Market News and Charts for March 05, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

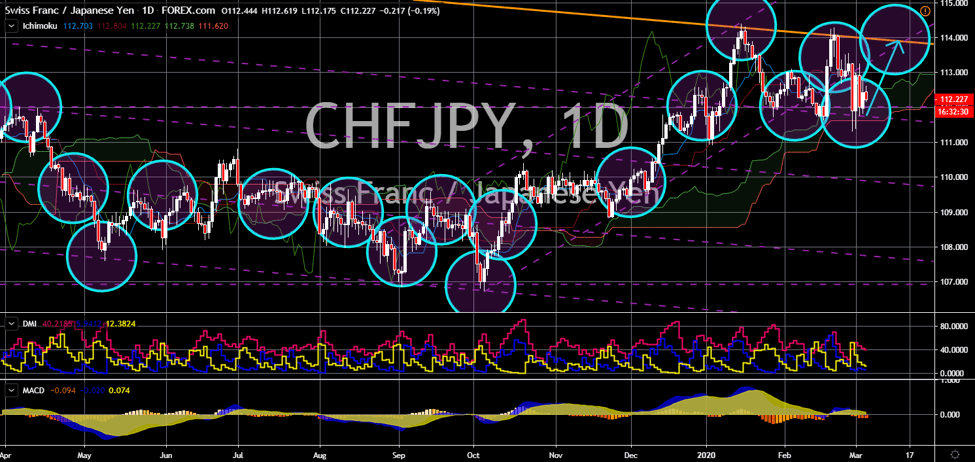

AUD/CAD

The pair will continue to move higher in the following days after it bounced back from its June 2010 low. The Bank of Canada followed its US counterpart, the Federal Reserves, in cutting the country’s benchmark interest rate. The BoC slashed its key interest rate by 50 basis points. The cut was the country’s first interest rate cut since 2015. Canada was able to weigh down pressures around the world to cut its rate amid then escalating US-China trade war. However, following the announcement of the WHO that coronavirus is a worldwide pandemic, central banks began to lower interest rates. The World Health Organization further warned that COVID-19 is a more significant threat than SARS in 2002. On the other hand, the RBA said that an interest rate cut would not save economies from the deadly coronavirus. Following this statement, investors and traders will hold onto the Australian dollar for relief.

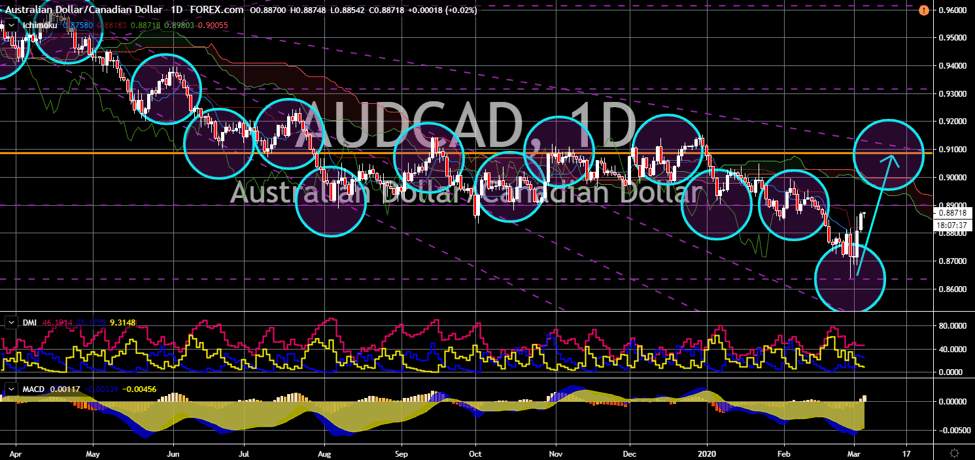

AUD/CHF

The pair broke down from a downtrend channel support line, sending it further lower towards another downtrend channel support line. The Swiss franc is shining bright despite weak figures for its GDP growth for the fourth quarter of 2019. Switzerland posted a 0.3% gross domestic product growth, lower than the forecast of 0.2% but higher than 0.4% prior. The same is true for its Consumer Price Index (CPI) report month-over-month (MoM). For February, CPI went three notches higher from its previous record of -0.2% to 0.1%. However, it is still lower from the projected 0.2% by analysts. The GDP performance for Q4 overshadowed the comments made by the Reserve Bank of Australia. According to the RBA, cutting rates cannot defend a country’s economy from the economic threat posed by the deadly coronavirus. Australia also has disappointing results for critical reports, such as GDP growth and the Services PMI.

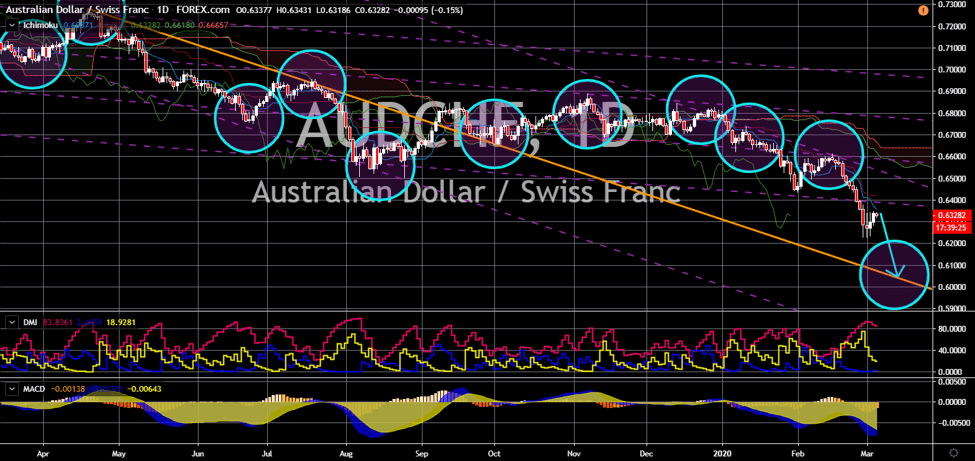

CAD/CHF

The pair will continue its steep decline towards its 4-year low. 2019 has been a good year for Canada. Despite being highly exposed to China and the US, the BoC defied expectations by analysts of an interest rate cut. However, just yesterday, March 04, Canada’s central bank slashed its interest rate by 50 basis points of 0.5%. The decision came amid the growing number of coronavirus cases outside mainland China. Last Friday, February 29, the US reported its first death from the coronavirus. The death prompted the Federal Reserve to cut its benchmark interest rate by 50 basis points last Tuesday, March 03. Thus, the Swiss franc is receiving a spotlight from investors and traders. As the Japanese yen and Canadian dollar weakens, the franc became the ideal safe-haven currency for investors and traders. Switzerland’s interest rate for the past four months was stable at -0.75%.

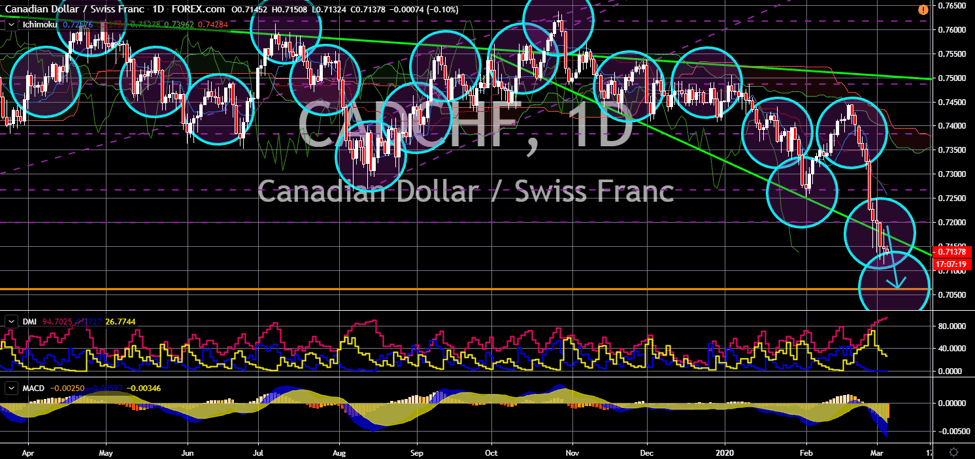

CHF/JPY

The pair will bounce back from a critical support line, sending it higher towards its previous high. The Swiss Franc stole the spotlight from the Japanese yen as the ideal safe-haven currency among G10 currencies. The Japanese government in February posted its fourth-quarter 2019 GDP growth, which disappointed its investors. Gross domestic product growth came crashing after the figure showed the country growing at -1.6%. If Japan posted another negative growth rate for Q1 2020, Tokyo would enter a technical recession. In Europe, the EU’s economic powerhouses were also experiencing a slowdown in growth. Germany, France, and Italy posted stagnant and negative growth. Germany grew zero percent, while France and Italy entered the negative territory at -0.1% and -0.3%, respectively. Thus, the luster of the Swiss franc as a safe-haven asset outshines all currencies. The country has the lowest interest rate in the world.