Market News and Charts for March 03, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

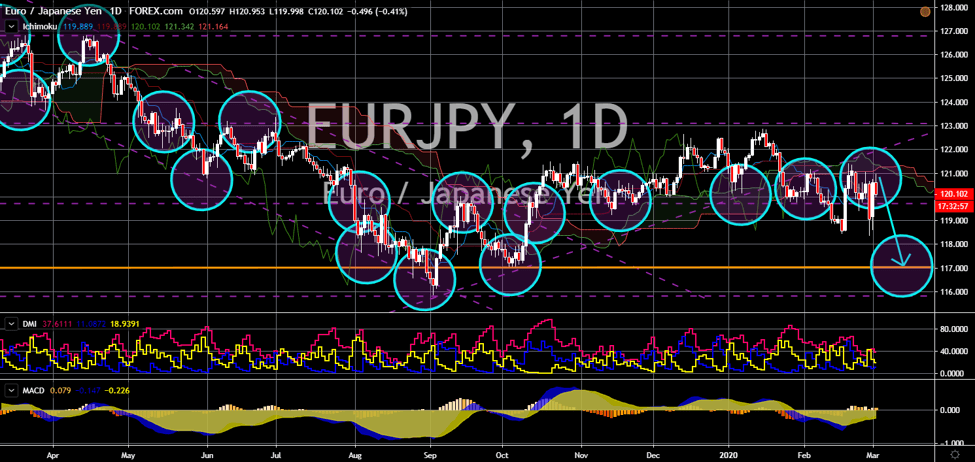

USD/ILS

The pair will break out from a “Falling Wedge” pattern resistance line, sending the pair higher towards a major resistance line. The US-Israel relationship is under pressure following the rise of Bernie Sanders, a Democratic 2020 US presidential candidate. Sanders, unlike other candidates, has been vocal about his concern on Israel and its leadership. He skipped the American Israel Public Committee (AIPAC) conference yesterday, March 02. The meeting coincides with Israel’s election for prime minister. In a span of 12 months, Israel voted three (3) times for one of the country’s top positions. This was amid the failure of the incumbent prime minister to form a coalition government. Benjamin Netanyahu has been Israel’s prime minister since 2009. He previously held the same position from 1996 to 1999, making him the longest serving PM in the country. He was the key for a strong US-Israel alliance.

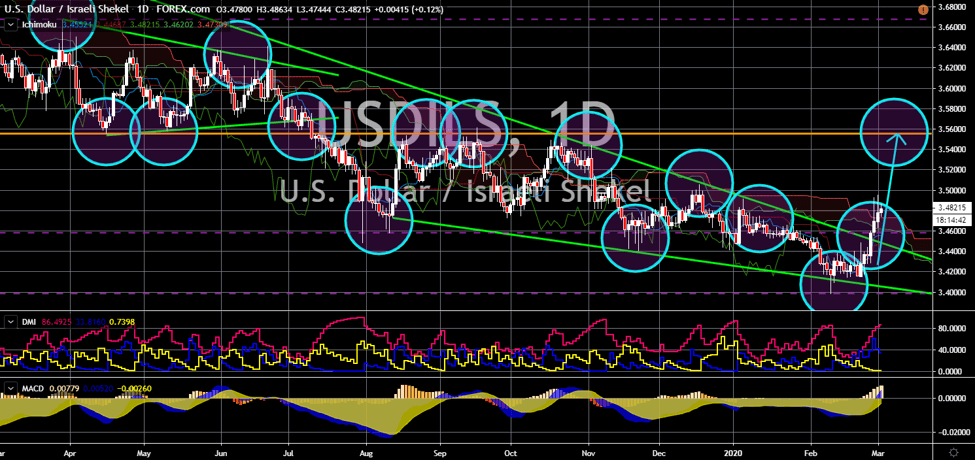

USD/CZK

USD/CZK

The pair will bounce back from an uptrend channel support line, sending the pair higher towards the channel’s middle resistance line. Investors are pessimistic about Czech Republic’s upcoming reports today, March 03. Their primary concern was the sluggish growth of Germany and France and that other EU-member states will be infected. Last month, Germany said its growth was stagnant at zero (0) percent which disappointed investors. France and Italy followed the report but with a weaker data. Both countries posted negative growth rate for the fourth quarter of 2019. Germany, France, and Italy were the three (3) largest economies in the European Union. Once one of the fastest growing economies, Czech Republic will experience the same fate with the EU’s largest economies. Analysts expect the country to post lower figures compared to its prior report of 0.2%. As a member of the single market, Czechia is highly exposed to Germany and France.

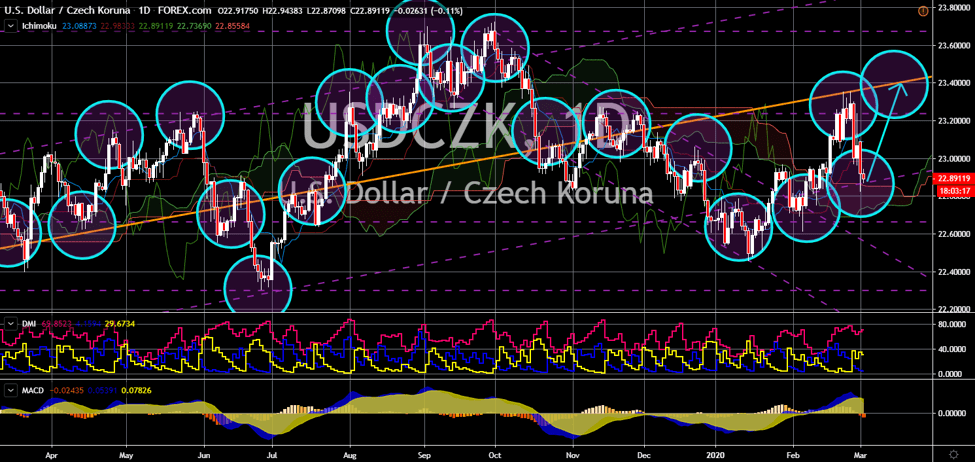

EUR/CHF

The pair will continue to move lower in the following days towards its July 2015 low. The EU’s three (3) largest economies – Germany, France, and Italy – posted disappointing figures for their Manufacturing Purchasing Managers Index (PMI) reports. All of them posted below 50 results which indicates an economic contraction. The disappointing results further add to the pessimism of investors. This was after Germany, France, and Italy also posted a zero and negative GDP growth rate for the fourth quarter of 2019. Meanwhile, as the EU economy plummets and coronavirus hunts the global market, Switzerland’s currency is one the rise. As a safe-haven asset, Swiss franc has been the ideal investment for investors who are wary of global economic uncertainty. Its appeal further increased as the Japanese yen loses its safe-haven status. This was after the country posted negative GDP growth which might send it into recession.

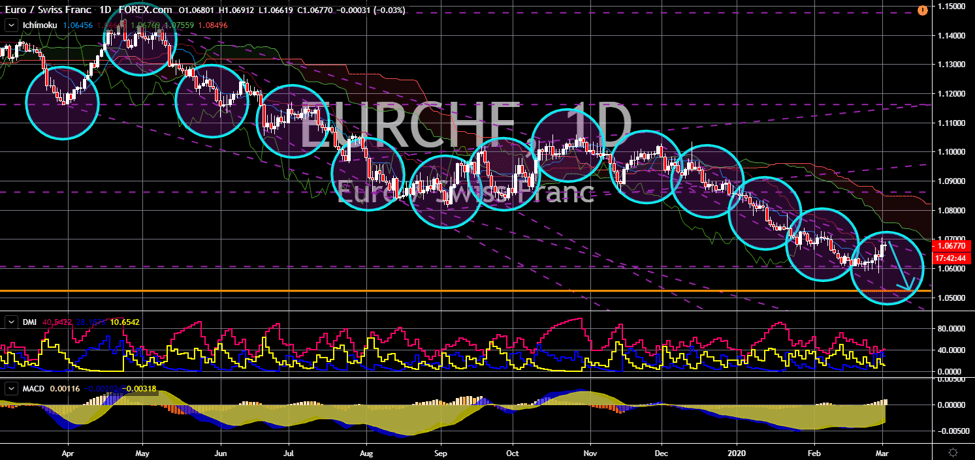

EUR/JPY

The pair will break down from a key support line, sending the pair lower towards a major support line. Japan is on the brink of recession and might lose its status as a safe-haven economy. Last month, Tokyo posted a negative 1.6% growth for the fourth quarter of 2019. This was despite the US and China signing their phase one trade deal agreement, temporarily halting the trade war. Aside from this, the Japanese yen is the worst performing currency among the G10 currencies. This resulted from investors wanting to keep away from the yen as a safe-haven option. In addition to this, the Japan Services Purchasing Managers Index (PMI) entered contraction again. The figures of 46.7 was below its previous record of 51 and was the lowest result for the past 12 months. For these reasons, the Japanese yen will suffer the most than the single currency. Just like Japan, the EU’s largest economies also posted stagnant at negative GDP growth for Q4.