Market News and Charts for February 20, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

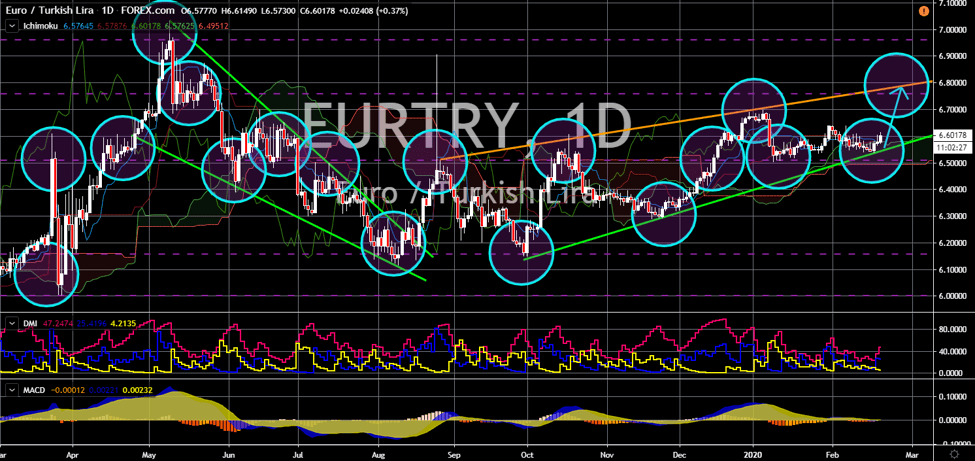

USD/SGD

The pair will continue its rally after it broke out from a major resistance line. Singapore has downgraded its forecast for economic growth to a range between -0.5 and 1.5 percent. This was amid fears of coronavirus spreading throughout the country. About 74.2% of the country’s population were from China. Dipping below zero (0) percent growth for two (2) consecutive quarters will put the country into technical recession. Despite this, analysts believe that this will only be for short-term. During the SARS outbreak in 2003, Singapore’s economy shrank by 0.3% in the second quarter. Following this was an economic expansion of 5.3% in the following quarter. The US, on the other hand, has been publishing positive results. Yesterday, February 19, Washington posted 0.5% growth in the Producer Price Index (PPI) month-over-month (MoM). The result was higher from the 0.1% expectations and 0.2% in the prior month.

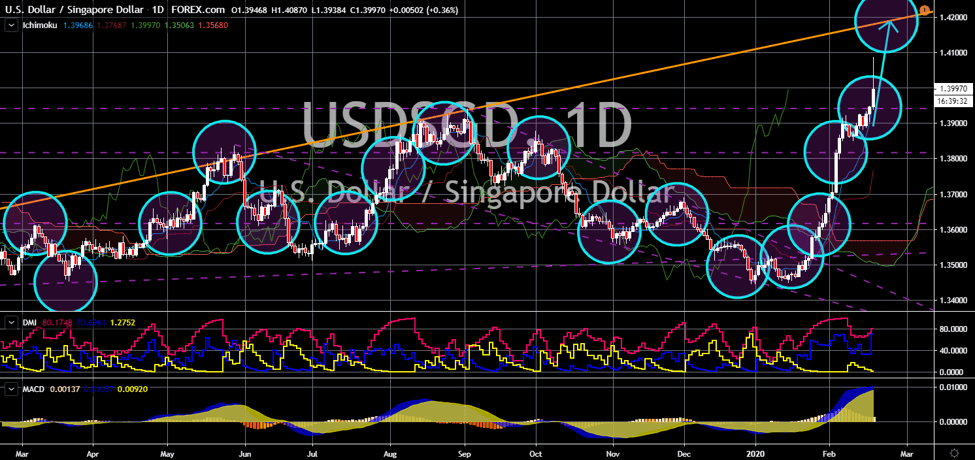

USD/HKD

The pair broke out of a major resistance line, sending the pair higher towards a key resistance line. Hong Kong is in a position that no other countries will not want to experience. The Special Administrative Region (SAR) is heading towards a back-to-back recession. During the third and fourth quarter of 2019, the country published negative GDP growth rates of 2.8% and 2.9%, respectively. Political unrest was the primary reason for the slump in figures. Analysts, however, further warned that the negative growth is likely to continue in the first quarter of 2020. Hong Kong is relying to mainland China to boost trade and tourism industry and make an economic comeback. However, the second-largest economy in the world is also struggling to keep its economy afloat. This was amid the economic implication of coronavirus or also known as COVID-19. The country’s unemployment forecast for January was also the lowest since 2016.

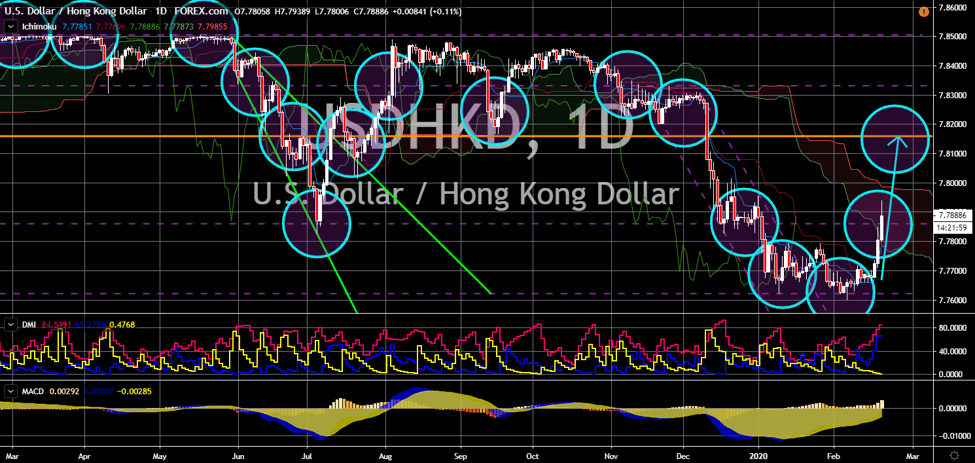

EUR/DKK

The pair will continue its steep decline after it broke down from a key support line. A new challenge is brewing for the leaders of the European Union – Germany and France. This was after a Danish MEP said that Denmark’s reason for joining the bloc was because of the United Kingdom. Britain left the EU on January 31 and some EU-member states are desperate to make a post-Brexit trade agreement with them. MEP Peter Kofod added that the EU should allow Denmark to continue making trade with its best trading partner. In addition to the comment by the Danish MEP was an uprising among the eastern bloc. The members of the V4 nations continue to increase their influence inside the bloc. Meanwhile, the EU’s economic powerhouse is slowing down. For the fourth and final quarter of 2019, Germany’s gross domestic product (GDP) was zero (0). This worries investors that the largest economy in Europe might enter a recession.

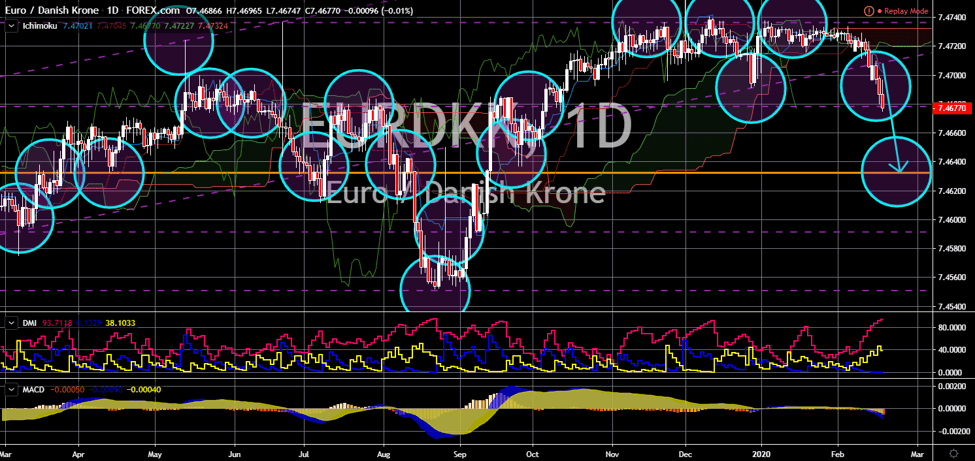

EUR/TRY

The pair bounced back from a “Rising Wedge” pattern support line, sending the pair higher towards its resistance line. The Turkish lira continues to plunge amid decisions made by the central bank to cut its benchmark interest rate. On February 19, the Central Bank of the Republic of Turkey (CBRT) cut rates for the sixth time since the second half of 2019. This slashed the country’s rate by 13,250 basis points. The decision to lower rates was due to soaring inflation in the country. Turkey’s inflation rate reached its heights in 2018 at 25.2%, the highest in 15 years. Despite this, analysts are optimistic that the country will recover this 2020. Meanwhile, the European Union will continue to struggle this 2020 with the slowdown of Germany. For the fourth quarter, the EU’s economic powerhouse recorded growth at zero (0) percent. The withdrawal of the United Kingdom from the EU will also weaken the single currency.