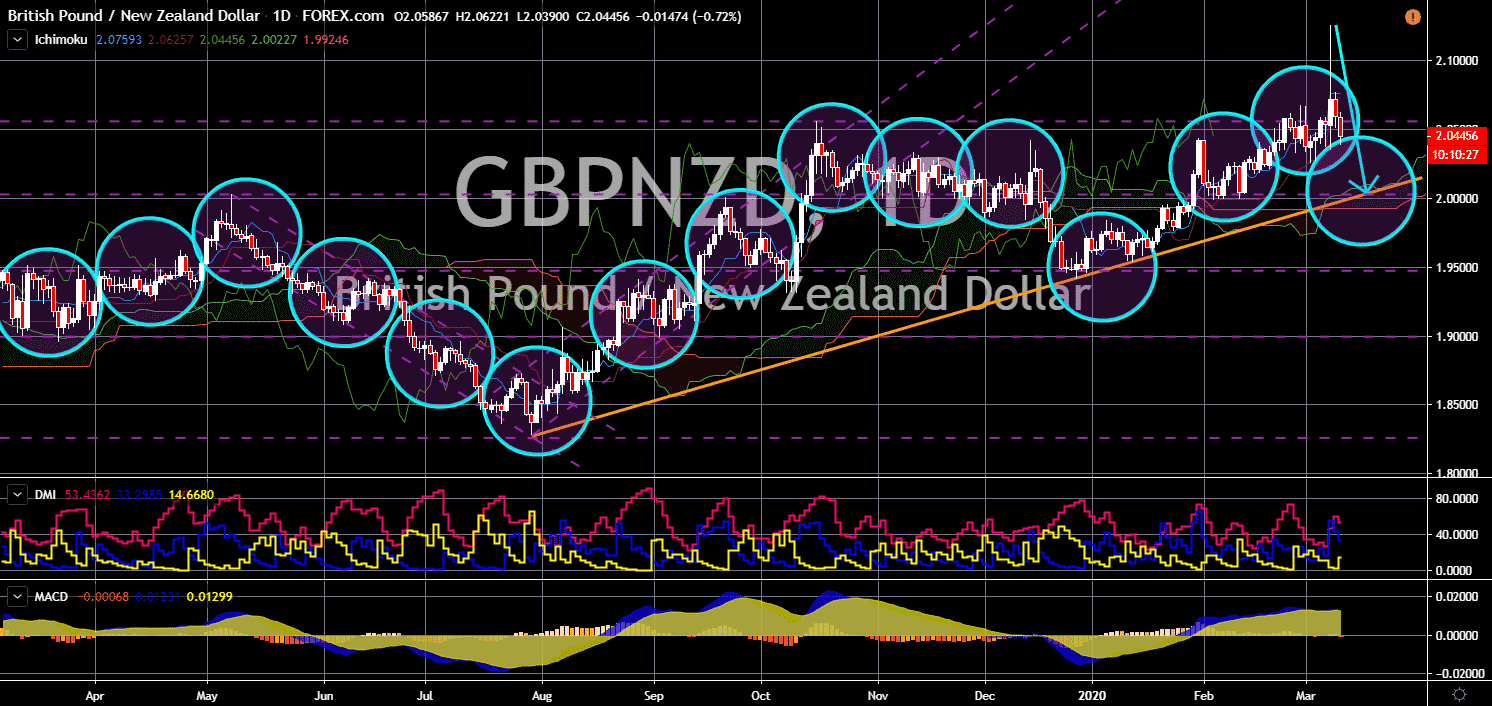

GBP/NZD

The pair failed to break out from a critical resistance line, sending it lower towards an uptrend support line. The United Kingdom is due to publish major reports today, March 11, including the much-anticipated interest rate decision. The Bank of England (BOE) slashed 50 basis points on its benchmark interest rate from 0.75% to 0.25%. The decision by the central bank was its response to the increasing number of cases of the deadly coronavirus. The move also follows the interest rate cut by the Reserve Bank of Australia, the Federal Reserve, and the Bank of Canada (BoC). Analysts expect the British central bank to make another rate cut on March 26, its original interest rate decision meeting. On the other hand, the Royal Bank of New Zealand (RBNZ) says an emergency cut was not on its option. New Zealand’s central bank held its last cut during the second half of 2019 amid the escalating US-China trade war.