Market News and Charts for December 06, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

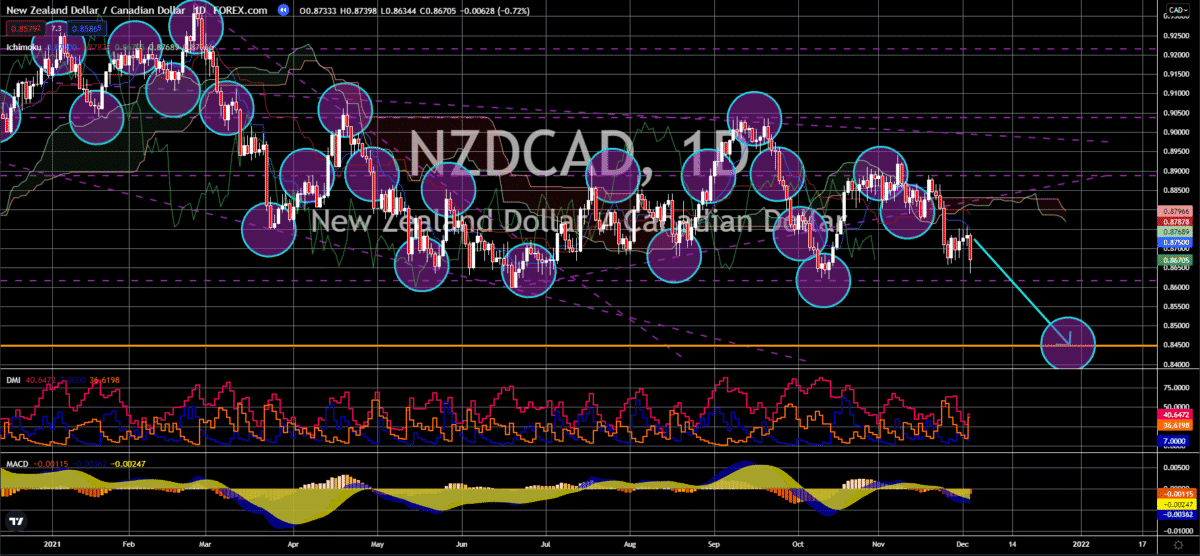

EUR/AUD

The Reserve Bank of Australia maintained its benchmark rate unchanged at 0.10% at its December 06 meeting. The decision came amid increased pressure for the central bank to tighten monetary policy earlier than its 2024 target. Other economic measures also supported a rate hike. The ANZ job advertisement data inched higher by 7.4%, beating its previous record at 6.2%. The increase is due to the easing of Covid-19 restrictions. Further, the services sector published 55.7 points on the Purchasing Managers Index (PMI) report. The figure exceeds the 55.0 points expectations and its previous data of 51.8 points. The AIG Services Index for November also accelerated to 49.6 points, just 0.4 points from the expansionary 50.0 points level. Meanwhile, the Construction Index fell to 57.0 points. Its decline is amid a deceleration in building approvals, which plummeted by -12.9%. Moreover, the House Price Index in the third quarter logged a 5.0% hike from Q2’s 6.7% record.

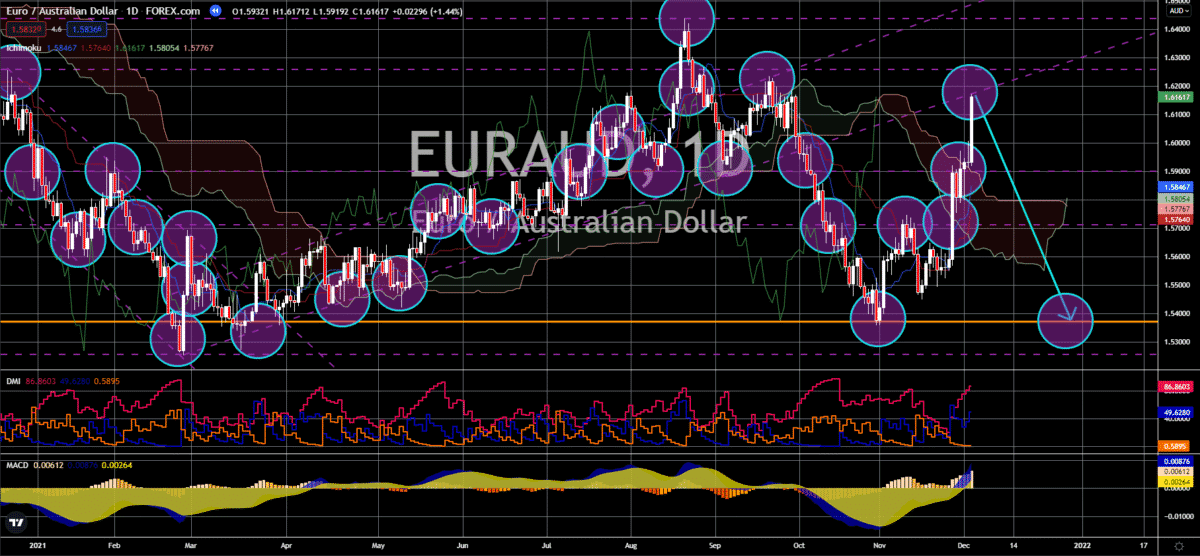

EUR/USD

The German and French PMIs disappoint investors and traders. Europe’s largest economy failed to meet analysts’ 53.4 points forecast for the Services PMI. The actual figure came at 52.7 points, an inch higher than October’s 52.4 points record. Likewise, France missed the 58.2 points estimate with the 57.4 points result. Only Italy was able to surpass forecasts and the previous month’s record after posting 55.9 points. Overall, the Eurozone’s data advanced to 55.4 points from 54.8 points in October. On the other hand, the Composite PMI showed records of 52.2 points for Germany, 56.1 points for France, and 55.4 points for the currency bloc. Italy’s 57.6 points is the only result to beat its previous record. Another recent report is the Eurozone’s retail sales. The annualized data hiked 1.4%. It is lower than September’s 2.6% record but is above the general consensus of 1.2% in the month. On a month-on-month basis, the report is up 0.2%. The figure is in line with the forecasts.

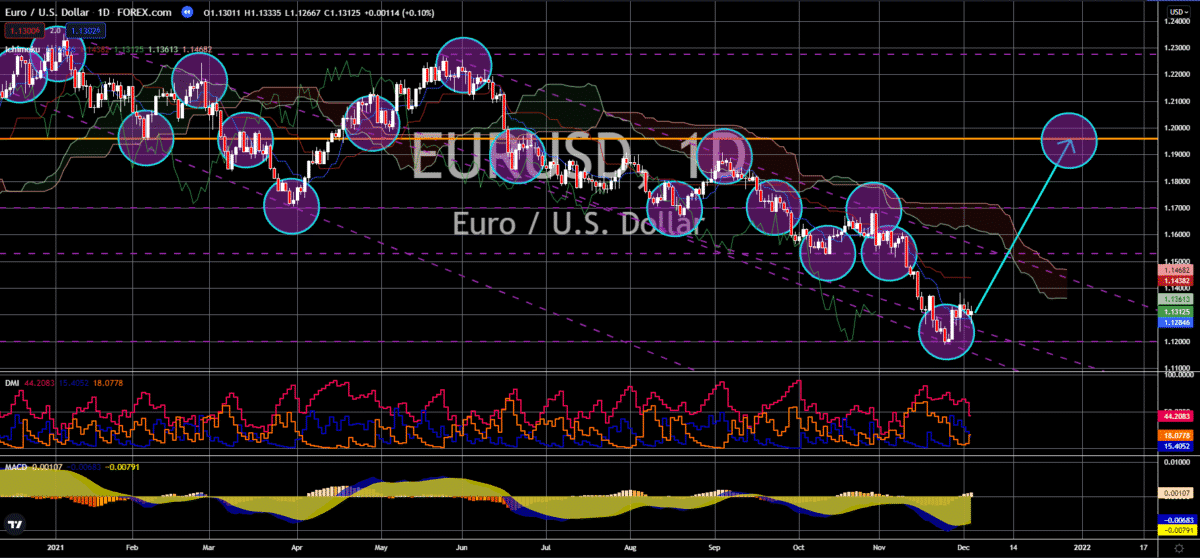

USD/JPY

The US non-farm payrolls added 235,000 jobs, only half of analysts’ projected figure of 530,000. Despite the huge miss, the unemployment rate in the US improved. It settled at 4.2% in November, lower than the previous month’s 4.6% result. The data is also better than the expected 4.5% result. On the other hand, the weekly jobless claims saw a rise in unemployment benefit claimants. The latest data showed 222,000 individuals, which is a U-turn from the pandemic low of 194,000. Still, it is below analysts’ 240,000 estimates. Another highlight from last week’s report is the Purchasing Managers Index. The Markit Composite and Services PMIs plummeted from the previous month’s result but better than expectations. The figure came at 57.2 points and 58.0 points. As for the ISM Non-Manufacturing PMI, the 69.1 points record beat last month’s 66.7 points result and the 65.0 points forecast. Aside from positive results, the crypto weekend sell-off would push USD higher.

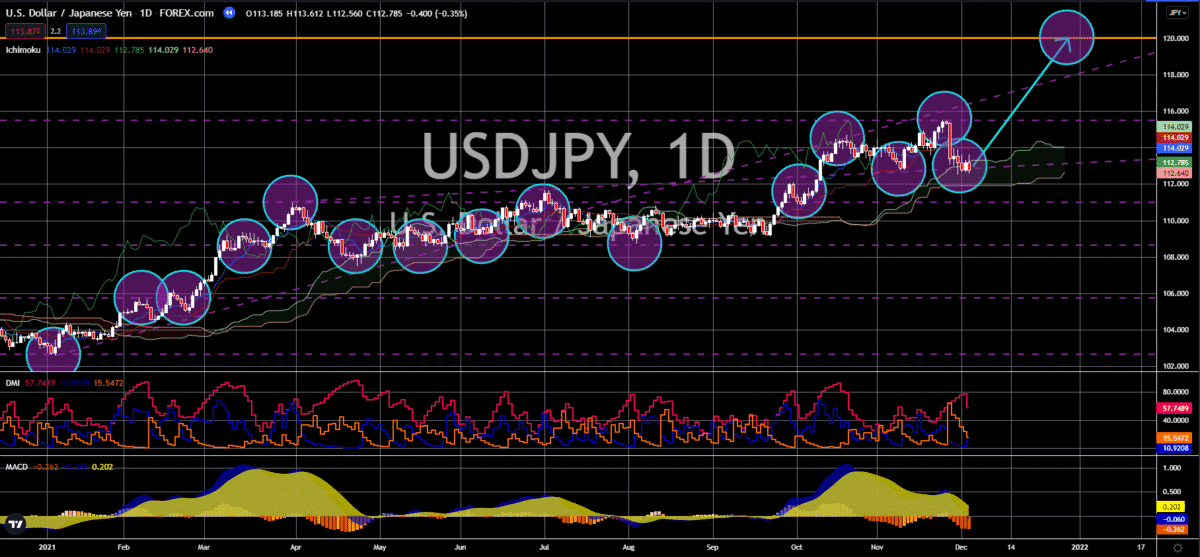

NZD/CAD

The lifting of Canada’s border restrictions with America improved the former’s employment data. Canada’s unemployment rate is down to 6.0%. For the record, the pre-pandemic level is 5.6%, and the March 2020 figure came at 7.8%. Meanwhile, November’s participation rate remains at 65.3%. There were 153,700 positions filled in the month, with full-time workers accounting for 79,900 of the employment change. However, the third quarter labor productivity data tumbled by -1.5%. It is worse than the expected 0.8% decline in the quarter ending in September. Meanwhile, the result is a reversal from Q2’s 0.6% improvement. Analysts anticipate the employment data to divide the Bank of Canada’s policymakers. On December 08, the Canadian central bank will have this year’s last meeting. In October, the BOC started to reduce its asset purchasing program in preparation for an interest rate hike. The meeting could give investors a hint on the exact date of a rate increase.