Gold and Silver: Two-day high

- After the price of gold fell to $ 1805 on Tuesday, we saw a recovery to $ 1840 yesterday.

- The price of silver jumped to a two-day high of $ 21.80 yesterday.

- On Wednesday, the US Federal Reserve (Fed) announced the largest increase in interest rates since 1994 to deal with inflation fears.

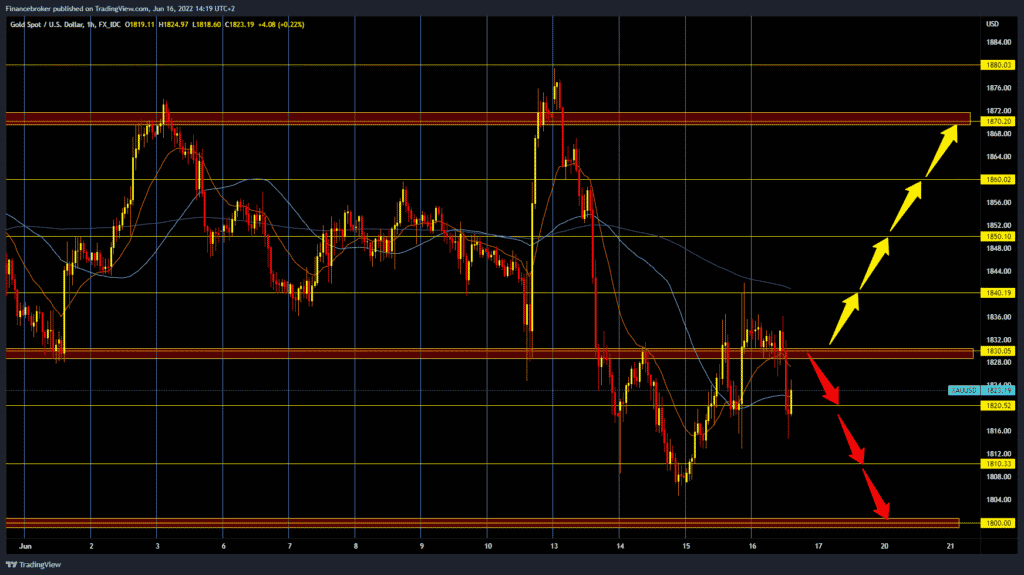

Gold chart analysis

After the price of gold fell to $ 1805 on Tuesday, we saw a recovery to $ 1840 yesterday. The price didn’t stay there long, and during this morning’s Asian session, we saw a new withdrawal below $ 1820. Today’s low was at $ 1814. As of this morning, the price has recovered to $ 1823, and we need a return above $ 1830 to determine the chart better. For the bullish option, we need a new positive consolidation and a return above $ 1840. After that, we could attack the $ 1850 level and try to continue the bullish momentum towards the $ 1870 upper resistance zone. For the bearish option, we need negative consolidation and a drop to the support zone around $ 1810. From further bearish pressure, the price of gold could test and psychological $ 1800 for a fine ounce of gold.

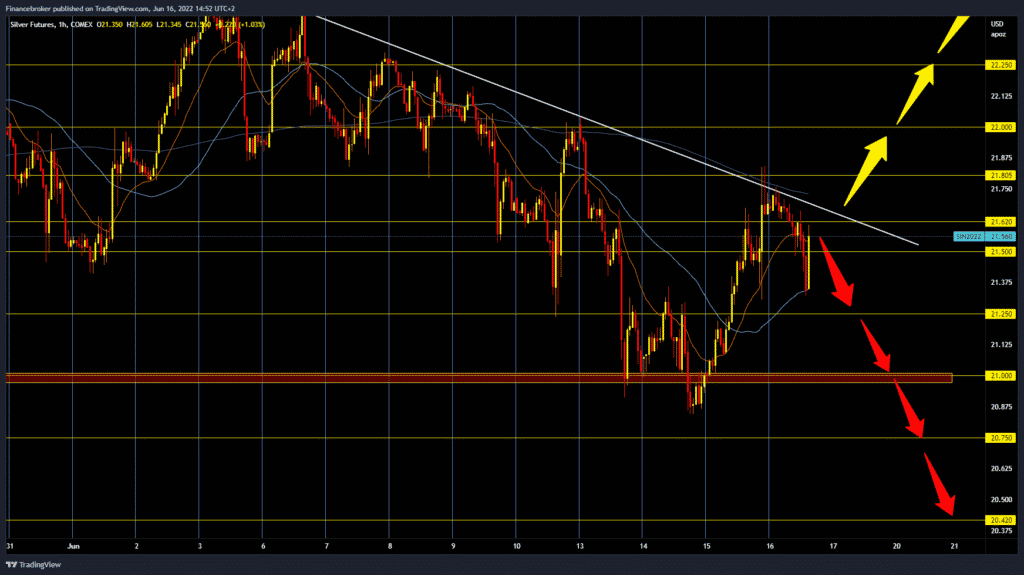

Silver chart analysis

The price of silver jumped to a two-day high of $ 21.80 yesterday. At that point, we see the formation of a new lower high, a decline from the upper trend line to bearish consolidation during the Asian trading session. Today’s minimum was at $ 21.32, and bearish pressure on the chart is noticeable. To continue the bearish option, we need the continuation of today’s negative consolidation and a drop to yesterday’s support zone of around $ 21.00. Break prices below would open up space for us at $ 20.00 prices. The bullish option needs a positive consolidation above the upper resistance line. After that, we could think about a continuation of the bullish trend. Potential targets above are the $ 22.00 and $ 22.25 levels.

Market overview

Fed and gold

On Wednesday, the US Federal Reserve (Fed) announced the largest increase in interest rates since 1994 to deal with inflation fears. The US Federal Reserve has also revised its inflation forecasts for this and next year, along with lower inflation expectations. Further, policymakers also signaled a rate increase of 0,50% or 0,78% at the next meeting.

Fed Chairman Jerome Powell will give a Friday speech at the Inauguration Conference on the international role of the US dollar in Washington. The US Federal Reserve recently praised the US economic transition and tamed market fears of higher rates while showing readiness to reach the inflation target of 2.0%.