Market News and Charts for April 15, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

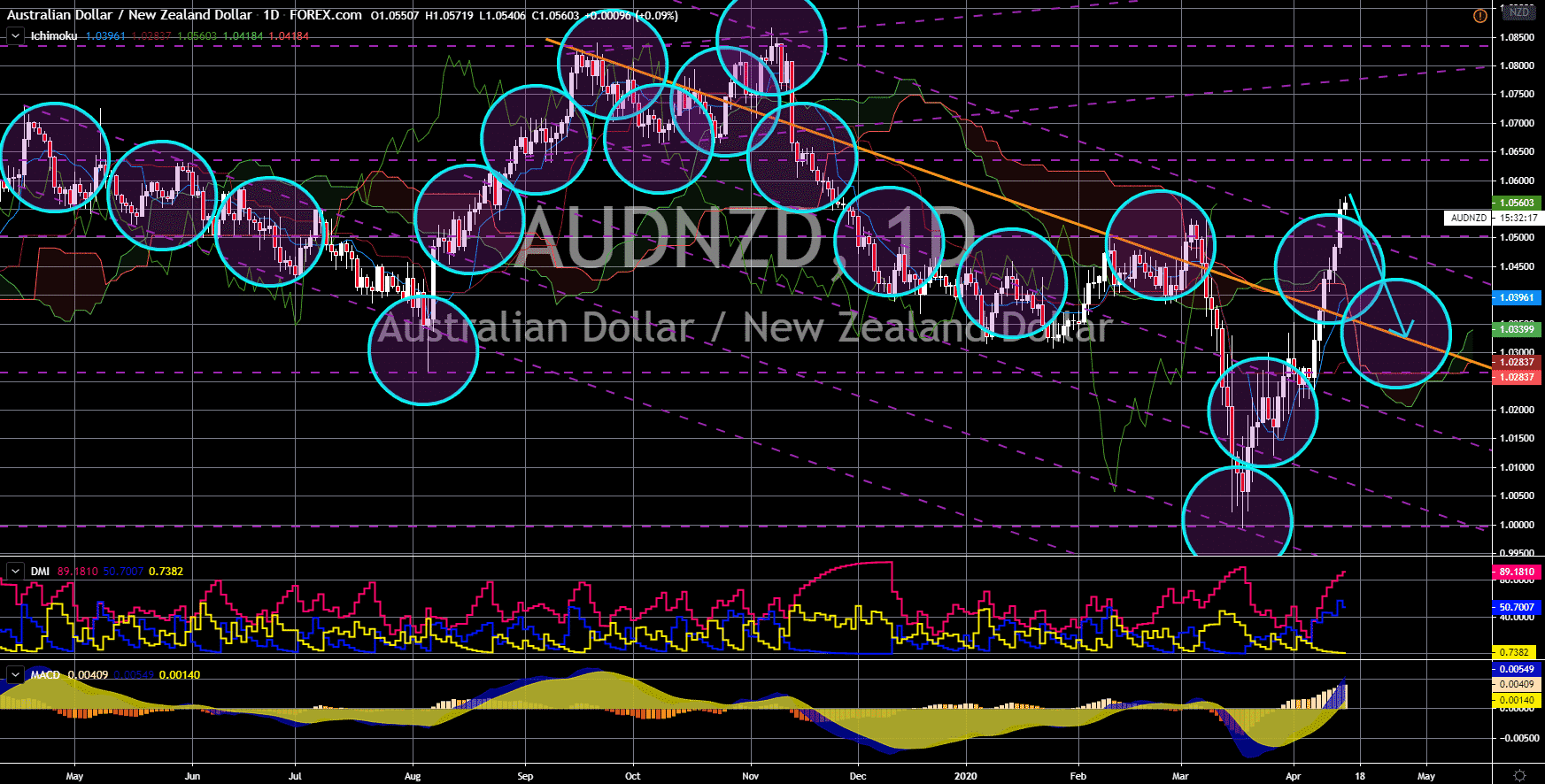

USD/CNH

The pair will continue to move lower in the following days after it failed to break out from an uptrend channel resistance line. The United States and China were both recovering from the recent slump in their exports and imports. China had the biggest decline among countries affected by the coronavirus as cases peaked from mid-February to mid-March.

The US, on the other hand, is on the peak of COVID-19 as death related to the virus climbed passed 18,000. America was open to its response to the coronavirus pandemic. The US government introduced a $2 trillion stimulus package. This was coupled by the own aid initiative by the Federal Reserve, which unveiled a $2.3 trillion package. The central bank’s stimulus package was the biggest in global history to date. China, however, was still secretive when it comes to the Chinese Communist Party intervention in the local market. Analysts believe that this will result in lower confidence of investors to China.

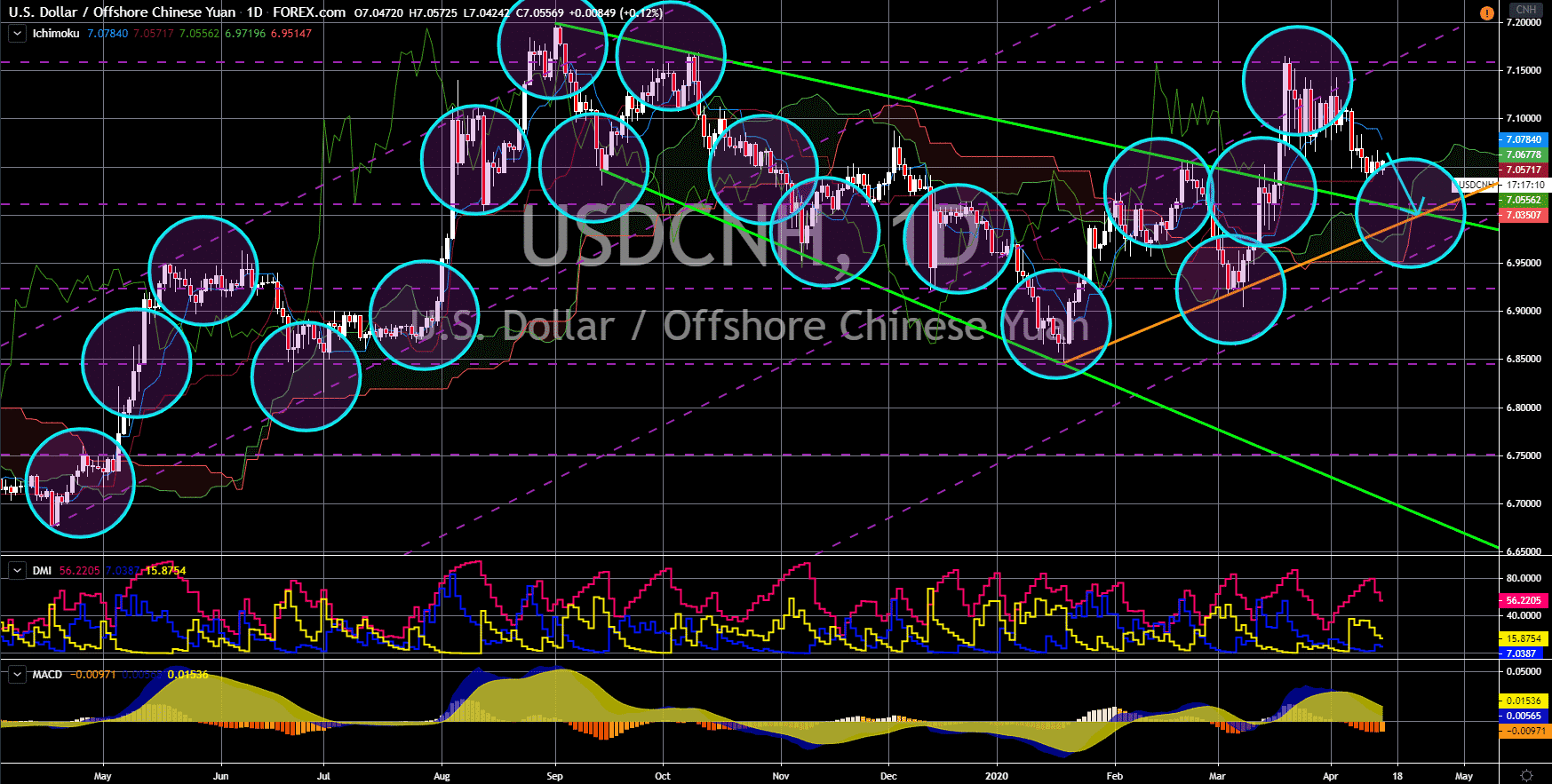

USD/TRY

The pair is currently trading on its all-time high and will continue its upward momentum in the following days. Turkey is in big financial trouble. The country incurred a budget deficit of $7.36 billion for the month of March. In addition to this, Turkey is losing US dollar reserves on its treasury. Moreover, the country’s central bank slashed 100 basis points on its benchmark interest rate in March. The implication of this is a weaker Turkish lira against other currencies, especially to the greenback.

In recent news, Turkish President Recep Tayyip Erdogan also rejected an offer from the International Monetary Fund (IMF) for fresh financial loans. Erdogan said it was not the country’s priority. However, investors and traders see this move as a betrayal to the Turkish economy. Analysts expect that foreign funds will continue to leave the country and place their bets to the cheaper US dollar. The stimulus package by the US government and Fed attracts investors.

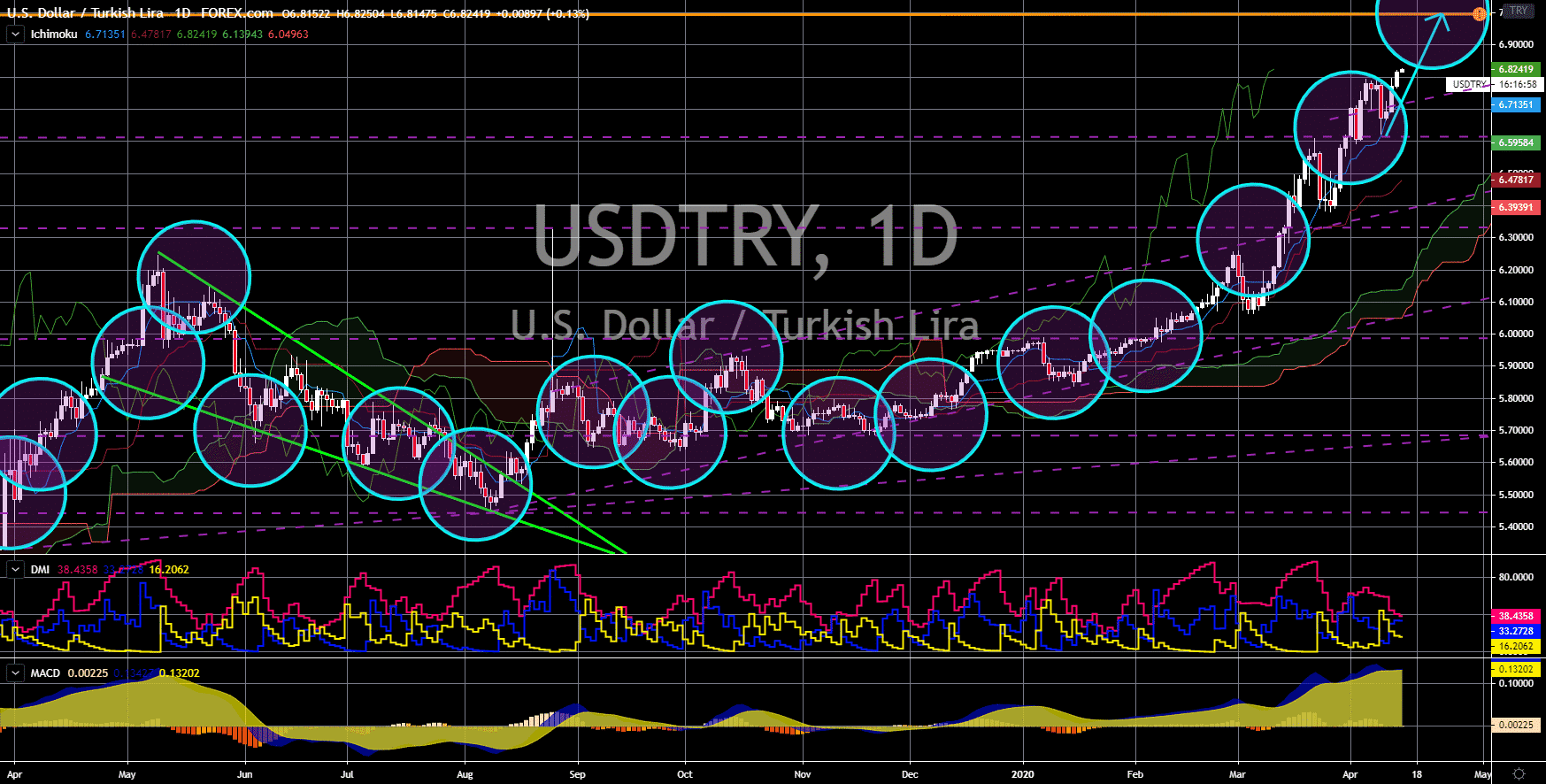

EUR/NZD

The pair bounced back from a key support line, sending the pair higher towards a major resistance line. The world faces an impending global recession as each country is set to publish major reports this month. Economists anticipated mixed results for the first quarter while they warned investors and traders of a catastrophic second quarter. This was due to the economic effect of the coronavirus.

Among the countries which will be hit the most from the global pandemic are the members of the European Union. Prior to COVID-19, economic powerhouses in the EU were already struggling. This was caused by the US-China trade war, which disrupted the global supply. On the fourth quarter of 2019, Germany posted a zero percent growth while France and Italy dropped to negative territory. Analysts warned that the first quarter will be catastrophic for EU member states. New Zealand, on the other hand, already flattened the curve for coronavirus cases.

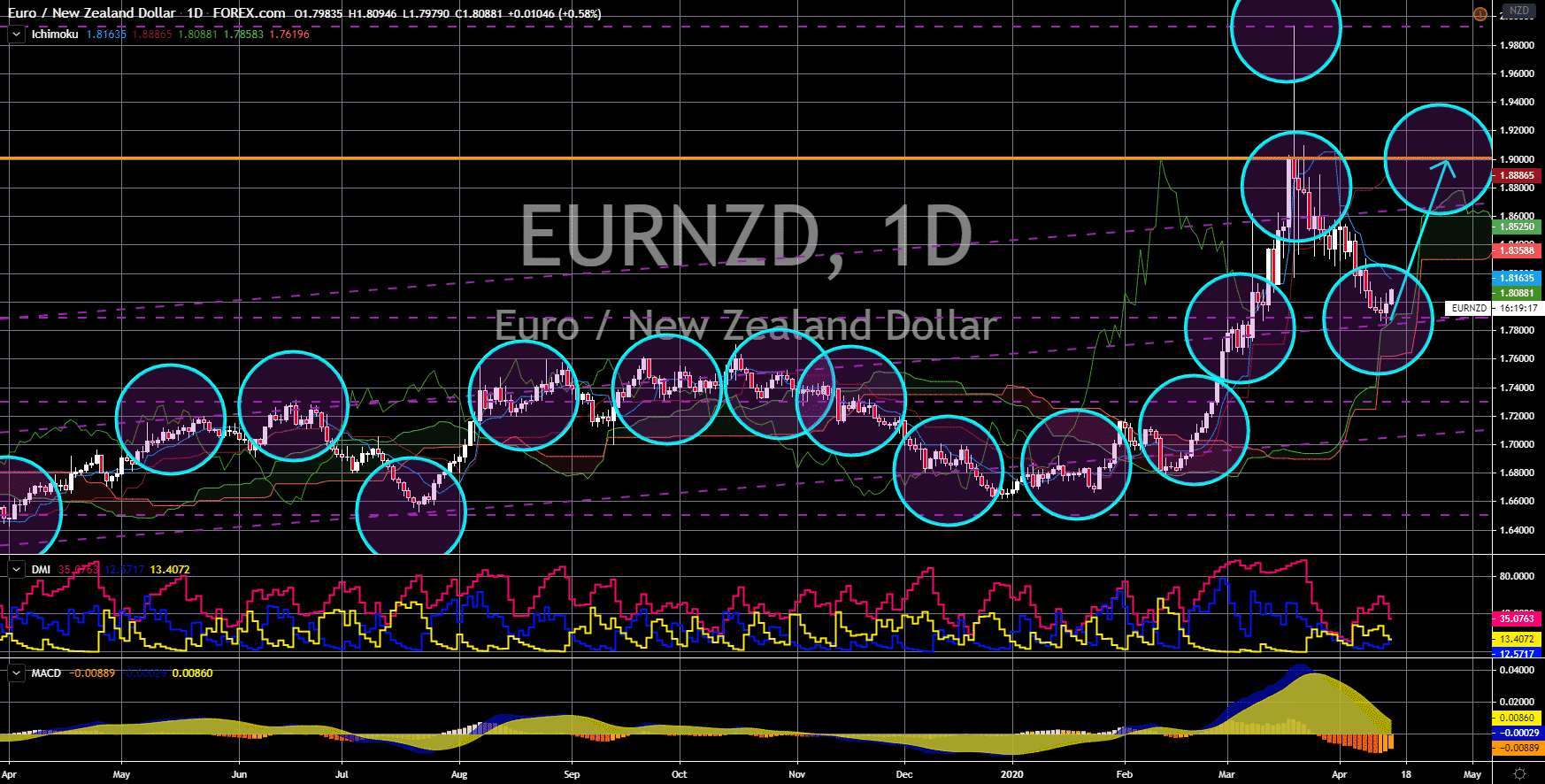

AUD/NZD

The pair will reverse back after its recent rally, sending the pair lower towards its nearest support line. Both Australia and New Zealand were able to flatten the curve for coronavirus cases. Despite this, both countries decided to extend the lockdown. Governments of Australia and New Zealand were worried that the wave 2 of coronavirus cases could derail their efforts to contain the virus.

A similar situation happened in South Korea. The country lifted its restrictions after the number of coronavirus cases dropped, but figures went up again as international flights brought the COVID-19 back to the country. Employment in Australia was still strong, causing the Australian dollar to surge against NZD. However, unlike New Zealand, Australia was not prepared financially to aid small businesses against the economic threat by the deadly virus. New Zealand provided a $3 billion tax break to small businesses to help them survive the lockdown.