Market News and Charts for February 03, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

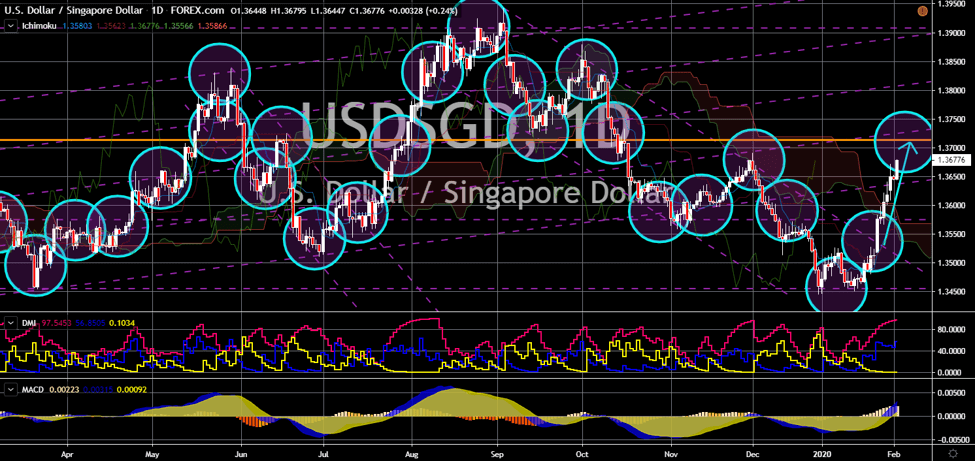

USD/SGD

The pair will continue to move higher in the following days after it broke out from a downtrend resistance line. The US dollar will continue to surge as more US companies are due to report their earnings report. The better-than-expected results helped US indices to break their previous record and set a new all-time high price. In line with this, the US Manufacturing Purchasing Managers Index (PMI) will be reporting today, February 03. Analysts are anticipating positive results in relation to the earnings report. Meanwhile, Singapore Manufacturing Purchasing Managers Index (PMI) is flirting to post below 50-points result. A figure below 50 is an economic contraction while above 50-points is an economic expansion. In other news, Singapore and other Southeast Asian countries’ stock exchanges will continue to plunge. As of writing, the novel coronavirus cases exceed 17,000 nationwide stirring fears of a global economic slowdown.

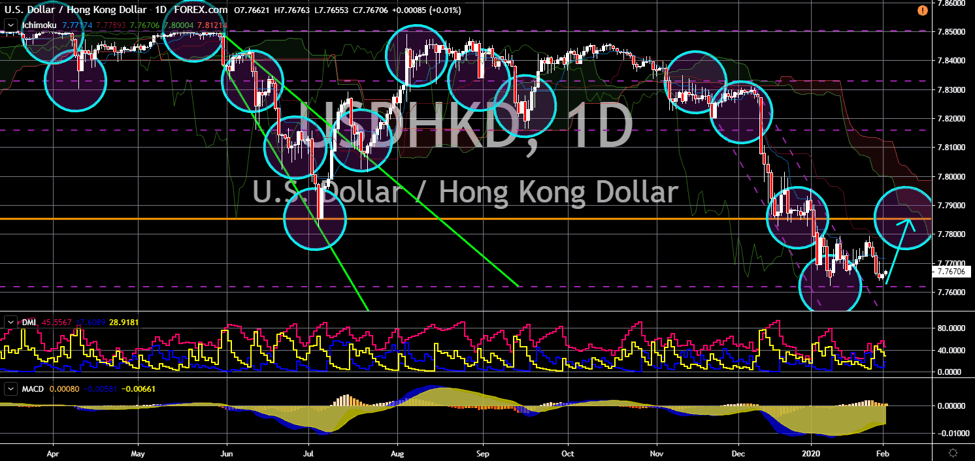

USD/HKD

USD/HKD

The pair will bounce back from a major support line, sending the pair higher towards a major resistance line. Hong Kong’s gross domestic product (GDP) for the fourth quarter will continue to plunge. This was amid the continuous protest in the city and fears of coronavirus outbreak in the special administrative region (SAR). Since October 2019, the country’s GDP was on the negative territory. The SAR finally entered recession in November after two (2) consecutive negative GDP results. The negative growth will likely continue as Hong Kong faces another problem. The coronavirus outbreak in Wuhan, China has led to a mass migration from mainland China to Hong Kong. Chief Executive Carrie Lam rejects calls for her government to close border with China. This was despite major economies like the US and Australia closing their borders to any arrivals from mainland China. This will further put pressure on the already embattled country.

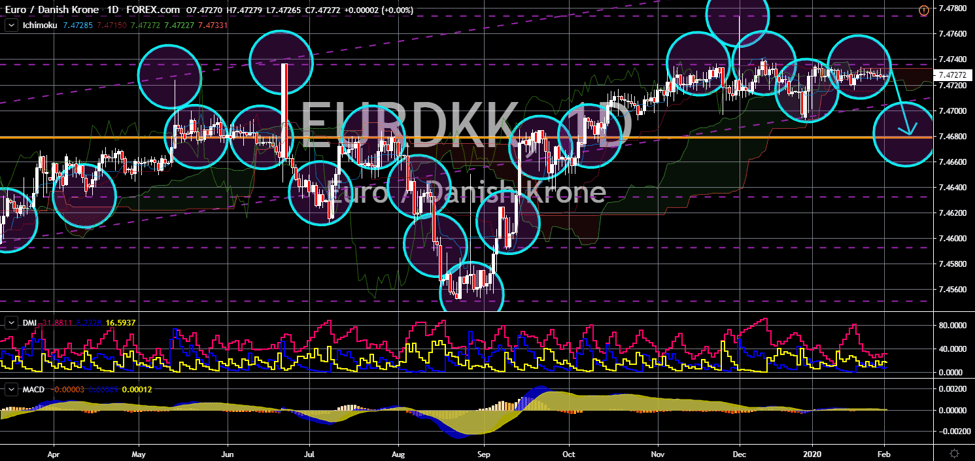

EUR/DKK

The pair will reverse back and head towards a major support line. On January 31 at 11:00 PM, the United Kingdom officially leave the European Union. Britain has been a member of the bloc for 47 years until its withdrawal. Brexit Party leader Nigel Farage said that the UK’s departure will blow a massive impact to the EU politically and economically. He further stated that the European Union will collapse within the next 10 years. He also told the EU Parliament that Denmark, Italy, and Poland, could be the next member states to leave the bloc. Despite this, Denmark supports EU decisions when it comes to digital taxation. Denmark’s EU Commissioner Margrethe Vestager was re-elected under Ursula von der Leyen’s leadership. She recently served as the Competition Commissioner under Jean Claude Junker in 2014. Now, she is serving as a Vice President of the European Commission for a Europe Fit for the Digital Age.

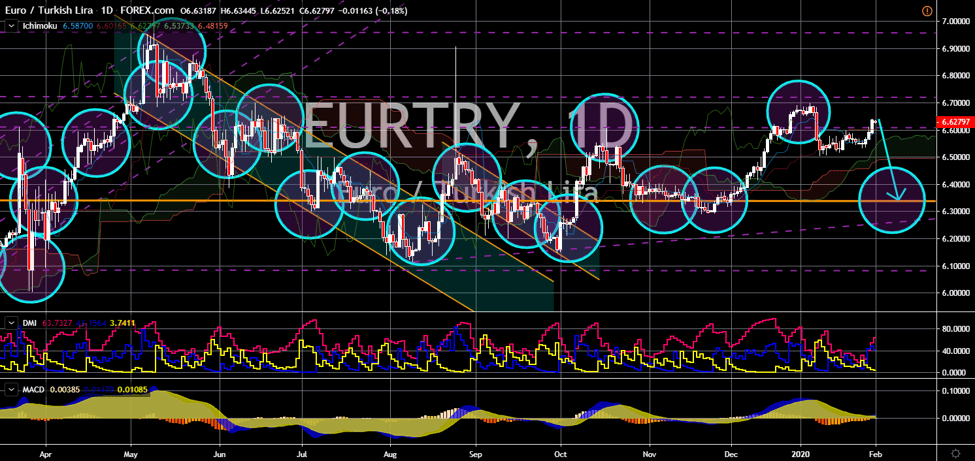

EUR/TRY

The pair will reverse back in the following days and head towards a key support line. Turkey continues to challenge the European Union and the NATO (North Atlantic Treaty Organization) alliance. NATO has called out Turkey for its purchase of Russia’s S-400 missile defense system. The EU, on the other hand, has questioned Turkey’s intention for accession in the bloc. Turkey recently signed a maritime border agreement with Libya after sending troops in the country as civil war deepens. However, Italy and Cyprus have opposed this move as it will violate their own international rights. Turkey is looking to increase its influence in Europe by creating a pipeline for liquified natural gas (LNG). This will directly compete with Israel who made its own agreement with EU member states for a pipeline. Meanwhile, a Greece politician tore a Turkish flag inside the European Parliament. Moreover, the EU is looking to cut pre-accession aid to Turkey by 75%.