Gold and Silver: Strong Downtrend

- Yesterday, the gold price fell below the $1,700 level for the first time this year.

- The price of silver fell to $18.00 yesterday, after which we see a short recovery to the $18.40 level.

- A strong US dollar, which is the mirror opposite of a weak euro, reduces the price of gold.

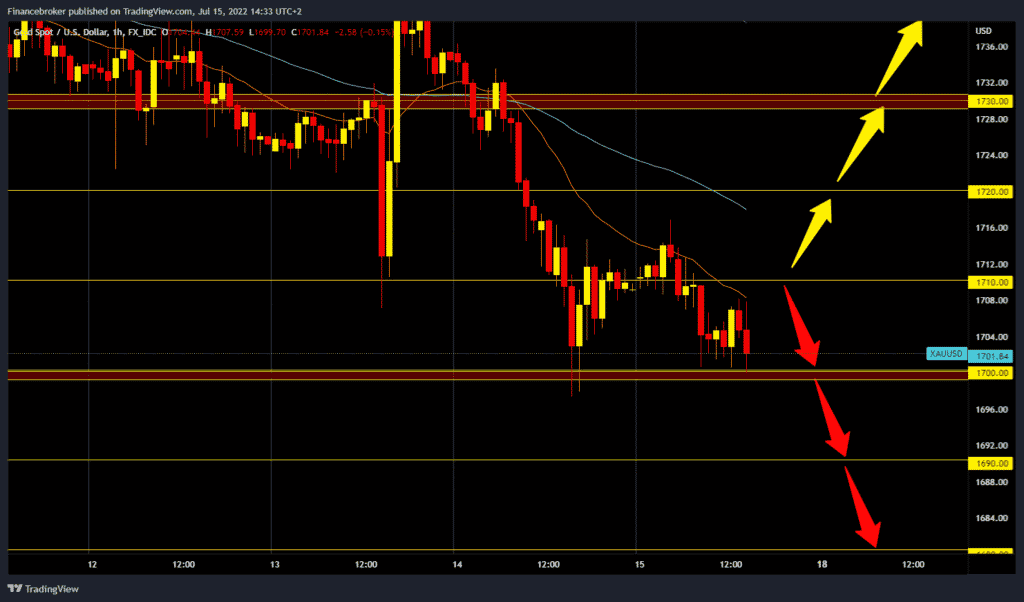

Gold chart analysis

Yesterday, the gold price fell below the $1,700 level for the first time this year. Yesterday’s low was at $1696, but a return above $1700 soon followed. During the Asian trading session, the price recovered to $1717, this did not last long, and we see a new pullback to the $1700 support zone. Chances are high that we will soon see another break below and the continuation of the bearish trend. Potential lower targets are $1690 and $1680 levels. For a bullish option, we need another positive consolidation and a return above $1710 to get support in the MA20 moving average. Our next target is the $1720 price, where the MA50 moving average awaits us. A price break above would move us away from the uncomfortable zone, and we could continue further towards $1730 and $1740.

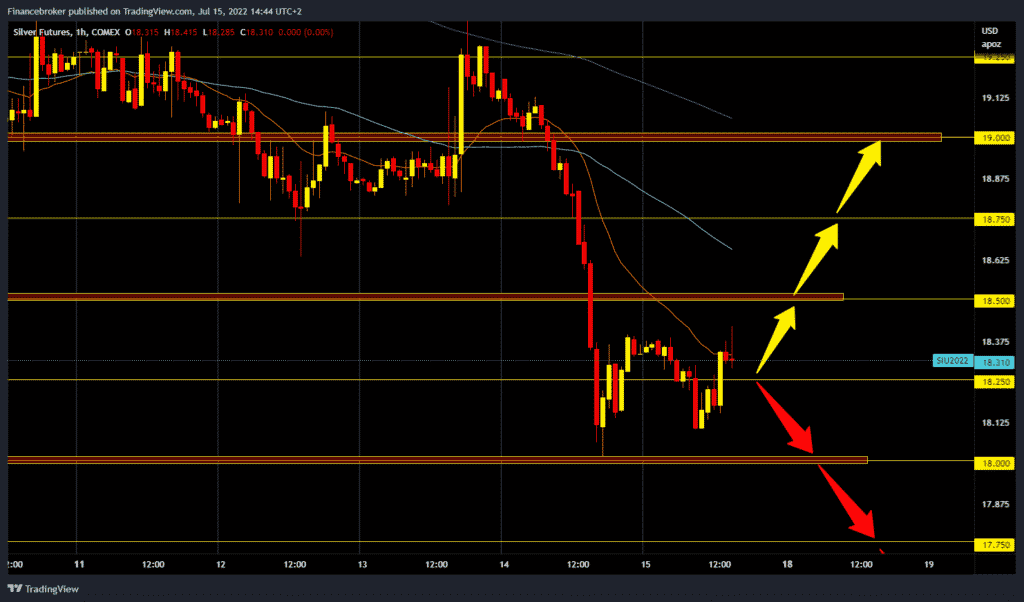

Silver chart analysis

The price of silver fell to $18.00 yesterday, after which we see a short recovery to the $18.40 level. During the Asian trading session, the price made a new pullback and stopped at the $18.10 level. A new recovery to $18.30 soon followed, and we are now consolidating at that level. The price could take advantage of the current bullish impulse and climb up to the $18.50 level. It would form a new higher high, and we would see where to look for new support for the next bullish impulse. We need a negative consolidation and a return to the $18.00 support zone for a bearish option. And a price break below would form new lows this year. Potential targets are $17.75 and $17.50 levels.

Market overview

A strong US dollar, which is the mirror opposite of a weak euro, reduces the price of gold. Nevertheless, Commerzbank economists expect a recovery of the yellow metal in the coming months. If the ECB meeting shows a more decisive approach will be taken in the fight against inflation, gold could indirectly benefit. However, higher interest rates are bad news for gold as a non-interest-bearing investment. Market participants seem to be increasingly anticipating a US recession. Gold should benefit from this as a safe-haven. This is one of the reasons why we expect higher gold prices in the coming months and quarters. Additionally, for this to happen, the still strong ETF outflows would have to end, and interest buying would have to return to the market.