Oil and Natural Gas: Fears of global inflation

- Oil prices fell more than $ 2.00 on Monday.

- The gas price during the day ranged from 8.50 to 8.80 dollars.

- Russia’s crude oil production could fall by 18% by the end of next year, the U.S. Energy Information Administration predicted, referring to the planned European Union embargo on Russian oil imports.

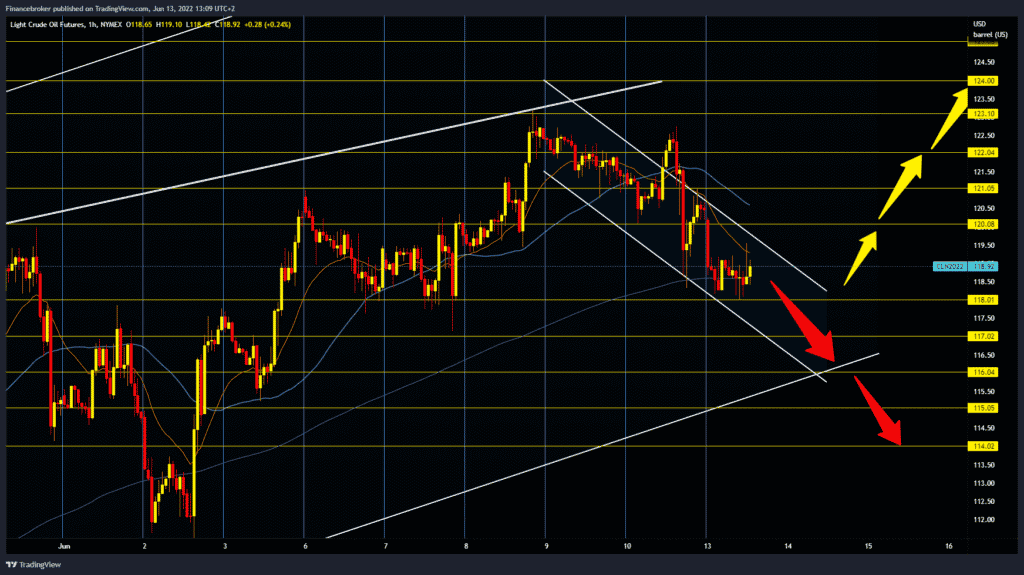

Oil chart analysis

Crude oil prices fell more than $ 2.00 on Monday as an outbreak in Beijing eroded hopes of rapid growth in fuel demand in China, while fears of global inflation and economic growth further pushed the market. Prices fell after Chinese officials warned of the virus’s spread in the capital and announced plans for mass testing in Beijing by Wednesday. Concerns about further interest rate hikes following a sharp rise in U.S. inflation data on Friday are also putting pressure on global financial markets. Both global gains rose more than 1% last week after data showed strong demand for oil in the world’s largest consumer, the United States, despite concerns about inflation and hopes that consumption in China could recover from the lifting of quarantine measures 1. June.

Oil producers and refineries are working at full capacity to meet summer demand. We need support at a $ 118.00 price for the bullish option and positive consolidation that would move us up. After that, we have to climb above $ 120.00 for the price to form a new higher low and continue the bullish recovery. Potential bullish targets are $ 121.00, $ 122.00 and $ 123.00 levels. For the bearish option, we need a continued pullback to the bottom line of support at $ 116.00.

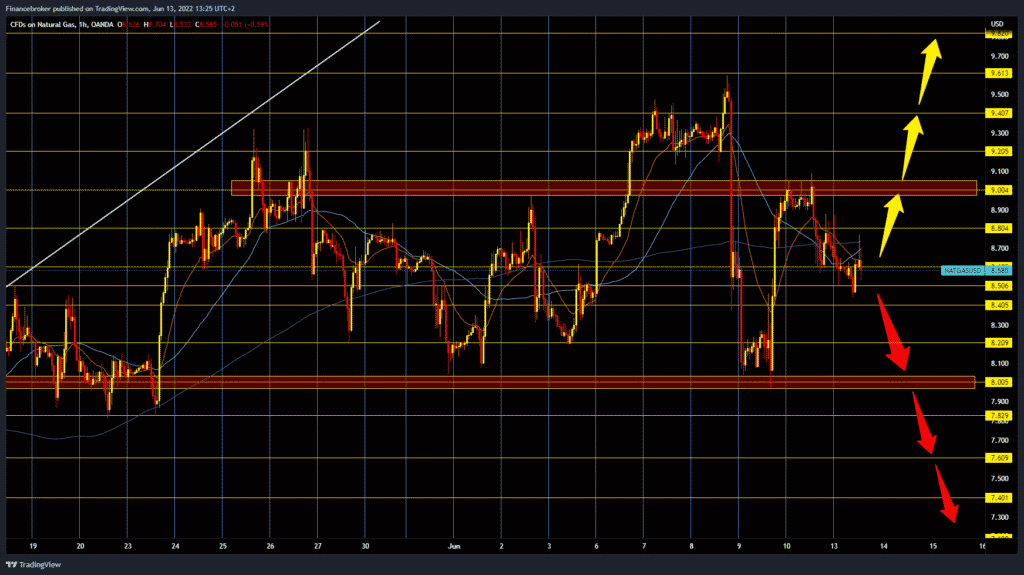

Natural gas chart analysis

The gas price during the day ranged from 8.50 to 8.80 dollars, remaining in negative territory following the consolidation that began on Friday. Viewed in this way, the price of natural gas could again seek support at the $ 8.00 level this week. We need to continue the negative consolidation and break below the $ 8.50 level for the bearish option. For the bullish option, we need a new positive consolidation and a return above $ 8.80. We could take this as a positive sign for a potential continuation on the bullish side. Our first target is $ 9.00, and then our potential targets are $ 9.20, $ 9.40 and $ 9.60.

Market overview

Russia’s crude oil production could fall by 18% by the end of next year, the U.S. Energy Information Administration predicted, referring to the planned European Union embargo on Russian oil imports.

U.S. energy authorities predict that Russian oil production will fall from 11.3 million barrels daily in the first quarter of 2022 to 9.3 million barrels per day in the last quarter of 2023 as a result of the E.U. embargo on imports of crude oil and refined products.

The EIA also noted that current sanctions and new sanctions from the West could push oil production rates in Russia even lower, rising oil prices.

Oil will continue to glide along the Druzhba pipeline, which supplies Central Europe, but Poland and Germany have promised to abandon Russian oil by the end of the year. According to plans, this would effectively reduce the import of Russian crude oil and products into the E.U. by 90 %.